Bolstered by pre-order deals and free subscriptions, Disney+ reveals more than 28M subscribers

This week, Disney reported the official subscriber count for Disney+: 28.6M. At first blush, it is an incredible count for a service that’s been around for less than three months. However, when considering Disney+’s many early-signup offers, and, more importantly, Verizon’s “Disney+ on us” deal, it feels less  astonishing. Can Disney maintain growth, and can it persuade subscribers to stick around when the multi-year deals and the free year from Verizon ends?

astonishing. Can Disney maintain growth, and can it persuade subscribers to stick around when the multi-year deals and the free year from Verizon ends?

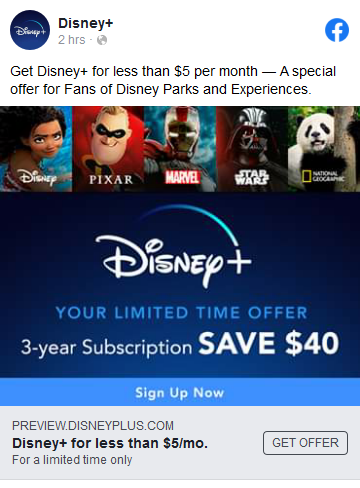

Disney did not release pre-launch subscriber counts, but it made all the right moves to capitalize on the Disney fan-base before launching Disney+ in November. It ran four waves of pre-launch promotions for fans, with the first deal offered to attendees of its D23 fan club; second to Disney Visa card members; third to Disney Movie Club members, and fourth to Disney parks loyalists. These deals featured a discount when pre-paying two or three years of the service, and Disney used direct mail, email, targeted Facebook ads, and onsite marketing at the D23 event to reach these fans. Disney did report that Disney+ had 10M sign-ups at launch, and it’s easy to believe that the pre-order sign-ups would have contributed significantly to this early number. For Disney+, these early subs help mitigate (or at least defer) churn, since they will be customers for a minimum of two years.

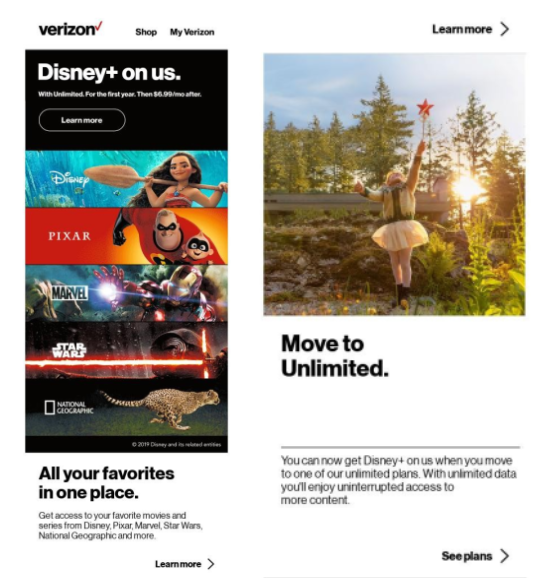

Next, Verizon announced a free year of Disney+ for its unlimited wireless, Fios Home Internet, and 5G Home customers. Verizon reported about 17 million of its customers would be eligible for “Disney+ on us.” On Disney’s earnings call, executives asserted 20% of subscriptions came from Verizon, meaning Verizon is responsible for a little over 5M Disney+ subscribers. Verizon successfully activated Disney+ subscriptions from 30% of its “Disney+ on us”-eligible base, then, leaving 70% that could still be converted. Looking ahead, Disney+ could benefit from the growth potential of 12M qualifying Verizon unlimited/internet subscribers that have not yet signed up for Disney+, which may help sustain its rapid growth trajectory, but would also increase the churn risk when those subs reach the end of their free year. The carrier has also been working hard to drive upgrades to unlimited among its base and attract new subscribers by leveraging the Disney+ offer—so new subs may be taking the deal, too.

In another scenario, only a small percentage of the remaining qualifying Verizon subscribers sign up for Disney+ (after all, they haven’t signed up yet, despite Verizon’s marketing efforts), meaning that the partnership has already produced its greatest value. Based on how the partnership plays out in the months to come, there’s always the possibility that Disney and Verizon could extend the deal, making “Disney+ on us” look more like T-Mobile’s long-standing “Netflix on us.”

Like any smart streamer, Disney knows that churn is inevitable with a month-to-month service, and it has been taking additional steps (beyond the option to pay annually and the multi-year sign-up deals) to try and mitigate it. Recently, Disney expanded its Disney+/ESPN+/Hulu bundles to include not just ad-supported Hulu, but also options to bundle ad-free Hulu or Hulu+ Live TV with Disney+ and ESPN+. It has even sent emails to Verizon subs who are getting Disney+ for free to encourage them to turn their subscription into a bundle “for only $6 per month” (Mintel ePerformance/eDataSource estimate that Hulu sent about 2M of these emails to Verizon customers in January).

What we think:

In conclusion, the early numbers show that Disney+ has rapidly amassed subscribers in its early days. The pre-launch deals and Verizon offer have undoubtedly bolstered the total. This speaks to Disney’s foresight with its streaming platform, and the strength of its—and Verizon’s—marketing. But now we watch to see how quickly this early activity subsides, and whether Verizon can continue to contribute to Disney+ subscriber growth by successfully converting its qualifying customers who haven’t yet activated the deal. Most importantly, we don’t know yet how well Disney+ will do when the year-long and multi-year offers end—will the service be compelling enough for these subscribers to stick around when they’re not getting the service for free, or sharply discounted?