Canadian credit card retention best practices

The size of the bank matters

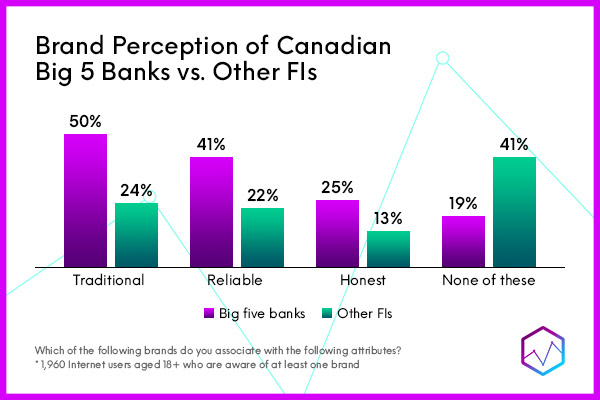

The size of the bank will influence best practices for that particular bank. The Big 5 Canadian Financial institutions have very recognizable brand personalities that consumers engage with, driving retention and brand engagement. Because of this, consumers are more likely to have a strong opinion on brand perception about the big five banks compared to other financial institutions.

While there is a high degree of uniformity in brand perception among the Big 5 banks, smaller institutions are more likely to be associated with being unique. This means that these brands must work harder to drive retention when a similarly-perceived competitor launches a better offer.

Best practices

Brands need to differentiate

There is little perceptual difference among consumers for the larger Canadian financial brands. These brands must work harder to differentiate themselves to drive retention and avoid losing customers to similarly positioned competitors. One way brands can do this is to continue focusing on building strong and unique rewards programs to attain a larger share of their consumer’s wallets, and offer incentives for engagement with service features like online billing.

Consumers want to associate positively with brands

Consumers want to feel positively about the brands they associate with. This is because brands are often perceived as the extensions of a consumer’s moral self. Brands can utilize social media to tie social positivity to their brand, but can also create a positive brand image by reinforcing the wide array of services associated with their cards. Sometimes, consumers need to be reminded why they chose the card in the first place.

Enhance customer loyalty

Loyalty is the key to retention and can even be leveraged to build new business through referral offers. Brands can build loyalty by rewarding their customers with credit limit increases, exclusive promotional rates, and card upgrade offers.

Brand personality

Finally, it is important for financial institutions to align their marketing, advertising and branding strategies with the values and brand personality they would like to be associated with. For example, many financial institutions that want to be perceived as being innovative and progressive have a brand image projecting a more sober and traditional image. These deviations from brand objectives need to be identified and corrected to better guide consumer perception, and also to retain customers who expect their brand experience to align with the brand image presented.