Soaring Prices Drive Brands to Emphasize Gas Offers

Increased gas prices have left consumers spending considerable amounts more at the pump, creating an opportunity for credit card brands to counteract the new burden with a shift in advertising spend and messaging. If they do it right, they have the opportunity to provide consumers with highly desired relief.

With global circumstances causing gas prices to spike, credit card brands scrambled to provide consumers with any semblance of relief.

The high desire for gas, largely a result of increased demand following the pandemic and the loss in supply due to factors like the conflict in Ukraine, has caused consumers to allocate more of their monthly budget to fuel. Since consumers are spending more at the gas station, an opportunity arose for brands to promote any offering that provides some reward for the extra dollars spent. Though gas prices have dropped slightly since June, the underlying reasons for the high prices are still present. The uncertainty around where prices may go means that this opportunity for brands to provide relief continues.

Changes in Spend

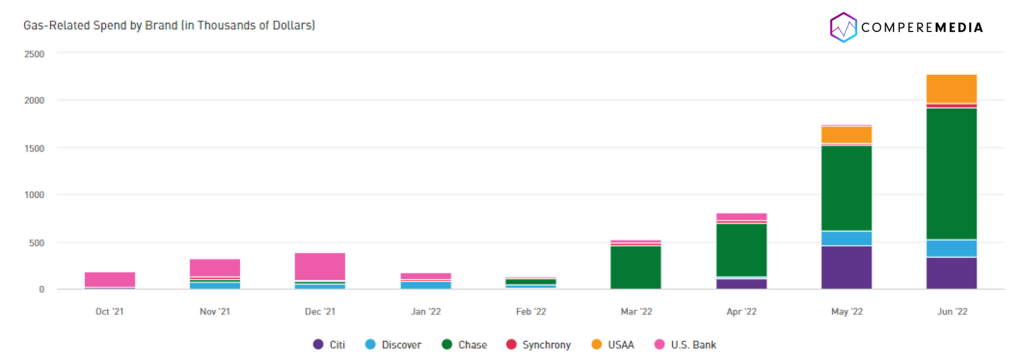

Although brands allocated efforts to gas-related offers prior to price increases, spend has consistently risen since February 2022.

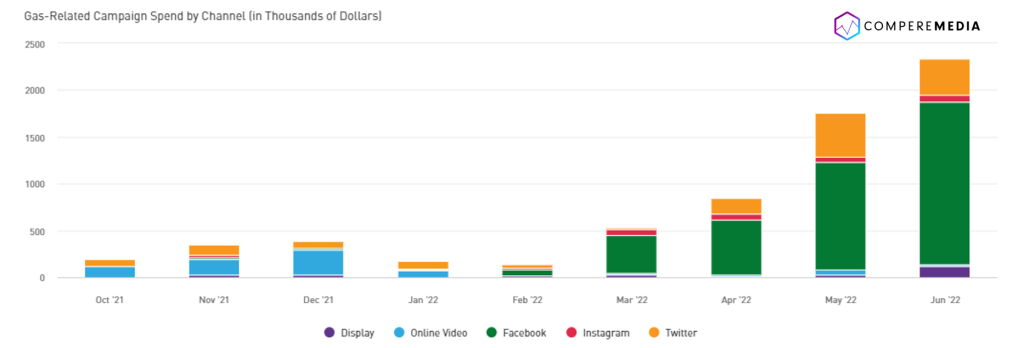

Gas-related spend primarily went to paid social, with Facebook seeing the greatest increase, connecting brands to consumers feeling the brunt of astronomical gas prices.

Source: Comperemedia Omni [10/1/21-6/30/22] as of 7/14/22

Changes in spend to promote gas offerings varied at the brand level, dependent on the rewards a company already had available.

Aside from U.S. Bank, brands with the highest spend on gas-related campaigns significantly increased spend during Q2 2022 to present solutions to rising prices.

Brands are expanding the narrative

Some credit card brands that previously did not heavily focus on gas offerings entered the space with campaigns dedicated entirely to the sector.

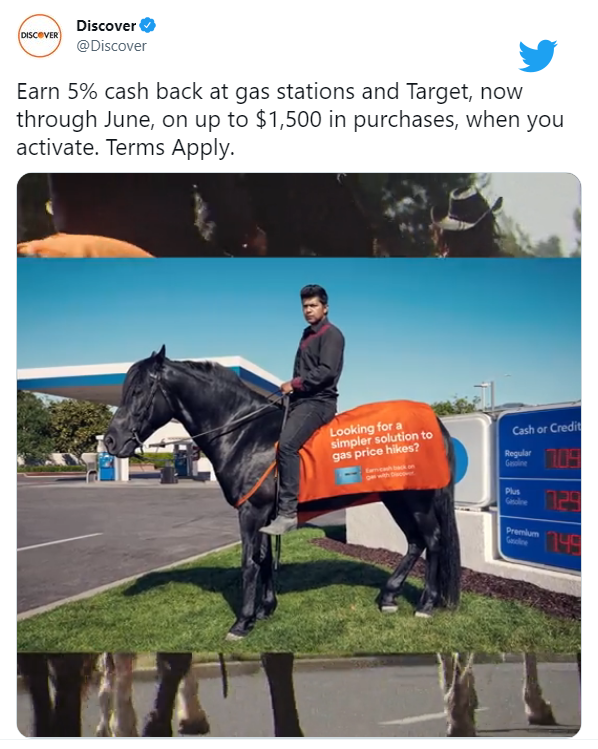

While Discover promoted 5% cash back on gas as part of rotating category offers before, paid social efforts for the gas offer increased in 2022.

USAA took the opportunity of heightened gas prices to launch an entire gas-related campaign in May 2022. Unlike the other top brands, USAA did not start investing in gas-related campaigns until May 2022. The brand heavily promoted 2x the points on gas via paid social. The potential of drawing in consumers by promoting a gas offer was desirable enough for USAA to drastically increase spend from April 2022 to May 2022 on a new gas-related campaign.

Shift in rewards

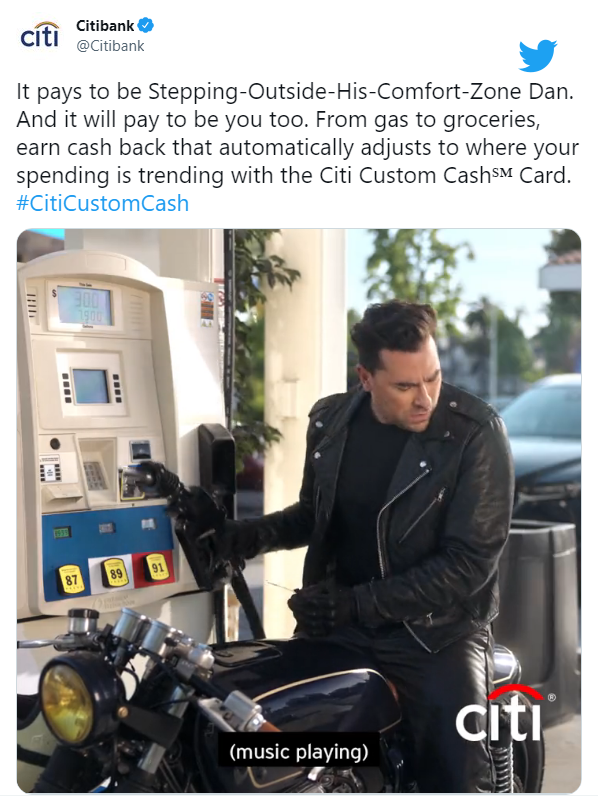

To stay competitive, some brands altered the rewards on which gas-related campaigns focused. Citi revamped gas-related campaigns in 2022 to feature a cash-back benefit instead of points.

Although the Custom Cash card adjusts cash back rewards to a users top eligible spend categories, the social posts created in 2022 showcased a storyline with a gas station as a backdrop to drive home the message of the cash back opportunities to counteract high gas prices.

What’s next for gas offerings?

The expectation for gas rewards has changed: As seen with the sharp increase in spend for gas-related campaigns promoting rewards above 2%, the barrier to entry for brands looking to provide relief has changed. Until gas prices stabilize, consumers will be drawn to the most rewarding offer that counteracts their heightened gas bills. Brands can take the path of Discover and increase gas rewards for a limited time, signaling a recognition of the plight consumers face due to current circumstances.

Non-traditional rewards can offset high prices: Brands can consider alternative rewards that create something positive out of increased spend at the pump. Partnering with Chevron, Acorns promised an investment of $.25 in a consumer’s future when they spent at least $20 on gas through 7/21. The non-traditional approach taken by Acorns gave consumers a way to partially offset increased spend at the gas station with a small future benefit. Other brands can follow Acorns’ lead and find key partners to provide some benefit to consumers without having to restructure their rewards entirely.

Stay up to date on the latest financial services marketing trends by signing up for our newsletter here.