Crypto Curious: 5 misconceptions about crypto

As crypto becomes more established with frequent features in mainstream media, it’s important for marketers who want to tap into both the consumer interest and this burgeoning new area to be aware of some prevalent misconceptions and how that might impact the brand.

#1 – The current crypto winter is the end of crypto.

“Crypto winter” describes a prolonged period of low prices, and the one we’re currently experiencing is certainly not the first. Past booms have been almost entirely fueled by speculation with little product-market fit and real-world use cases, whereas busts happened because of issues within the crypto industry. Speculation still played a factor in the most recent boom, especially given apps like Robinhood and SoFi adding crypto to their offerings at a time of peak investment interest. However, the difference in this boom was the crypto-based innovations, like NFTs and DeFi, which have created fundamental value that is unique to crypto and laid the groundwork for additional utility in the future.

What’s unique about this crypto winter is the combination of external and internal variables. Like previous busts, the stablecoin crash of Luna/UST and a domino effect of centralized crypto lenders toppling contributed to the current market downturn but this time was compounded by other macro-level factors like uncertainty and interest rate hikes affecting assets broadly. Each crypto winter and corresponding recovery period that the space has experienced has resulted in a winnowing, but projects with strong fundamentals and active communities have persisted. Historically, a steep drop in prices has not reflected overall crypto adoption rates or the broader innovation that’s happening in the space. Though sentiment indicates this could be a prolonged crypto winter, and brands should invest accordingly based on the volatility, it’s unlikely that crypto is going away for good because of the fundamental value that was created in this cycle.

#2 – All cryptocurrencies are the same.

There are over 18,000 cryptocurrencies in circulation, and for the average consumer, it can be difficult to differentiate between them. The shared goal of crypto is for different parties who don’t necessarily trust one another to transact with each other, without using a centralized intermediary like a bank. Different cryptocurrencies have different approaches for accomplishing this, by making tradeoffs between security, scalability, and decentralization – or what’s known as the Blockchain Trilemma.

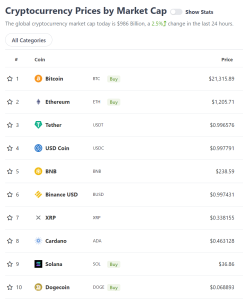

Some other variables consumers may consider include utility, the community culture, and the founding team. For instance, a crypto like Dogecoin (DOGE), which was created based on a meme, doesn’t offer much in the area of technological innovation but has received outsized interest and derives its value primarily from social sentiment. Other consumers are on the hunt for smaller cap coins that bring new ideas and innovation, like Solana (SOL) and Avalanche (AVAX) which experienced upwards of 10,000% gains during the previous bull market. Based on the needs of your brand or target consumer, it’s worth being selective with the projects you choose to engage in, though most consumer interest is concentrated in the Top 20 cryptocurrencies by market capitalization.

#3 – Crypto is a hedge against inflation.

Unlike government-issued currencies where supply is managed by central banks, the monetary supply of crypto is more predictable. With Bitcoin (BTC), this looks like an eventual hard cap of 21 million coins, whereas Ethereum’s (ETH) supply is based on a policy of minimum necessary issuance. This predictability with crypto issuance is what has led to its positioning as a safe-haven asset.

Though certain crypto assets like BTC and ETH have demonstrated long-term lasting power, the reality of the market’s volatility is that crypto has not proven to be a reliable hedge against inflation in more developed countries, instead behaving more like high-growth tech stocks. More accurately, crypto could be considered a hedge against hyperinflation, which is easily observed in high crypto adoption rates and interest in countries that have devalued currencies, particularly in Latin America and Africa. Brands that market in these areas might use the “hedge against inflation” narrative for their crypto offerings, but brands marketing in countries with more stable currencies might want to steer clear of this messaging.

#4 – Crypto is perfect for crime.

Early in crypto’s history, there were strong ties made with drug trafficking and money laundering, with the misplaced assumption that all transactions are anonymous. The reality is that the blockchain creates an immutable record of transactions, including any wrongdoing, that is both time-stamped and auditable. Given the nature of its design, criminals intending to use crypto have found that the blockchain is not ideal for breaking the law, with enforcement groups finding new ways to monitor activity. In fact, crypto-based crime dropped to all-time lows in 2021, with only 0.15% of all crypto transaction volume being considered illicit.

Unfortunately, there have been outright scams in the crypto space, but that’s typical of emerging technologies like the Internet. (Remember all those Nigerian princes emailing us to ask for money?) For now, brands can shoulder some of the responsibility and take additional measures to protect their customers, including providing educational resources. With the Biden executive order earlier this year and various crypto bills introduced in Congress recently, action is being taken to further reduce illicit activity and protect consumers.

#5 – All crypto is bad for the environment.

Environmentalists will celebrate crypto winter because it’s predicted that the amount of energy use by crypto has been cut in half. Most of the top cryptocurrencies use an energy-efficient security model, but the two largest cryptos – BTC and ETH – rely on an energy-intensive security model, which provides financial rewards for people to participate in “mining.” Those incentives become much less appealing during a bear market, because as the asset price decreases, mining becomes less profitable. However, even during bull markets, there are economic incentives to mine with the cheapest energy available, and that often takes a renewable form with geothermal, hydroelectric, and even natural gas flares being used by Exxon Mobile in a crypto mining pilot. With Ethereum set to eliminate the need for mining and transition its security model to one that would reduce energy use by a minimum of 99.95% later this year, some of the concerns of crypto’s impact on the environment should be mitigated when this occurs. For the time being, many NFT projects advertise as being carbon-neutral.

While skepticism over crypto’s environmental impact is not totally unwarranted, there is work being done to make it more environmentally friendly, and concerns should be balanced against the potential innovation that the technology can bring. Consider that the energy use of the current banking system is much higher than crypto, but this usage is widely accepted due to the number of people it serves and the utility it adds to their lives. Brands can frontrun the concerns by choosing projects that have lower environmental impacts and include appropriate messaging in their marketing.

Why this matters for brands right now

While sentiment around crypto is currently low, the existence of crypto-based innovations and its entrance into the cultural zeitgeist indicates crypto is likely to make a comeback in the future. Brands can take advantage of this market lull to work towards developing a robust long-term strategy, being aware of some of these negative perceptions around crypto to counteract those narratives and be proactive with messaging. Establishing a loyal customer base during a bear market will give a brand a headstart and an edge on the competition when the bull market finally returns.