Brands go all in on contactless payments

Financial services brands heavily increased “contactless” messaging in Q3, and Q4 is already shaking up to be an even bigger quarter for contactless marketing.

What we’ve seen

Financial services doubled down on contactless messaging in October, with campaigns generating over 106M impressions through display and paid Facebook in October—about a 120% increase from the month prior.

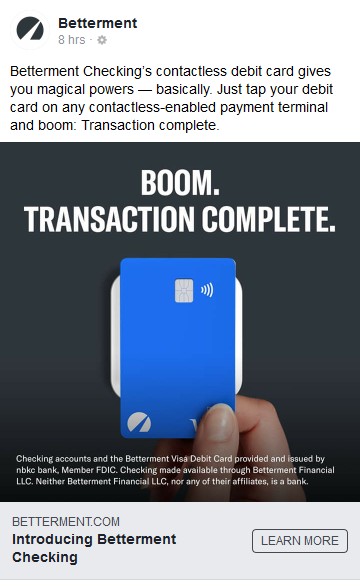

The top three marketers accounted for more than 60% of contactless marketing impressions generated 2020 year to date. While Betterment was the most prominent brand in Q3 overall, Citizens Bank, TD Bank, and Mastercard picked up contactless marketing impressions in September.

Facebook accounted for a majority share of spend among the contactless campaigns observed, totaling over $1.3M.

Wells Fargo and Betterment placed their debit cards front and center to remind consumers that debit cards are contactless too. Mintel research on consumer payment preferences shows debit is favored by younger consumers, and particularly Black and Hispanic consumers. Marketers should consider messaging that aligns with audiences’ varying lifestyles.

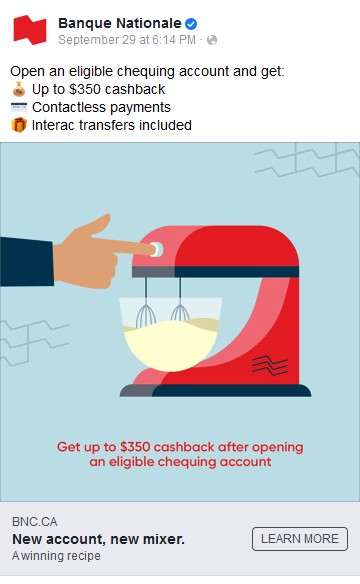

National Bank of Canada and Citizens Bank touted contactless payments as a perk on eligible checking accounts. National Bank of Canada promoted contactless payments alongside an up to $350 cashback checking account offer, while Citizens Bank spotlighted its contactless debit card with an up to $400 cashback checking account offer.

Apple Pay also made an appearance. During Apple’s Q4 2020 earnings call Tim Cook said that Apple in general continues to be enthusiastic about payment services. He noted, Apple Card is “doing well,” and Apple Pay is “doing exceptionally well.”

Per Mintel research on consumer payment preferences, among consumers aged 18-44 in Canada and the US, about 20% used Apple Pay in the past year.

What’s next?

Remove friction from consumers’ everyday lives.

Rise of contactless payments…

As contactless messaging increases, and consumer ad fatigue kicks in, it will become more difficult for brands to differentiate themselves. While safety is top of mind as the pandemic wears on, it’s not just about the safety features; brands that incentivize the use of contactless cards and mobile wallets can capitalize on increased integration of contactless features across various aspects of consumers’ lives.

…and social commerce.

While merchants have also been retooling their checkout experiences to suit consumers’ desires for low- or no-contact shopping, contactless payment options may not be enough to entice some shoppers into physical stores. As such, FSIs should consider the growing role of buy-now-pay-later services and social commerce as they work to secure top of wallet placement.

![[Watch]: Credit card marketing during COVID-19: Lenders proceed with caution](https://welcome.comperemedia.com/wp-content/uploads/2020/07/CM_SocialMedia_CreditCardMarketing_Pink300_Blog_2000x1000.jpg)