3 customer acquisition strategies to grow your business

A strategic blend of media channels and engagement mechanisms is key to paving the path for a successful customer acquisition strategy. Brands need to make an effort to understand customer needs and pain points and to capitalize on a healthy and long-term customer relationship.

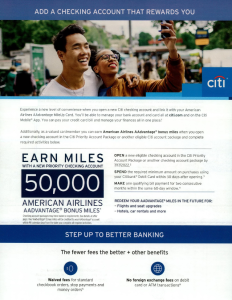

Looking at the financial services sector, brands have often focused on the top-of-funnel approach, with very few brands emphasizing the use of relationship-deepening tools like email or comparative approaches that showcase their differentiation among competitors. To name a few, Capital One and Discover have utilized effective email strategies to either lure prospects in or cross-sell to existing customers. Utilizing these middle-of-funnel marketing channels helps prospects make an informed decision. Going further down, bottom-of-funnel marketing is still flooded with promotional offers and discount tactics, but more needs to be done to encourage prospects to act on their decision. American Express, Bank of America, and Citibank are a few top financial services brands that have leveraged personalization and targeting strategies in email marketing to take it to the next level.

Here we have outlined a step-by-step funnel approach with channel tactics to help businesses not only acquire customers but also secure loyal customers.

1. Leverage social media and digital advertising to optimize top-of-funnel marketing.

Brands should consider resorting to social media advertising (using mostly Facebook and Instagram, with the opportunity to sprinkle in influencer marketing) and digital advertising when targeting prospects. With the main objective of informing the audience about the brand, marketers need to understand the differences between customer segments to produce advertising content that defines who the brand is and addresses the needs of its customers. This will help create interest in the right audience and urge them to take the next steps in their funnel journey. While digital advertising, (eg TV, display, and video), is known to span well-established, high-investment channels for building awareness, social media presence, both paid and organic, could also go a long way in targeting younger generations and thus generating prospects. Fintechs have set a great standard for demonstrating this progressive thinking in their advertising by adopting this approach in their marketing.

2. Utilize comparative and informational messaging to tackle middle-of-funnel marketing.

Customers at this stage of their journey are most interested in comparing products to understand what makes the brand stand out and what makes it most relevant to their preferences. Brands need to utilize this stage of the customer journey by promoting products’ value proposition in a way that enlightens prospects with an in-depth overview of the product along with a possible comparison or a call-out for what differentiates them the most from the competition. With direct marketing working wonders in enlightening prospects about the product, brands should make efforts to include testimonials, comparison matrices, or product ratings to help customers make a decision. Brands must strike a balance between creating solution-focused content and educating prospects on methods to validate their decisions. Capital One is one such brand in the industry that has effectively combined its products’ value proposition with customer testimonials and affiliate ratings, thereby helping prospects in their decision-making stage.

3. Deliver a personalized experience or showcase relationship benefits to succeed in bottom-of-funnel marketing.

Prospects who have reached the decision-making stage do not need to see the same marketing campaigns as they witnessed at the beginning of the customer journey. This is the phase to provide the most personalized marketing content by offering promotional discounts/rates. They could even leverage data-driven creativity in the form of gamification or targeting techniques, to create an engaging customer experience. Personalization helps brands stand out among the competition and also builds brand recognition; it’s not about addressing customers by their names in the final stages of marketing, but more about delivering relevant content to them. Furthermore, utilizing a cross-channel marketing approach helps brands deliver the right content at the right time. Email marketing is a great channel to target different buyer personas and personalize the message in a way that helps generate the highest open rates. Financial institutions such as Bank of America and Citibank have made efforts to showcase relationship benefits to customers, sending personalized offers to expand customer relationships.

What we think

While there are plenty of solutions for implementing marketing campaigns regarding customer acquisition, the above strategies can help brands that are looking to generate loyal customers and win relationships across various lines of business. Looking forward, the marketing environment may be more aligned with data-centricity, helping businesses create wealth through personalized and targeted marketing campaigns. Businesses that implement the above tactics will not only have a better chance of acquiring customers but will also create business efficiencies along the customer’s funnel journey.