Three Reasons Why Cash is Making a Comeback

Cash or credit? In recent years, the battle between payment types was becoming an increasingly one-sided affair. Cash usage had been trending downward for multiple years before the COVID-19 pandemic accelerated the decline, shifting consumer perception toward cash from “not ideal” to downright impractical. Preference to use cash plummeted in 2020 as consumers adopted credit cards and debit cards with mobile and contactless capabilities, representing a safer and more convenient form of payment. With mobile payment apps like Cash App and Venmo encroaching on cash’s common use case as an intrapersonal payment, alarm bells were sounding for the long-term utility of cash.

However, recent Mintel data shows that cash is making a resurgence as a payment preference, chipping away at the dominance of credit card payments. The segment of consumers who prefer using cash for the majority of their purchases rose to 15% this year, the highest mark since 2019, while the group that prefers credit cards shrunk to its lowest point since the same pre-pandemic point.

What is behind this cash comeback? Consumers are reflecting on the specific effects that economic trends are having on their payment habits, driving the surprising reversal.

1. Credit is Expensive

For much of the past decade, consumers enjoyed the benefits of a low-interest-rate environment, which allowed credit card owners to reap maximum rewards from their cards with relatively low rates on revolving balances. However, persistent inflation disrupted the status quo, forcing the Federal Reserve to raise interest rates in order to make borrowing more expensive.

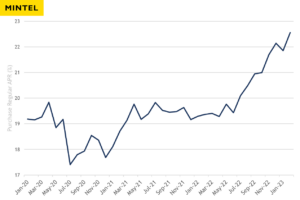

Banks then passed down the increased costs of borrowing to their customers, who now see higher APRs on their credit cards. While the average purchase APR in direct mail offers sat just above 17% in July 2020, it has risen to 22.6% as of February 2023. What does this mean for cardholders? For the more than 50% of active card accounts that revolve a balance rather than paying their monthly bill in full, interest payments are noticeably costlier.

2. Credit Cards Have Been Overused

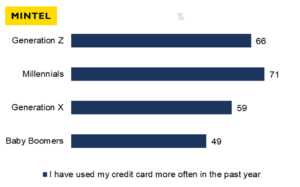

To cope with the rising cost of goods, customers have been forced to lean on their credit cards to make payments. In fact, Mintel research shows 6 in 10 consumers have used their credit card more often in the past year, a figure that rises to 7 in 10 among 18-34-year-olds. Not all credit card customers have been able to meet the demands of these rising monthly bills; credit card transitions into delinquency increased throughout 2022, most significantly among young cardholders. In this manner, credit cards have become a victim of their own success, with consumers’ appetite for credit outpacing their ability to adjust to the price environment. With the penalty for revolving balances becoming more severe, and rising prices making it more difficult to make full monthly payments, consumers are being pushed back toward payments that can be made upfront, with no risk of debt.

3. Budgeting is Prioritized

One discrete advantage cash has compared to card payments is its physical, tangible sense of value. Recent Mintel research shows that budgeting tools were the most sought-after form of financial wellness that 25-34-year-olds desired from their banks, illustrating a common pain point experienced by consumers as their financial commitments expand and diversify. One threat of using credit cards to cover these proliferating payments is the ease with which one can overspend. The rising adoption of mobile wallets allows consumers to virtually “swipe” their cards, making payments as quickly and easily as they send text messages. While this has streamlined the purchase process for consumers, it has also made them more aware of just how easy it can be to lose track of a planned budget.

What we think

The increased preference toward cash should send a clear message to financial institutions: consumers are rejecting debt in favor of responsibility. Cash did not suddenly gain new utility in consumers’ lives; rather, it became more appealing when juxtaposed with products that lead to debt. For banks, this can incentivize innovation in the debit card space, where young customers feel more comfortable making payments that can potentially yield rewards without the risk of debt. Many financial institutions offer budgeting tools on their mobile apps, but there is room for improvement as consumers eschew these offerings for methods like cash stuffing, which convey a more physical representation of a monthly budget. Finally, credit card issuers will be encouraged to proactively guide new cardholders toward healthy payment habits, realizing the risk of alienating customers whose budgets are stretched is at a particular high point.

For more information about the financial services industry, download our 2023 Financial Services Trends today or click here to learn more.