Fintech Q2 2021 strategy review

In an interesting turn of events, traditional banks have disrupted the fintech industry. Popular value propositions for challenger brands (eg no overdraft fees and early payday) have been adopted by legacy institutions. Brands like Capital One and Huntington announced these offerings in Q2, resulting in fintechs responding accordingly and re-establishing their value against traditional banks.

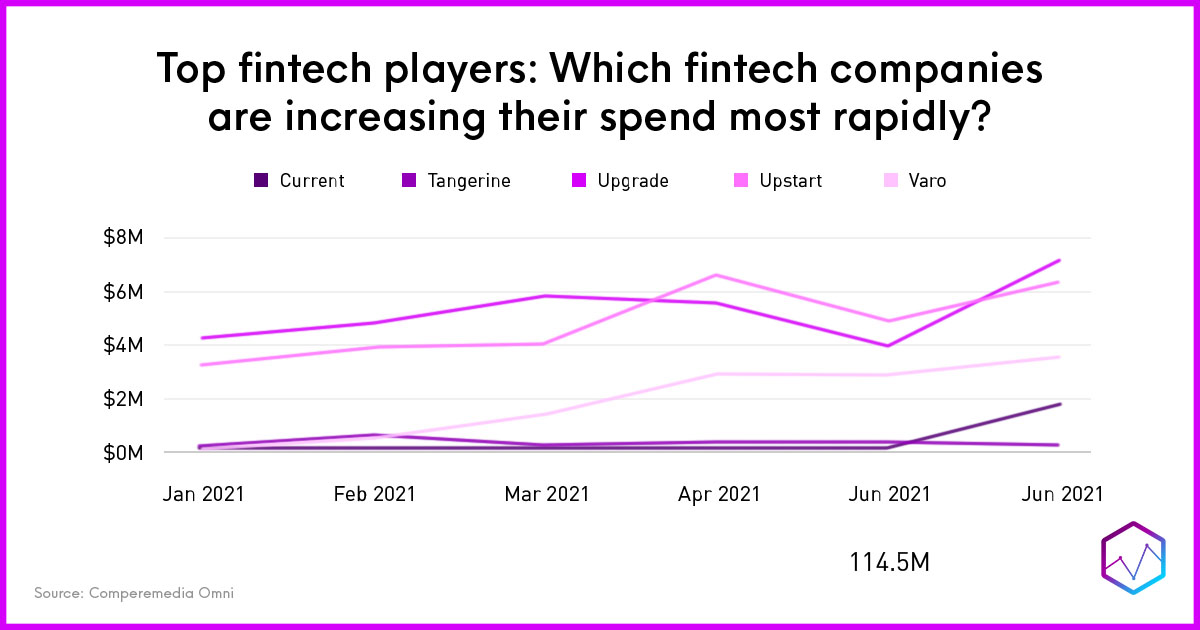

The neobank behemoth Chime, which popularized “get paid two days early” and featured its overdraft protection frequently in marketing, cut back spend in June by 52%. Offers shifted in tandem with the spend decrease: Chime boosted its overdraft protection threshold from $100 to $200 as well as its SpotMe product, which offers a $200 no-fee pay in advance.

While Chime decreased its spend, Varo Money became the fastest-growing fintech in Q2; its spend increased 19x since the start of 2021. Varo’s recent promotions targeted the underbanked: campaigns stressed its credit builder product, equipped with no fees or deposit, as well as an instantaneous cash advance of $100.

Offering no-strings-attached cash to consumers is gaining traction: instant cash advance has become the new keystone value proposition for many neobanks to replace overdraft protection and early payday. Dave, which IPO’d in early June, marketed the speed of its $100 cash advance, stating consumers can get the money in 90 seconds. Dave’s national campaign used real people to state how much money they received from Dave, an effort for Dave to relate to consumers and associate its brand with cash advance.

Current also aimed to relate to its consumers through a national TV campaign. The neobank spent $469k in June for a new ad that uses creator culture to connect with younger audiences and associate its brand with authenticity, stating its product allows its consumers to “live the life [they] create.”

What we think

It’s apparent that while traditional banks are catching on to the value that challenger brands provide to consumers, these fintechs are agile enough to find new ways to appeal to their target demographics. Competing banks will need to consider the value that cash advance and credit builder products can bring to their consumers in order to continue to disrupt the disruptors.