Insider Insights: Silicon Valley Bank ongoing coverage

In the wake of the Silicon Valley Bank collapse, our team of thought leaders is analyzing consumer sentiment and brand activity and providing real-time recommendations on how to navigate this unprecedented event. From how consumers feel, and how brands are addressing the situation, to what to expect this week and the weeks to come, our experts cover it all as the finance industry responds to the SVB collapse.

We will continue to update this page with the latest Insider Insights from our team of experts. Using Comperemedia competitive intelligence tools to monitor up-to-the-minute email activity and engagement, social sentiment, and other direct marketing, we will break down the notable consumer and brand activity and offer predictions for how brands will continue to instill financial confidence in their consumer base.

Updated as of 9:15 am ET 3.24.2023

Fed rate hike and what it means

By increasing the Federal Funds rate by 25 basis points this week, the Federal Reserve signaled its commitment to bringing down inflation to its target of 2% but also acknowledged the importance of stabilizing the banking industry in the wake of SVB’s collapse by not taking a more aggressive stance. Following a two-day meeting of the Federal Open Market Committee (FOMC), Chairman Jay Powell announced the hike along with the Federal Reserve’s economic projections. The target for the Federal Funds rate remains at 5.3% by the …end of 2023, which means there are plans for one more rate hike this year before potentially pausing. However, Powell did not rule out further hikes based on incoming data.

Here are Comperemedia’s three takeaways based on Jerome Powell’s remarks during the press briefing.

- Anticipated credit tightening: According to Powell, the fallout from the collapse of Silicon Valley Bank and Signature Bank will likely lead to further credit tightening as banks take a more cautious approach to ensure they have liquidity on hand should their depositors start withdrawing money. Powell equated the situation to be similar to an undetermined increase in the Federal Fund Rate in terms of its potential to slow down the economy.

- What to watch: An accelerated slowdown in the supply of credit via marketing. In February, acquisition mail volume, a key indicator of the supply of credit, fell for credit cards, mortgages and loans; this trend may now accelerate.

- Deposit flows are stabilizing: According to Powell, deposit flows “have stabilized in the last week,” suggesting that the crisis might be over for small and regional banks that were suffering as some depositors looked to move their money to institutions perceived to be more stable.

- What to watch: Some consumers have been reevaluating their banking relationships as a result of the crisis and may be more open to switching banks than before. Banks may take the opportunity to sharpen their points of differentiation and pitch their brand of banking as an alternative.

- Regulatory changes on the way: The Federal Reserve has already begun a post-mortem of the Silicon Valley Bank collapse led by Fed Vice Chair for Supervision Michael S. Barr. The aim is to understand the breakdown between the regulators who had been flagging warnings and the actions of leadership at SVB and to address future concerns.

- What to watch: Barr will publish his report by May 1 and, whatever the outcome, we may see intended and unintended consequences that could reshape the banking landscape.

Below are five ways to maintain trust and confidence during a crisis and inflationary period:

1. Invest in authentic and impactful messaging from the CEO.

The below email from its founder and CEO further strengthens its position and commitment to “client service.” It stated, “today, as every day, we are processing transactions, opening accounts, funding loans, answering questions, and serving clients’ overall banking and wealth management needs.”

Subject: Focused on Serving Our Clients

Vol.: 209k

RR: 31.4%

Walden CEO Charley Cummings shared his perspective on the collapse of Silicon Valley Bank and why Walden Mutual is different from other banks.

What it means

Communication from CEO during the times of crisis helps address issues with confidence and expresses transparency. Brands need to watch out for the content to be authentic and strategic in a way that not only expresses its stand but also highlights an appropriate customer care strategy.

2. Think beyond the CEO when listening to concerns

According to the New York Times, First Republic “lost roughly $70 billion in deposits in recent weeks – nearly half of its total depositor base…” To gain back customer confidence, First Republic thanked customers via tweets, calling out their tweets and appreciating them for being on their side.

Engagement Rate/Follower: 0.32%

What it means

Customer care strategy doesn’t always have to be about resolving issues. Brands should take steps to post content that makes their customers feel appreciated and also more connected with the brand..

3. Raise the bar by setting new industry standards

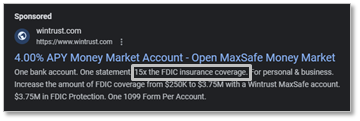

Following Mercury’s update last week, Brex tweeted that it raised the amount of FDIC insurance coverage to $6M, claiming it to be an “industry–leading” move.

Engagement Rate/Follower: 0.89%

What it means

Customers are anxious to look for ways to reduce any financial risks, and raising the FDIC insurance limits or educating them on ways to get such services goes a long way in reducing anxiety among customers.

4. Elevate customer reach by welcoming new customers

Last week, Brex mentioned that it opened 3,000 new accounts over the weekend.

Citizens Bank of Edmund CEO, Jill Castilla, posted on LinkedIn that they are seeing an overwhelming number of customers in their bank branches looking to open a new account.

What it means

Proactively taking steps to welcome customers and also reaching out to them via marketing or media channels will help create a sense of trust and reliance for the brand. This also creates a discourse that puts more faith and confidence in systems that are not national banks.

5. Invest in educational marketing touchpoints

Citizens Bank of Edmund’s CEO has been actively posting on LinkedIn educational videos on FDIC insurance, credit score management, and how banks are regulated.

Engagement Rate/Follower: 0.088%

What it means

Focusing on empowering customers’ knowledge instead of focusing on selling products during difficult times helps form impactful relationships with customers. Sharing perspectives and building awareness about finance will help build long-term engagement.

Comperemedia has the ability to analyze, in real-time, the communication brands are sending across multiple channels including direct mail, email, and paid social. Our team of expert analysts is able to provide your competitors’ volume numbers, read rates, key messaging, subject lines, and more. If you are interested in finding out how we can help your brand navigate these complicated issues, please reach out to our consulting team today.

If you are a client, you can dig into this data and read analyst commentary by logging in or reach out to your Account Manager today.

Updated as of 10:15 am ET 3.20.2023

First Republic Bank rescued by large U.S. banks, after receiving $30bn in deposits

After the SVB collapse, San Francisco’s First Republic Bank suffered a drastic stock market drop, down 70% in the last nine trading sessions. The bank’s squandered position resulted in a downgrade notice and left the regional bank in treacherous waters. On March 16, legacy powerhouses such as JP Morgan Chase, Citi, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley stepped up to assist in a rescue—infusing First Republic with $30bn in deposits. U.S. regulators said the show of support was most welcome and showed the resilience of the banking system.

Before the rescue, First Republic was actively communicating status updates/educational materials with its customers to provide reassurance via email and worked to humanize its brand on social media. National banks opted for less of a public-facing communication strategy in response to SVB, but have spoken out on the rescue effort.

New Email Creatives | Bank of the West, Woodforest National Bank, Aspiration

BMO sent out an email on March 16 reinstating its “best-in-class financial strength and stability” as a result of this acquisition and in the wake of the banks’ failure crisis. While this message could add some relief, it can try to be more informative in its approach by including any useful links to FAQs or resources on the company’s website, or explaining what the FDIC limits are and/or ways to insure deposits that are over these limits.

An email message from Woodforest National Bank comforted the customers by stating “banks across the country remain well-capitalized and financially strong, and Woodforest stands among the best.” What’s unique about this messaging is the fact that it promoted its IntraFi services that helps customers ensure deposits over $250k so that they are 100% FDIC insured. This simple, easy-to-digest language in the CEO’s messaging helps portray the brand as a trusted partner to customers.

Aspiration also reminded customers in an email about this insurance and how it works, educating its customers about its mission of the safety and security of their deposits.

Subject: Your Aspiration account balances are protected

Vol: 894k

RR: 22.2%

New Social Media Creatives | Mercury, Truist, Betterment, Citi, Upstart, SoFi

Mercury further boosted its FDIC insurance to up to $5M and welcomed new customers via Twitter posts. It Tweeted “In fact: between last Thurs – Mon, 24% of new customers were approved within 2 hours of completing an application.”

Despite staying relatively quiet since the SVB collapse, large banks such as Truist and Citi joined the ongoing online conversation to state their role in the First Republic rescue. Smaller fintech players continued to provide social media-driven educational content around the current banking environment, pushing to keep their audiences informed with need-to-know, relevant takeaways. Notably, SoFi (who has been an active educator around SVB) announced a boost in APY on savings balances to 4.00% to promote direct deposits while making sure to not its FDIC insurance coverages.

Cross-Industry Creatives | Tommy John, Camp

Some brands touted a sale based on the event; the capitalization to sell products may run the risk of being seen as tone-deaf.

Looking ahead: What can financial services brands expect next?

Bank consolidation: We’ve gone from more than 8K+ banks to 4K+ banks since 2000 and the consolidation trend will likely accelerate as a result of the SVB collapse. Local banks provide an invaluable service to consumers and small businesses in their communities and won’t give that up without a fight.

Credit crunch: The supply of credit via marketing has already been slowing at a time when consumers have record levels of debt and when interest rates on credit cards are at record highs. An even more cautious outlook may cause some banks to cut back on their marketing activity and further reduce their risk exposure. We have already seen a more cautious approach in the marketing of credit cards and loans and anticipate that this will likely accelerate as a result of the SVB crisis.

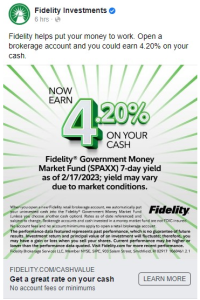

Flight-to-safety: There is an opportunity for brokerage accounts and fintechs to court wealthy investors with the message of providing the flexibility of a bank account but without the same risk. Auto investing service Wealthfront, for example, offers a high-interest Cash Account that allows account holders to pay bills and write checks along with $2M in FDIC insurance. It took to Instagram this week to remind customers/potential customers that its coverage is “8x more than what you’d get from a single bank.“

This may also manifest as a flight to put money in money market accounts. According to NPR’s The Indicator, “When the Fed hikes interest rates, deposit rates on savings accounts don’t go up as much as interest rates on other kinds of investments. So depositors take their money and go in search of higher returns elsewhere. One common destination is a mutual fund.”

Comperemedia has the ability to analyze, in real-time, the communication brands are sending across multiple channels including direct mail, email, and paid social. Our team of expert analysts is able to provide your competitors’ volume numbers, read rates, key messaging, subject lines, and more. If you are interested in finding out how we can help your brand navigate these complicated issues, please reach out to our consulting team today.

If you are a client, you can dig into this data and read analyst commentary by logging in or reaching out to your Account Manager today.

Updated as of 10:00 am ET 3.17.2023

New email communications | Kinecta, Nav, Huntington Bank, Robinhood, Fidelity, Thrivent, Charles Schwab

Brands have been quite boisterous with emails addressing the SVB subject, similar to what we have seen so far this week across other channels: CEO responses, newsletters, webinars, and live Q&A. Notable messages involved “actions [the customer] can take today” and encouraging customers to save seats for upcoming webinars.

New lending offers | Bankrate, LendingTree

The 30-year fixed mortgage rate dropped almost 50 basis points on average this week and brands like LendingTree and Bankrate utilized references to “bank collapse” in their messaging to promote their products.

Vol: 983k

RR: 10.8%

New social media content | UMB, SoFi, Wealthfront, First Tech, US Bank

While some brands are just beginning to join the social conversation around the SVB collapse, others are innovating their communications to deliver timely consumer touchpoints. Notably, Wealthfront and US Bank both tapped into the current economic environment to elevate key product attributes of their products and services, tying hyper-relevant situations to value-add opportunities.

Engagement Rate/Follower: 0.098%

How to approach educational marketing during economic turmoil

Do’s:

- Keep a consistent brand voice throughout educational materials.

- Consider the true value-add of the material to your specific audience.

- Strip away the complexities and align your content to the platform it will be delivered on.

Dont’s:

- Hop into a conversation with education-forward content if it does not align with the direct needs of your tailored audience.

- Play the blame game or shift the issue onto other parties.

- Speak to a thousand topics at once in long-form, drawn-out content.

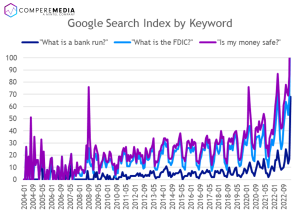

To underscore the importance of education right now, here is a visual of search activity for various keywords. Not only do consumers want to know the basics, but they want security in their finances.

Comperemedia has the ability to analyze, in real-time, the communication brands are sending across multiple channels including direct mail, email, and paid social. Our team of expert analysts is able to provide your competitors’ volume numbers, read rates, key messaging, subject lines, and more. If you are interested in finding out how we can help your brand navigate these complicated issues, please reach out to our consulting team today.

If you are a client, you can dig into this data and read analyst commentary by logging in or reach out to your Account Manager today.

Updated as of 11:30 am ET 3.16.2023

How the finance industry is responding to the SVB Collapse: New channel and brand communications

In the wake of the financial turmoil caused by the Silicon Valley Bank and Signature Bank collapses, brands will need to lean into their customer service to provide ample support and consideration to ease consumer concern. One of our 2023 Omnichannel Marketing Trends, Supporting Character Energy, emphasizes the importance of leading with a customer-first mentality to not only showcase the ongoing value of a brand, but also to support customers during a financially volatile time. These customer-centric efforts must go beyond the run-of-the-mill FAQ documents, to ensure customers’ needs and concerns are being handled with care—and in a manner that amplifies security and reinforces confidence.

New email creatives:

As some fear that consumers will ditch small banks for ‘too-big-to-fail’ banks, community banks are fighting for a more confident perception. This importance is augmented by the fact that community banks make up the majority of lending to small businesses. “Safe and secure” is the theme in email engagements from smaller banks like Michigan State University Federal Credit Union and Golden1 Credit Union.

New social campaigns:

Some brands, like BMO and NerdWallet, are taking to social media to amplify their “safe and secure” sentiment by adding additional context to fuel their narratives. From infographics to blogs to live-streamed conversations, brands are working to equip their customers with the information needed to truly feel prepared, supported, and secured with their financial decisions.

New SMB support strategy:

Fintechs are taking steps to protect SMB customers; in an attempt to acquire new customers, Mercury introduced “Mercury Vault” for small business customers (startups), protecting up to $3M in FDIC insurance and a money market fund. This Twitter post touted its unique position in the industry with this feature, stating “12x the industry standard.”

Owned Twitter

Engagement Rate/Follower: 3.61%

Source: Comperemedia social media monitoring [03/09/23-03/14/23] as of 03/14/23

Comperemedia has the ability to analyze, in real-time, the communication brands are sending across multiple channels including direct mail, email, and paid social. Our team of expert analysts is able to provide your competitors’ volume numbers, read rates, key messaging, subject lines, and more. If you are interested in finding out how we can help your brand navigate these complicated issues, please reach out to our consulting team today.

If you are a client, you can dig into this data and read analyst commentary by logging in or reach out to your Account Manager today.

Updated as of 1:45 pm ET 3.15.2023

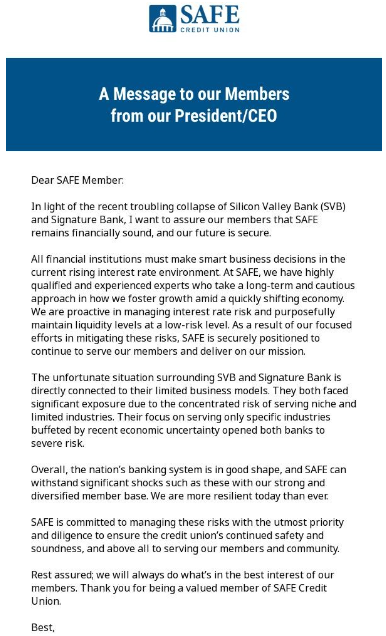

As we take a look into emails written by credit union CEOs, it’s important to note that engagements at this time are not seen as opportunities. These communications should be seen as support, education, customer service, and confidence reassurance to customers that their money is safe.

What are we seeing in email communications?

Credit union CEOs are reaching out to customers directly via email to stand out and increase the impact of their engagements. Due to the much smaller customer groups that CUs cater to, an email directly from the CEO offers more of a personal impact than blanket marketing outreach.

To instill confidence in their members, SAFE Credit Union and First Tech Credit Union used emails written by their CEOs to underscore the strong and secure future ahead for customers, as well as how their respective business models prevent risk and liquidity issues. First Tech outlined its history as a “beacon of safety”; SAFE stressed its experts and its member-first mentality. While for national banks, an email from the CEO may be more noise and seem like a flatline sentiment, this approach could be particularly impactful for regional banks, as their smaller customer group may appreciate this kind of high-value visibility from leadership.

Subject: A message from Greg Mitchell: First Tech remains strong and secure

Vol: 128k

RR: 21.1%

Subject: A Message to Our Members

Vol: 71.6k

RR: 25.0%

Based on February’s Consumer Price Index and the SVB collapse, what is the Fed’s next move?

Inflation rose 6.0% year-over-year in February, slightly easing from January’s Y/Y measure of 6.4%. February marks the lowest Y/Y reading for inflation since September 2021. Core CPI (the price of goods and services minus food and energy), rose from 0.4% in January to 0.5% in February, and currently sits at 5.5% for the 12 months ending February.

- What it means: While core CPI increased M/M, a large part of that has been driven by rising shelter costs, which make up about a third of core CPI. Shelter costs rose by 0.8% M/M and 8.1% Y/Y as of February. Shelter is by and large a lagging indicator, however, and it takes a while for it to be accurately reflected, thus overstating CPI data in these monthly reports. Looking at core CPI minus shelter, one can see that the 12 months ending February showed a 3.7% reading, a promising deceleration from January’s 4% Y/Y figure.

Future Interest Rate Predictions

Hiking rates in the upcoming March meeting is still very likely. Last week, Jerome Powell, chairman of the Federal Reserve, said that he expects rates to go “higher than previously anticipated” off the back of a red-hot labor market and inflation data not decelerating at the rate that the central bank hoped. As a result, there were expectations that March’s rate hike would come at a higher-than-projected 50 basis points. However, turmoil in the banking space this week has led to speculation from many corners of Wall Street that the Fed would take a more restrained approach. Goldman Sachs is predicting the central bank will skip March’s rate hike altogether. The Federal Reserve will likely want to keep its foot on the gas, which makes hiking rates at the upcoming March meeting extremely likely. Due to the collapse of SVB and Signature Bank, the prospect of a 50 basis points increase is essentially off the table. The Fed is likely to stay the course but meet in the middle and make do with a 25 basis points increase. Markets are sharing the same sentiments; according to CME Group’s FedWatch tool, the probability of this currently sits at 65%.

Comperemedia has the ability to analyze, in real-time, the communication brands are sending across multiple channels including direct mail, email, and paid social. Our team of expert analysts is able to provide your competitors’ volume numbers, read rates, key messaging, subject lines, and more. If you are interested in finding out how we can help your brand navigate these complicated issues, please reach out to our consulting team today.

Updated as of 6:15 pm ET 3.13.2023

What is the social sentiment surrounding the SVB fallout?

Online conversations centered around the SVB fallout took social media platforms by storm on March 10. Mintel social media listening has already identified nearly 1M social posts mentioning Silicon Valley Bank, with the topic receiving approximately 2.4 social mentions per second. Unsurprisingly, 70% of related posts are fueled by a negative social sentiment as top social topics are emphasizing themes of collapse, failure, and bailout—signaling a heavier tone that brands must actively consider when joining and contributing to the ongoing conversations. It will be critical for brands to be aware of the conversational tone at large to ensure their messaging and communications are effective while avoiding a venture into tone-deaf waters.

Read more on our initial observations of how brands are attempting to ease consumers’ concerns and lend a helping hand:

Being transparent with customers

Some impacted brands took positive steps to educate customers on what the impact is and what they are trying to do about it.

- Brex proactively released an FAQ on its website right after the SVB collapse news on Friday and assured its SVB customers of steps it’s taking to help support these small business customers. Among all the support initiatives that it mentioned, one stated that it increased the FDIC insurance on business accounts from $1M to $2.25M.

- Affirm immediately educated its customers via a press release on March 10 that it does not perceive any meaningful risks to the firm.

- SoFi utilized its Daily News alerts *(Subject Line: 🏦 Weekend announcement from the Treasury; Volume: 2.5M) as a mechanism to inform customers about the news and current events regarding the SVB crisis but turned to Twitter to assure customers claiming little exposure to SVB with, “Your money is safe with SoFi.”

Brand recommendation:

Be empathetic to mitigate risks. Brands can make themselves more approachable during a crisis by not only educating and informing about their exposure and stance but also offering a conversational tone in their messaging to reassure customers about their money and next steps. Further, creating a space or system where customers can engage in a dialogue with the bank will help emphasize the brands’ customer-centric approach.

Meeting immediate operational challenges

Many businesses envision challenges with upcoming payroll and other operational needs and B2B brands are offering a way forward.

- Brex mentioned it “is partnering with third-party providers to offer an emergency bridge loan with funds available early in the week. We’ve seen a tremendous amount of interest in this program, and you can apply here.”

- Deel, a payroll and compliance provider, offered a backup payroll plan, offering $120M of its own cash off its balance sheet to support its customers’ (startups) payroll operations.

Some impacted small businesses are going direct to their customers with direct appeals for time and money to help them with immediate cash needs for running day-to-day operations.

- Kids’ store, Camp, sent this email to its customers to help continue operations.

- Etsy warned sellers of delayed payments via email and attempted to reassure customers that “teams are working hard to resolve this issue and send you your funds as quickly as possible.”

Investing brands take action

It’s clear this bank run event doesn’t concern just Deposits, nor does it just concern B2B. Using our insight into financial services brands’ email campaigns, we have seen that consumer investing brands have been particularly vocal about the impact this event has on markets. A few brands’ email campaigns were particularly hyper-reactive to the news (SoFi, Charles Schwab (Volume: 82.7k, Read Rate: 15.4%), NerdWallet (Volume: 3.27M; Read Rate: 8.4%)), leveraging their newsletters to notify their consumer base of updates and guidance on what to do next.

NerdWallet’s approach was particularly unique, as it paired an email newsletter with advisory content marketing regarding “10 ETFs With the Highest Exposure to Silicon Valley Bank.” The irony of this article, given NerdWallet’s deposits in SVB, is not lost on us; however, its proactive and informative approach helps them stay ahead of the conversation while providing actionable takeaways for its readers to provide a sense of control during a stressful period.

Brand recommendation:

NerdWallet’s strategy could be applied to any financial services brand with an investment sector. In wealth management engagements, be proactive to inform customers on what they should do, if anything and what types of investment portfolios may be affected. For brands wanting to boost advisory services, a supportive expert could be essential to instilling confidence in an investment customer.

Our predictions for the Fed’s next move

Tuesday is key: Last week a half percentage rate hike looked likely considering the red-hot job market and elevated inflation. We will get a better picture when the CPI data comes out tomorrow, but the Fed standing pat next week could happen, just to let all this drama fade into the news cycle, as well as relieve some stress off the more vulnerable smaller regional banks. Unfortunately, we don’t yet know if the Fed is thinking of the SVB and Signature situations as either management failures or a function of the rate hikes. If tomorrow’s CPI is similar to January, Fed chair Jerome Powell will likely continue with his goal of cooling inflation and decide to go forth with another hike of, most likely, a quarter increase. According to CNBC, traders feel the same and are pricing in about 2-to-1 odds that the Fed raises its benchmark borrowing rate by 25 basis points.

What should brands do to prepare for what is next?

Time to communicate! The government isn’t holding back in getting the message out, and banks should do the same to reassure customers and educate them about FDIC insurance. In the age of social media (and the 1 Million mentions on this topic already according to Mintel social listening), it is better to over-communicate rather than risk conveying a confusing message by under-communicating. During times of uncertainty, banks can educate consumers and small business owners and provide them with the resources to navigate the volatile environment. Not only will education help customers by reassuring them and arming them with the facts, but it is an opportunity to engage with them and build trust.

Resources to monitor communication strategies

Comperemedia has the ability to analyze, in real-time, what brands are sending out across multiple channels including direct mail, email and paid social. Our team of experts are also able to provide volume numbers, read rates, key messaging, subject lines and more from your direct competitors. If you are interested in finding out how we can help your brand navigate these complicated issues, please reach out to our consulting team today.

If you are a client, you can dig into this data and read analyst commentary by logging in or reach out to your Account Manager today.

*Comperemedia ePerformance [03/10/23 – 03/13/23] as of 03/13/23