Going a step further to understand consumer spending choices

In a recent Wall Street Journal article – “The Biggest Ways People Waste Money” – a group of experts discusses what they consider to be the biggest financial waste happening among consumers and what can be done about it. The article critiques consumer spending habits from everyday purchases like coffee to major life expenses like a new car and a house.

Here, Diana Kelter, Senior Trend Analyst at Mintel, and Jeannette Ornelas, Senior Digital Marketing Analyst at Comperemedia, respond to the article, explaining why it’s important for financial services issuers to consider tone, empower customers and reach them where they are.

Consumers are not consulting financial professionals

While the expert critiques in WSJ are valid, it’s important to note that the majority of consumers are not consulting financial professionals. According to Mintel Reports data on financial literacy, only one in four adults ranks financial professionals in their top 3 personal finance sources. This is even lower among Millennials and adults with household incomes under $50,000— both of which are more likely to learn about personal finance on social media than from a financial advisor, per Mintel data on lifestage marketing in financial services.

Tone matters

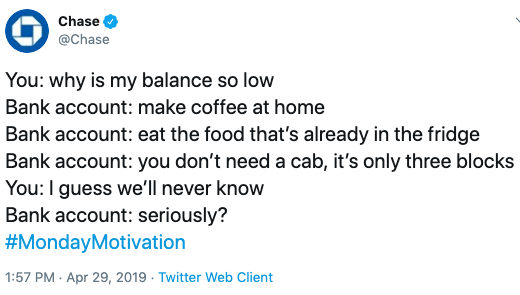

Recently, Chase made headlines for giving advice to Millennials via Twitter, which shamed them for buying coffee. The bank was met with severe backlash for what many perceived as a tone-deaf message. While Chase’s social media content typically tackles a variety of financial topics, a failed attempt to appeal to young people and be “relatable” shed light on the consumer cynicism and lack of trust that plagues financial services. This should serve as a big cue to marketers that financial advice must be delivered carefully, particularly when coming from a financial institution.

Recently, Chase made headlines for giving advice to Millennials via Twitter, which shamed them for buying coffee. The bank was met with severe backlash for what many perceived as a tone-deaf message. While Chase’s social media content typically tackles a variety of financial topics, a failed attempt to appeal to young people and be “relatable” shed light on the consumer cynicism and lack of trust that plagues financial services. This should serve as a big cue to marketers that financial advice must be delivered carefully, particularly when coming from a financial institution.

FSIs need to meet consumers where they are

Personal finance can be filled with stress and uncertainty. For many consumers, reaching financial wellness goals can be difficult when struggling to break even. Financial services providers have an important role to play, not only in offering the services needed to empower consumers, but in reaching consumers where they are to support them on their various paths to financial wellness.

Mintel’s ‘Redefining Adulthood’ Trend discusses the traditional life stages that once defined adulthood are now happening at a different rate for every consumer. With that in mind, priorities for spending are not straightforward and consumers don’t want to be scolded for how they spend their money.

For example, calling out a gym subscription as a non-essential spending choice might be true for some consumers, but Mintel data shows the case for having a gym membership is increasingly going beyond weight loss goals that come and go. A recent Mintel report on health and fitness clubs revealed that half of US consumers with gym memberships are motivated to go to relieve stress. With the importance of consumers finding outlets for dealing with mental health, the spend for a gym membership suddenly takes on a new meaning.

Go a step further

When it comes to catering to young adult spending habits, brands and financial institutions have two options: They can set unrealistic budgets that don’t mesh with today’s modern spending habits, or they can go a step further and help them understand the deeper value behind a transaction. The financial institutions that help consumers understand their spending habits on a more personal level will mitigate certain risks, including that spending in one area is a waste, when it might be important to that individual.