Financial services marketers chase the next normal

Brands decreased services and support communications, but that doesn’t mean digital acquisition strategy will go back to normal.

Credit Cards

Travel and entertainment card marketers are dipping their toes into digital waters once again, as many brands actualized shifted rewards structures to accommodate travel restrictions. Conversely, cash back cards decreased spend across the board.

American Express offered grocery & dining rewards for its Hilton Honors card. The issuer ran new display in June to offer 80k bonus points PLUS 5x bonus points at U.S. supermarkets and restaurants, which includes takeout and delivery services. The shift in rewards comes as no surprise as American Express shifted to grocery rewards for other travel cards, including Delta SkyMiles Platinum.

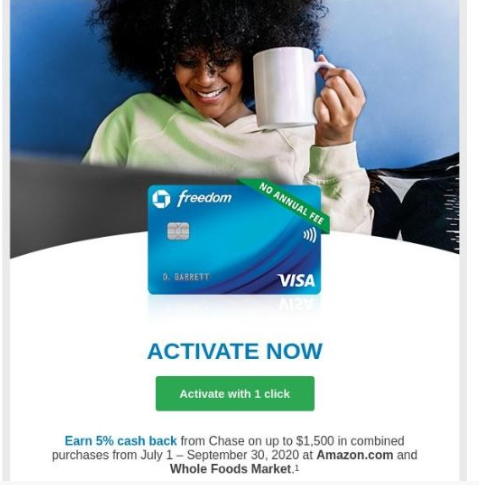

Chase introduced 5% cash back at Amazon and Whole Foods Market. Chase sent emails to current Freedom cardholders to present the opportunity to activate new rewards. The issuer is now offering 5% cash back on up to $1,500 in combined purchases from July 1-September 30, 2020, at Amazon.com and Whole Foods Market. Chase’s introduction of the new quarterly rewards category follows the prominent trend across major issuers to offer rewards in relevant categories amidst the COVID-19 pandemic, helping customers earn more on everyday purchases.

Deposits

Deposits outreach about COVID-19 and mobile account access abated in May and into June, after an overindexed volume in April 2020. With the exception of challenger brand Chime, top deposits brands increased spend across all channels in May.

Ally began investing in various ESPN podcasts to promote its competitive savings account. Ally encouraged customers to take advantage of its smart savings tools to help save for the future while touting its competitive roots.

Lending

Lenders slashed acquisition, retention, and customer communication volumes in digital channels in May and June. Select home lenders used national print and direct mail to communicate reassurance and tease home equity opportunities.

SoFi reintroduced a TV spot in June promoting its low fixed-rate personal loan. The lender spent nearly $925K in June, top programs the spot aired during Today and ABC World News.

Quicken Loans focused on putting family first in print advertisements. The lender addressed that “things may have changed” but their values remain the same, encouraging customers to put their families first and let Quicken Loans do the work.

Investment

Investment brands were the only category to increase communication about COVID-19 as state-by-state requirements continued to oscillate into June. Brands tested new channels to share investment opportunities aligned to reopening.

Fidelity promoted financial independence through use of its FI/RE tools. Fidelity introduced new Facebook campaigns that promoted its free tools and resources, encouraging consumers to take advantage of the tools in order to save for financial independence.

What’s next?

Credit Cards

Travel & entertainment cards will have their phoenix moment as they solidify the next normal in digital acquisition strategy. With travel and mass entertainment up in the air, T&E brands will position themselves for everyday, at-home entertainment.

Deposits

Deposits marketing will place a greater emphasis on account access and branch availability based on rapid fluctuations in stage of reopening. Acquisition offers will deepen headed into July as consumers place continued emphasis on saving.

Lending

Digital engagement and acquisition will increase for student lenders moving into July. Home and personal lending digital volumes will remain low, in line with direct mail.

Investment

Investment brands will use social media targeting to connect investment opportunities with local community recovery efforts or spikes. Positioning will lean into financial independence and planning for the future.