Challenger banks’ battle for customers is playing out on social media

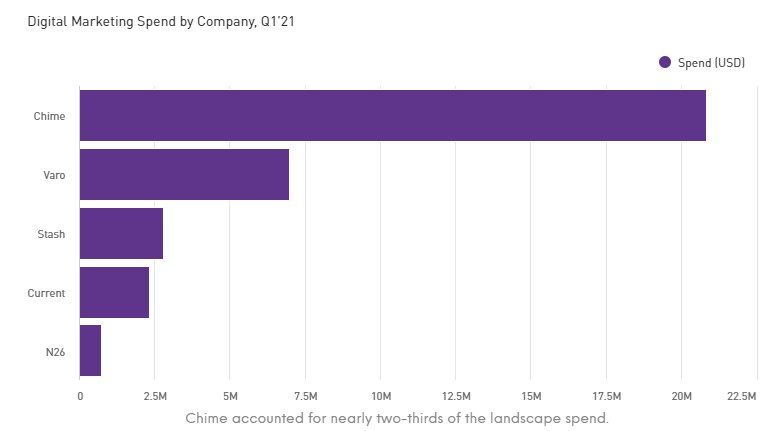

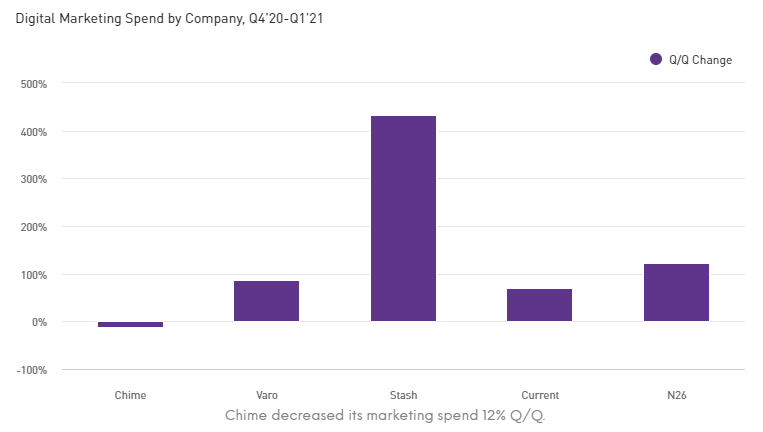

While Chime leads the challenger bank landscape in marketing spend, it was the only company to decrease spend Q/Q. Meanwhile, competitors are ramping up spend to gain market share.

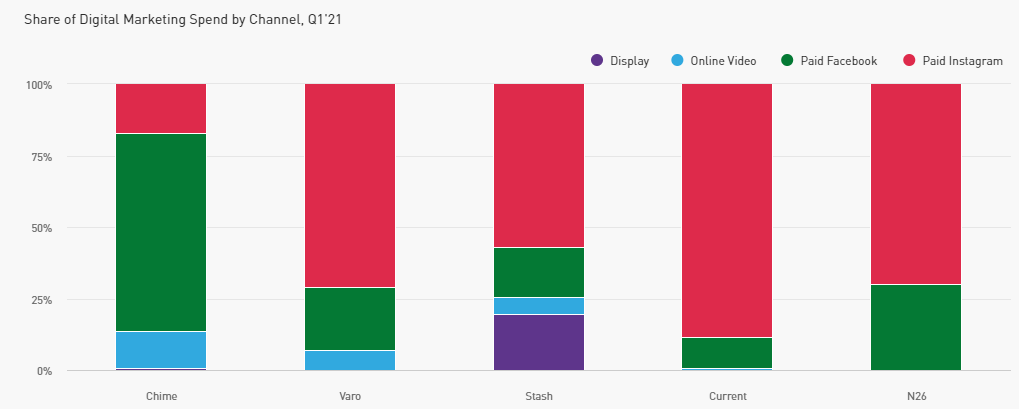

Challenger banks are predominantly marketing on paid social channels, where they are most likely to reach Gen Z/Millennials. Chime allocated the majority of its marketing spend to Facebook (which accounted for 55% of its Q1’21 spend), while competitors doubled down on Instagram. Notably, challenger banks largely forwent Paid Twitter; spend was nominal, accounting for less than 1% of the total landscape spend.

Chime sticks with Facebook

Chime focused on acquisition marketing, leveraging Paid Facebook to heavily promote its fee-free overdraft feature. Chime ran a couple of creative variations to promote the feature, changing up the color scheme and text overlays.The neobank ramped up spend in early March, at a time when fee-free overdraft messaging may appeal to many consumers who were awaiting a third stimulus payment.

The neobank ramped up spend in early March, at a time when fee-free overdraft messaging may appeal to many consumers who were awaiting a third stimulus payment.

Competitors double down on Instagram

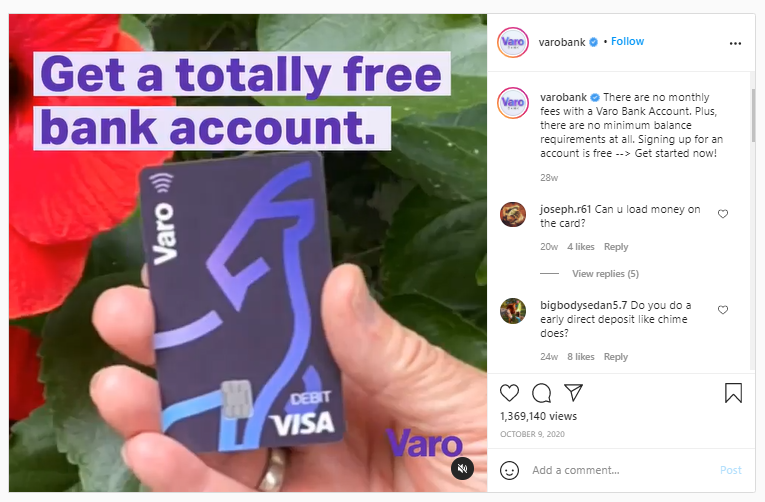

Varo leaned heavily on Instagram to increase awareness of its free bank account features, increasing its spend 52% Q/Q. The neobank allocated a majority of its Instagram spend (60%) to Instagram Stories, which speaks to the value of the ephemeral ad unit.

Stash focused its marketing efforts on attracting retail traders. Stash increased its Instagram spend 289% Q/Q, in an effort to ramp up investments in the legal cannabis market on its platform.

As the challenger bank attempts to attract a more open-minded audience toward the subject, Instagram’s younger-skewing audience is well primed.

As seen with Varo, Stash also allocated a majority share of its Instagram spend (80%) to Stories.

What we think

The social media landscape is at an inflection point and challenger banks are doubling down. Right now there are various factors at play. For one, it’s important to take into account how prolonged social distancing and quarantine orders impacted preferred modes of connection and communication. According to upcoming Mintel research on social media trends, over a third of people are using social media more than they did a year ago, that’s increased attention brands are monetizing.

Challenger banks know that social proof is a strong driver of consumer adoption. As such, they are meeting their audience where they are and not only have they grown rapidly, but they’re achieving growth despite smaller marketing budgets.

![[Watch]: Innovate to elevate! A rallying cry for card marketers](https://welcome.comperemedia.com/wp-content/uploads/2020/06/CM_SocialMedia_InnovateToElevate_Purple300_Blog_2000x1000.jpg)