Best of 2019: Canadian banking industry highlights

Throughout 2019, the Canadian banking landscape changed significantly, with banks stepping up to meet consumer rewards expectations, focusing on digital marketing, and utilizing buzzwords like “unlimited” or “ultimate” to promote new offerings.

Check out highlights from last year’s biggest trends:

Rewards and bundling

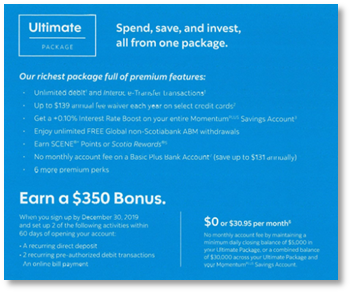

Canadians expect more value from their bank accounts. In order to deliver on this expectation, Scotiabank and RBC tied rewards programs to their accounts by carrying over rewards programs from their credit card products. Scotiabank also launched an Ultimate Banking Package with increased interest rates on savings accounts, waived fees on select credit cards and chequing accounts, and included a variety of other bundling and banking perks.

Direct marketing is for dinosaurs

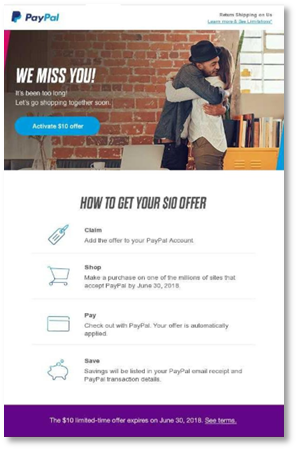

There was a significant direct mail acquisition volume disparity between 2018 and 2019 as banks shifted marketing to digital channels. Even email marketing activity declined compared to last year. Certain brands were holdouts: PayPal used email as a primary marketing channel, sending win-back and customer offers to Canadians.

Language is limitless

Canadian banks ramped up the rhetoric both in product nomenclature and within marketing campaigns by adding buzzwords like “No Limits,” “Unlimited,” or “Bank Without Limits.” The “Unlimited” Mintel Trend highlights how brands that offer unlimited access to services can promote these offerings as a convenient and budget-friendly solution to regularly repeated transactions. Canadian banks like RBC, Scotiabank and CIBC adopted this product and marketing strategy with the Signature No Limit bank account, the Ultimate Banking Package, and the “Bank Without Limits” marketing campaigns, respectively.

What to expect in 2020

In 2020, we can expect banks to continue to focus on digital marketing, leaving a direct mail open for any bank or credit union that really wants to take ownership of that space. Digital challenger banks and fintechs will continue to emerge with no-fee accounts and savings accounts with higher interest rates, made possible by their lack of branch overhead. In response, we will likely see more traditional banks tying rewards programs from other product lines to their account products in order to provide increased value to their accounts and avoid losing customers to these no-fee and higher interest offers.