State of the Economy: The bad, The good, and the Opportunity for Banks

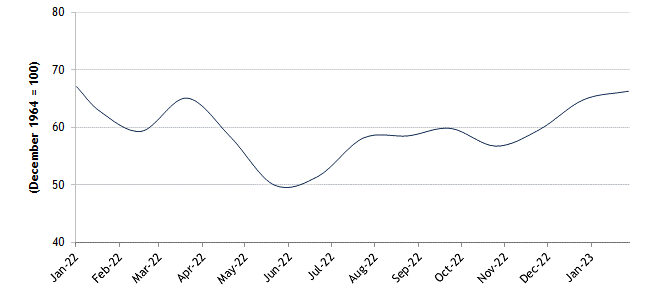

In a bid to tame inflation, the Fed’s rate hikes have coincided with expectations that the labor market and economic growth would suffer. However, the US economy has defied predictions and remained strong: 517,000 jobs were added in January, the unemployment rate dipped to 3.4%, annual inflation slowed to 6.4%, and GDP grew by 3% in Q4 2022 with 2.5% expected in Q1 2023. As a result, consumer sentiment has been on the up against the backdrop of a resilient economy, with growing optimism that the country could skirt a recession and achieve the coveted soft landing, where interest rates rise just enough to cool inflation without provoking an economic downturn.

But while consumers are more optimistic than they have been in nearly a year, policymakers remain faced with a conundrum: can the economy, particularly the red-hot labor market, withhold its current momentum while allowing inflation to slow to the 2% target rate? It is an argument that has had experts and officials sit on two different sides, particularly when it comes to prospects of higher interest rates – with one side advocating for swifter and more urgent rate hikes, and the other advising for more patience from policymakers. Interest rates currently sit at a range of 4.5%-4.75% – the highest they have been since 2007 – with rates initially expected to reach 5%-5.25%. Interest rates could very well rise even higher than the target range of 5%-5.25%, but it ultimately ties to how the labor market fares in the coming months alongside the rate at which inflation cools.

In the case that the Federal Reserve decides that more effort is needed on its part, and that interest rates may need to rise further, what does that entail for financial services providers and their customers?

The Bad

Elevated interest rates mean that borrowing is costlier for consumers and that they will realize higher rates on a variety of personal debt such as credit cards, auto loans, personal loans, and mortgages. For lenders, particularly in the mortgage space, that means they are likely to see lesser demand as a result. One segment that FIs (Financial Institutions) could see increased activity from is subprime consumers, however, especially given the fact that while inflation is cooling it still remains elevated by historic standards, remaining a sizeable financial burden on these low-earning households. As such, low-earners could turn to things like personal loans to continue meeting short-term payment needs and existing debt obligations.

The big banks in Chase, Wells Fargo, and Citibank have all slashed jobs in their home lending divisions last year as surging mortgage rates and high home prices depressed mortgage activity throughout 2022. With interest rate cuts out of the question until 2024, the housing market and its lenders have a similarly challenging 2023 to navigate, especially should the Federal Reserve amplify its tightening cycle (while mortgage rates are not directly connected to the interest rates the Fed sets, the effects of rate hikes still spill over into the housing market).

Coupling mortgage rates with other key factors such as home prices and household incomes, the current picture of housing affordability also looks grim; according to the Atlanta Federal Reserve, home ownership affordability is at its worst level since the onset of the housing bubble back in 2006. Current housing inventory also remains strained, as homeowners who locked in a much more advantageous rate in the past will feel disincentivized to sell, keeping upward pressure on already limited supply alongside elevated home valuations. Coupling that with diminished housing affordability, alongside the implications of further rate hikes, there’s more justification for would-be first-time homebuyers to hold off their purchase plans until 2024 when conditions are more favorable, and forthcoming Mintel research certainly shows when considering that just 8% of consumers are considering buying a home within the next 12 months.

The Good

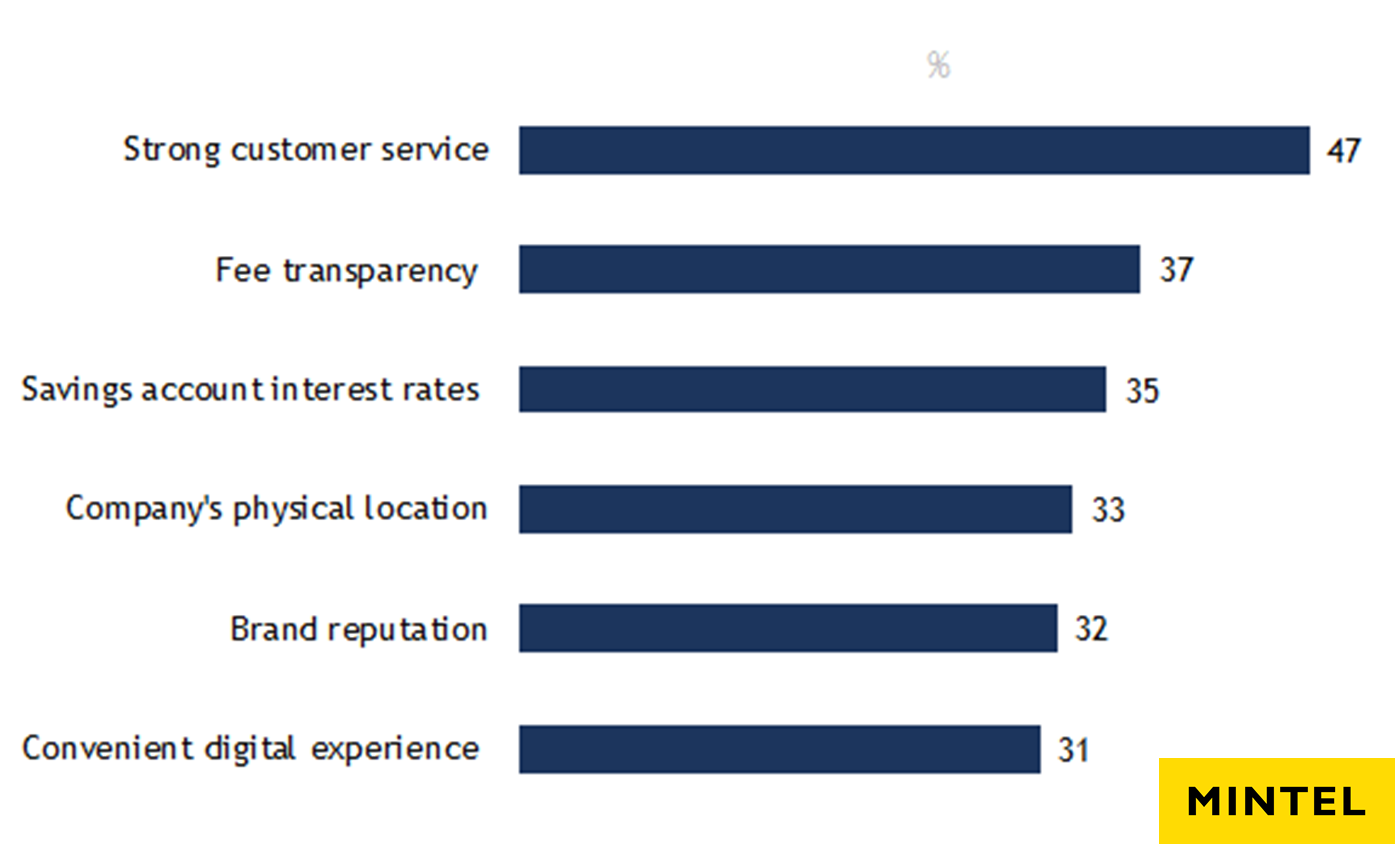

A silver lining for FIs and consumers remains in the form of high-yield savings accounts. Amid all the interest rate increases (with more to come) and stock market volatility seen in 2022, high APY (annual percentage yield) savings accounts gained significant traction as a safe haven for customers to store their money, guaranteeing a safe and consistent return. Online-only banks have found great success with this product especially, given the higher APYs they can pass on to their customers due to their lower overhead costs. According to Bankrate, various online-only banks are offering APYs upwards of 4% on their savings accounts, compared to the national average of just 0.23% APY. Consumers are taking note of these favorable rates as well; Mintel’s forthcoming research shows that 35% of banked adults cited savings rates as the most important factor when choosing a new provider, alongside nearly a third of consumers considering switching their savings account to a new provider outright. With rates on an upward trajectory, FIs will remain in fierce competition with one another for customers’ deposits throughout the year. As such, acquisition opportunities remain aplenty, buoyed by consumers’ heightened proclivity for switching their savings accounts to take advantage of the high-rate environment.

“Which of the following factors are most important to you when choosing a financial services company?” [NET – Any rank]

Base: 1,923 internet users aged 18+ who have a financial services product or account

The Opportunity

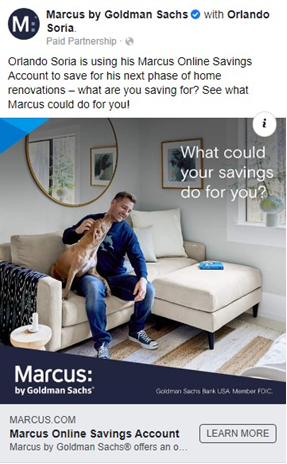

While high-yield savings accounts will drive considerable acquisition for FIs, there lies greater opportunity when prospect hunting by going beyond the standard rate-focused messaging and emanating a broader value proposition. Spotlighting high APYs is an effective strategy to get customers’ foot in the door, but FIs should take it a step further and demonstrate to prospects how the returns from these APYs can go towards helping fulfill their financial goals. Mintel research shows that saving for long-term and short-term goals are, respectively, the highest financial priorities for nearly 4 in 10 consumers this year. These goals can range from paying off credit card debt, establishing a rainy day fund, saving for retirement, or even a new car. FIs can supplement this type of aspirational messaging by providing best practices when it comes to topics like retirement planning or debt management, for example – illuminating to prospects a much more wide-ranging value proposition than other competitors’ rate-focused promotions.

FIs should never be just content that they gained a new prospect, but rather view it as a gateway for building deeper banking relationships with these potential customers, demonstrating to them how they can be subject matter experts that enable their customers to fulfill their goals and aspirations while being the best financial version of themselves in the process. In turn, FIs stand to gain the priceless currencies of trust and loyalty.

What we think

While it remains uncertain what path the US economy and Federal Reserve will take throughout the year, banks still have the opportunity to capitalize on the current high-rate environment through further deposit acquisition. And while banks may gain more prospects vying for the best rates, they have an even greater opportunity at establishing deep and meaningful relationships with these new customers from the get-go – showing them that on top of gaining the most competitive rates, they also have their bank’s support to aid them in achieving their financial goals and aspirations.