$0 fee airline credit cards: From unthinkable to the norm

Unthinkable just a few years ago, $0 airline credit cards have emerged as a category in their own right. For airlines, a no-fee card is an entry point for consumers and a future upgrade opportunity. While $0 fee airline cards lack the perks of fee-based cards, they have surprisingly strong value propositions with sign-on incentives, the ability to earn miles for everyday purchases and for some, no foreign transaction fees.

Consumers also have more choices now than ever before. It is critical to develop unique positioning for any no-fee travel rewards card. For airline cards, that means emphasizing the airline’s value over the concept of travel itself.

Approximately 76 million adults aged 18+ are members of a frequent travel program (includes frequent flyer, hotel or car rental)

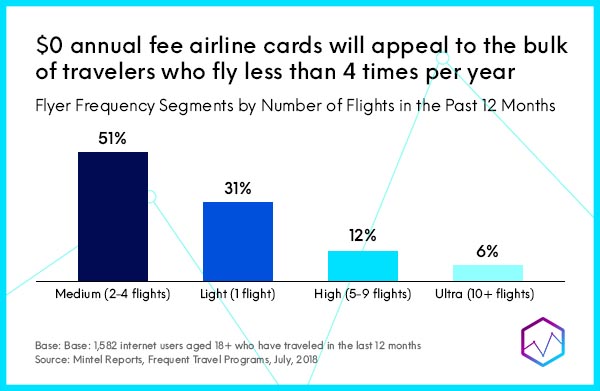

While flying is increasing, frequency is decreasing. This means there are more, less-frequent travelers who may be interested in an airline credit card, but don’t travel enough to justify an annual fee.

Airline-branded cards: Marketing in action

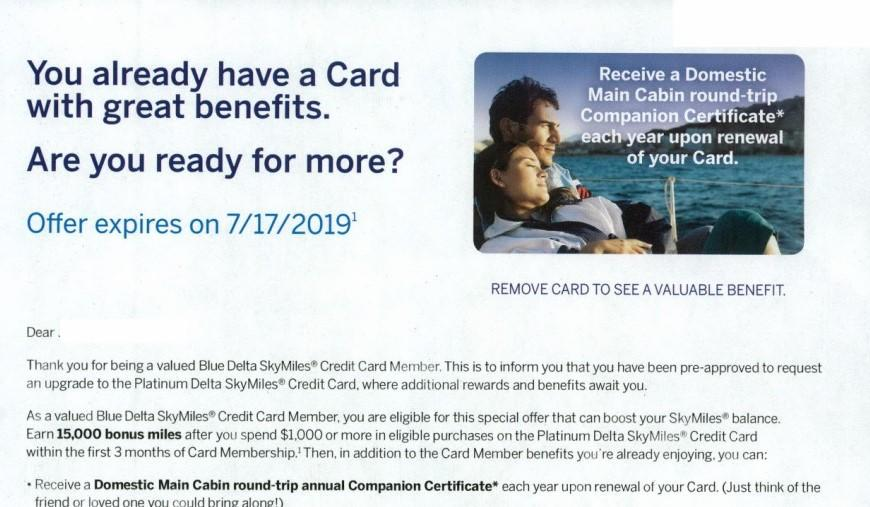

Delta: Blue Delta SkyMiles Card

Delta offered an upgrade to Blue Delta Skymiles Card Members.

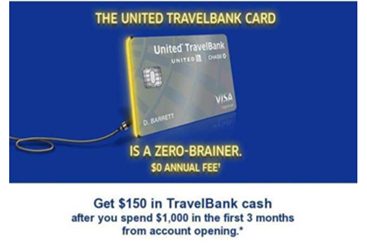

United Airlines: The United Travelbank Card

United offered $150 in TravelBank cash after spending $1,000 in the first 3 months after opening an account.

American Airlines: AAdvantage MileUp Card

Citi used email to offer an intro APR for 12 months on purchases and balance transfers for potential cardholders.

Competing no-fee travel cards: Marketing in action

Discover: It Miles Card

Discover launched a TV campaign for the no-fee It Miles card in May.

Wells Fargo: Propel American Express Card

Wells Fargo challenges consumers to find a better rewards card with no annual fee.

What’s next?

Last year’s launch of the Citi AAdvantage MileUp Card has moved the needle by taking a $0 airline card into the marketing mainstream. It will likely lead to product improvements and renewed marketing efforts in this emerging segment as Delta, United, JetBlue and their bank partners continue to weigh up a response.

With the new abundance of $0 fee airline cards, it will become increasingly important for marketers to justify the value of annual fee cards. The challenge for airlines and their partners will be to provide opportunities to upgrade those cardholders to fee-based products as the next step in their credit journey and to build long term loyalty.

![[Guest post]: D2C leaderboard: The direct-to-consumer brands owning digital advertising](https://welcome.comperemedia.com/wp-content/uploads/2019/07/CM_SocialMedia_D2CMarketing_Green200Blog_2000x1000.jpg)