Insurers’ top digital marketing strategies from 2021

A look back at 2021

As digital channels and digital tools continue to carve out a more integral role in the consumer experience, insurers shifted investments in 2021 to meet the growing demand and establish their presence with a well-rounded digital marketing strategy. They are doing this with three key focus areas in mind:

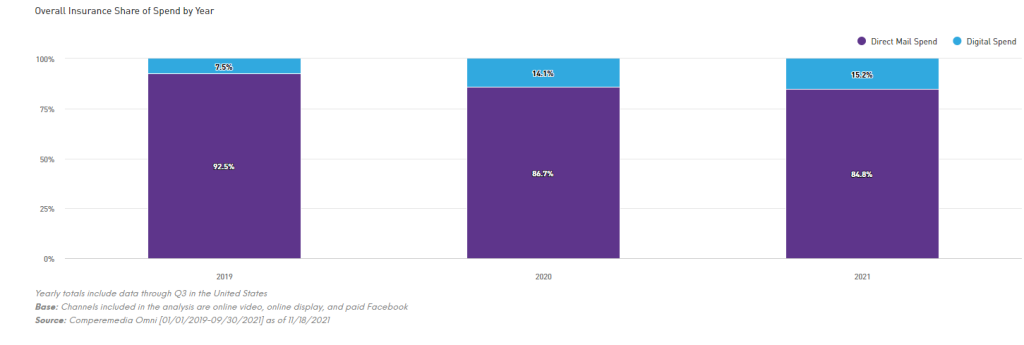

- Establishing relevance: Direct mail is the staple of insurers’ marketing efforts, with its spend trumping all other channels. But as the world moves toward all things digital, insurers have sought out ways to digitize their strategies in order to meet consumers where they are with messaging for products that elevate digital convenience.

- Gaining momentum: Insurers across all verticals have steadily increased their investment in digital marketing channels over the last two years. From online video to display to paid Facebook, channels in insurers’ digital efforts are continuing to earn a more sizable share of the overall media mix.

- Proving value: Insurers have utilized their increased digital presence to prove the value they can offer consumers through their new-age digital solutions. Property and casualty insurers messaged convenience, life insurers pulled away from traditional processes, and health insurers positioned themselves as advisors and partners.

The insurance digital divide

While direct mail continues to reign king of insurance marketing, digital media has steadily gained a percentage share of spend year-over-year. Insurers are beginning to tap into the value of digital channels as younger consumers, who consume a higher share of digital media, become a more sought-after demographic.

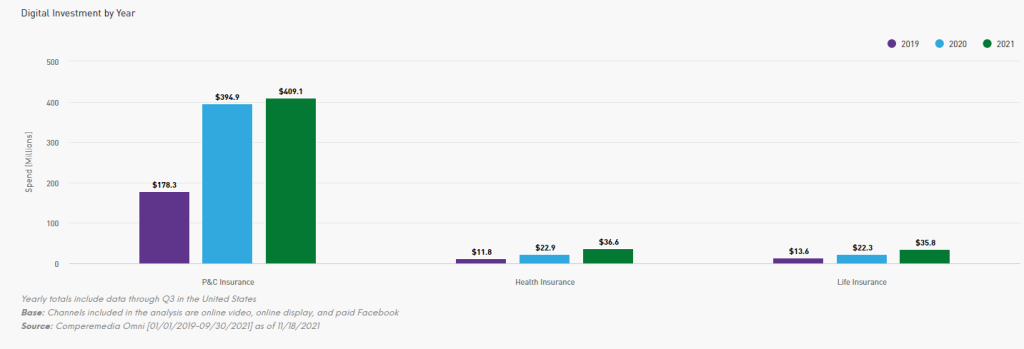

While P&C insurers represent the lion’s share of digital spend, all verticals showed boosted digital investment for the second consecutive year. P&C insurance digital spend increased 4%, from $394.9m in 2020 to $409.1m in 2021. Digital investment in life insurance experienced strong Y/Y growth, up 61% from $22.9m in 2020 to $36.6m in 2021. Year-over-year spend for health insurance tells a similar story – up 60%, from $22.3 to $35.8.

While digital preferences varied, health insurers more heavily weighed the impact of paid Facebook in their marketing portfolios. P&C insurers crafted a more balanced digital strategy to align with the overall vertical’s emphasis on driving brand awareness throughout the marketing funnel.

Property and casualty digital strategy

P&C insurers ramped up their investments toward paid Facebook, with it being the only channel to see boosted spend over 2020. Despite Y/Y decreases in online video spend, the channel still represents nearly half (43%) of the property and casualty digital channel investment in 2021.

While paid Facebook spend has increased, the digital media mix across P&C has remained relatively balanced M/M thus far into 2021. Aligning with the vertical’s broad-reaching tactics to boost brand awareness, the diversified spend allowed P&C insurers to interact with consumers at multiple touchpoints.

The top ten digital advertisers put a clear emphasis on the vertical’s leading product: Auto insurance.

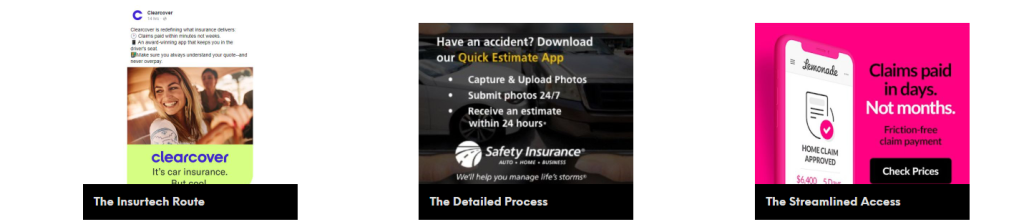

From quotes to claims to 24/7 customer service, P&C insurers leveraged the conveniences of their digital solutions. Insurers’ apps addressed consumers’ frustrations surrounding the timely nature of the insurance process by digitizing various points of the consumer journey.

A key feature across digital creatives was the ability to navigate claims straight from one’s mobile device. Whether it was speed of payment or the ability to streamline the claims process, insurers promoted consumers’ easy access to control their experience.

Life insurance digital strategy

Life insurers boosted their digital investments across the board, as the vertical continues to digitize its product offerings. Life insurers have continued to bulk up and promote their digital product enhancements to combat various barriers to purchase, such as lengthy application processes.

Aligning with a shift to focus on ease and simplicity, most of the top ten digital advertisers prioritized term life products. Some brands directly positioned themselves against traditional life insurers by highlighting their digital life insurance process across channels. Other brands attempted to step into the modernized life insurance landscape, promoting a low-question, 100% digital quote process. Another brand utilized a test-and-learn approach with paid Facebook to uncover the messaging that resonated best with its target consumers.

Health insurance digital strategy

Health insurers leveraged the responsive nature of paid Facebook more heavily to promote the perks of their health plans. The investment in paid Facebook trumped other digital channels, as insurers activated specific call-to-action messaging in the hopes of actively engaging with consumers.

Within the top ten digital advertisers, it was most common for health insurers to highlight the individual elements of their Medicare offerings.

Health insurers utilized digital tools and resources as ways to add value and guide consumers through their health insurance experience. Insurers aimed to give consumers control of their health journeys while making sure they were known as helpful partners along the way.

What we think

As the world continues to become more digitally integrated, insurers can craft marketing plans that connect with consumers by:

- Shaping a seamless narrative across platforms: While the majority of insurers are present across digital platforms, few actively implement strategies that build a story or carry a consistent feel across platforms. Consumers should be able to follow the narrative, while getting a new experience from one platform to the next.

- Avoiding redundancy in creative and messaging: Insurers should aim for their presence to feel fresh, even as the messaging follows a consistent narrative. Integrating a variety of creatives and messaging insurers can deliver unique interactions across platforms. Experiences that become redundant will annoy consumers, causing the value proposition to likely be lost along the way.

- Showing, not telling, the value proposition: The beauty of digital mediums is that they allow marketers to paint a picture of hyper-relatable situations, which creates the opportunity for consumers to connect with the content while seeing themselves in depicted circumstances. Insurers should take hold of the visual opportunity to carve out the consumer need for their offerings.

For more on insurers’ digital marketing strategies and expert recommendations, Mintel Comperemedia clients can log in to view the full report.