2020 banking annual review

The impact of COVID-19 made customers seek refuge in digital channels, accelerating the pace of digital adoption. With consumers relying more on online services and their smartphones, traditional and challenger banks with robust digital capabilities benefited from the uptick in digital activity. Don’t expect this activity to change any time soon as customers’ reliance on digital channels over physical ones will most certainly outlive the pandemic.

Banking Trends

- Merger & acquisitions = better for customers and communities: From PNC’s acquisition of BBVA USA to the merger of TCF Bank with Huntington, banks made sure to communicate that the results of these changes would always end up benefitting customers and communities.

- With the impact of COVID-19 on communities and the proliferation of social movements in 2020, banks showcased their involvement in an array of causes: Wells Fargo and Bank of America showcased their efforts in helping communities, while Chase and Capital One highlighted their strategies to help narrow the wealth gap among minorities. Banks utilized display ads to promote their causes and made sure to motivate the reader to learn more about the initiatives.

- Traditional and challenger banks with robust digital capabilities were well positioned when the pandemic broke: Chime and Stash had record numbers of account openings, while Bank of America and Wells Fargo saw an uptick in mobile check deposits.

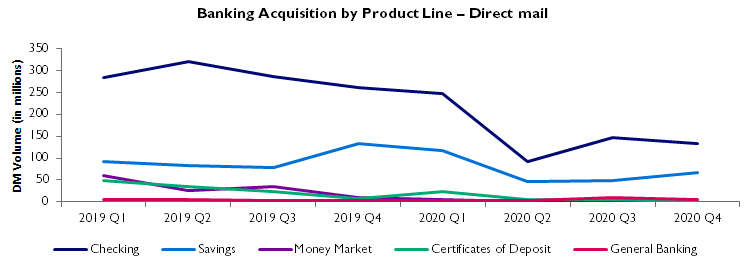

Despite the impact of COVID-19 in the banking industry, checking and savings remained the preferred product lines on which banks relied on to drive new business.

Even though overall deposit offers saw a YoY decline of 69%, savings saw the least impactful decline, at 45%, at a moment where U.S. savings hit a record 33% as COVID-19 caused Americans to stockpile cash and curb spending. Citibank and Chase led checking offers in 2020. Citibank, American Express, and Capital One led savings offers in 2020.

Checking Accounts

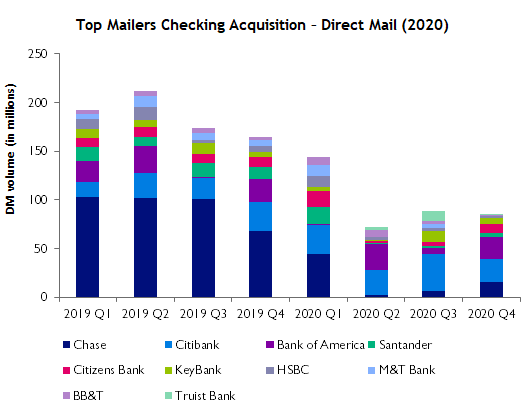

- Citibank surpassed Chase as the top mailer in 2020: On average, top mailers saw their volume drop by 28%, with Citibank offsetting this trend, increasing its volume by 27%. This surge in mail volume allowed Citibank to become the top mailer in 2020, leaving Chase ranking second.

- Citibank shifted the landscape from a focus on acquisition to leveraging existing customers to drive new business: While Citibank was the top mailer in 2020, it accounted for a staggering 96% of cross-sell offers among top mailers, showcasing the bank’s focus on customer retention while also creating new business by leveraging the existing relationship with its customers.

- Top mailers crafted their acquisition messaging around their cash bonuses: Top mailers positioned their bonuses at the front and center of their communications to attract new customers to open a bank account, or even switch banks.

- Smaller banks and credit unions took a jab at big banks: Smaller banks used their communications to emphasize that, unlike big banks, their checking accounts will never surprise customers with any “hidden fees.”

Citibank surpassed Chase as the top mailer in 2020, focusing on driving new business by leveraging the relationship with its existing customers.

Checking offers among top mailers fell 47% from 2019 to 2020. On average, top mailers saw their volume drop by 28%, with Citibank offsetting this trend, increasing its volume by 27%. This surge in mail volume allowed Citibank to become the top mailer in 2020. Citibank accounted for a staggering 96% of cross-sell offers among top mailers in 2020, showcasing the bank’s focus on leveraging its customers to create new business. Chase saw its volume decline by 82% year over year, the biggest decline among top mailers.

Savings Accounts

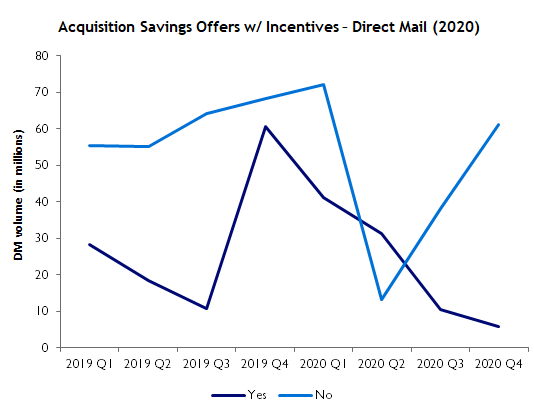

- Savings offers with incentives have been declining steadily: The decline in savings offers with incentives can be attributed to Capital One and Discover, which sent 39.2M and 16M of offers in Q4 2019, respectively, and none in Q4 2020.

- Even though interest rates are near 0% and banks are not providing customers with incentives to open a savings account, customers have not stopped saving since the pandemic broke: “A Federal Reserve report indicated that commercial bank deposits were up roughly $13.2 trillion at the start of the year, hitting $15.9 trillion at the end of the year.”

- Both banks and credit unions stopped disclosing their APYs on their communications: With interest rates so low, banks and credit unions stopped promoting their APYs, relying instead on the national average to benchmark their rates.

- Online banks positioned their tools as a way to help customers automate budgeting and saving: Ally, Chime, and Wealthfront used email to showcase customers how their tools can give them peace of mind through automation.

Savings offers with incentives have been declining steadily since the beginning of 2020, reaching their lowest point at the end of the year.

The decline in savings offers with incentives can be attributed to Capital One and Discover, which sent 39.2M and 16M offers in Q4 2019, respectively, and none in Q4 2020. Citibank was the only top mailer that increased its savings offers with incentives. Even though interest rates on deposit accounts are near 0% due to the pandemic, that has not stopped people from saving. Consumer willingness to save makes the landscape less competitive, which explains why offers with incentives have been consistently declining, while offers without incentives increased aggressively in the second half of 2020.

Debit Cards

- Banks highlighted security and convenience of their debit cards: Navy Federal Credit Union highlighted its Zero liability policy as part of the suite of security features of its debit card, while Capital One positioned its tap-to-pay technology as the convenience of not having to “carry checks or fumble for cash.”

- Banks promoted their contactless capabilities in email but missed the opportunity to position the feature as the safest way to pay amid the pandemic: There were countless banks promoting contactless as the ultimate convenience, but did not make emphasis on the feature being a good alternative for those cardholders wanting to enforce social distancing.

The value proposition of debit cards revolved around security and convenience.

Navy Federal highlighted the security aspect of the card through its “Zero Liability” policy, citing features such as 24/7 fraud prevention system, encryption technology, and more.

In addition to its $0 fraud Liability and Instant Card Lock, Capital One led the value proposition of its debit card with its contactless convenience, a welcome feature amid the pandemic

Mobile Banking

- Convenience and control were at the forefront of every mobile app value proposition: Bank of America motivated customers to “get your banking done easily and securely” with its app, while Chime highlighted that its mobile app will provide customers with “complete control of your money from the convenience of your smartphone.”

- Mobile deposits were often a highlighted feature: Both traditional and challenger banks sent emails to exclusively promote their mobile deposit capabilities through their respective apps.

- Digital assistants were not left behind: Bank of America and Chase sent separate emails to talk about the convenience of accessing their respective digital assistants through their mobile apps.

- Mobile banks did not promote their mobile apps in the same way traditional or online banks did: Given that the value proposition is tied to the performance of their mobile app, mobile banks did not promote their apps as a separate entity from their accounts, but as banking accounts improved and enabled by technology.

Emails often highlighted two important factors that make the case for mobile apps: convenience and control.

Citibank explained that, with its mobile app, customers had the same capabilities as if they were visiting a branch or calling customer service.

Chime leveraged Nerdwallet’s recognition of its app to position it as a trustworthy and efficient tool.

Key takeaways

The adoption of digital channels was accelerated due to COVID-19, but the trend will outlive the pandemic.

Fear of being exposed to COVID-19 made customers shelter themselves in digital channels to interact with their FSIs. After the pandemic, certain behaviors will go back to normal, but according to the Mintel Global Trend Driver Technology “consumers will rely more heavily on their devices to interact with their FSIs.” Now that consumers tasted the convenience of mobile banking, it will be difficult for them to go back to interacting with their FSIs in a more traditional way – for example, by visiting a branch.

Online and mobile banks had a good year.

With Revolut entering the US market, Varo becoming the first mobile bank to be granted a national bank charter, and Chime becoming the most valuable American fintech startup, it is clear that the accelerated adoption of digital channels spurred by COVID-19 benefited both online and mobile banks. These challenger banks are becoming more prominent in the banking landscape, posing real competition for traditional banks in the short and long term.

Checking and savings remained the preferred product lines on which banks relied on to drive new business.

Overall deposit acquisition offers in direct mail saw a YoY volume decrease of 69% in Q2 2020. Citibank, which was the top mailer for both checking and savings in 2020, leveraged its existing customers to drive new business.

![[Watch]: Innovate to elevate! A rallying cry for card marketers](https://welcome.comperemedia.com/wp-content/uploads/2020/06/CM_SocialMedia_InnovateToElevate_Purple300_Blog_2000x1000.jpg)