What insurers need to know about telehealth for seniors

As digital health innovations have gained in popularity, with the COVID-19 pandemic as a huge driving factor, so too has telehealth. Though telehealth is simply the intersection between technology and health and can include everything from test results sent between facilities to robotic surgeries occurring remotely, what we will focus on here extends to the opportunity around the consumer use case for senior members.

Telehealth growth is directly related to pandemic concerns

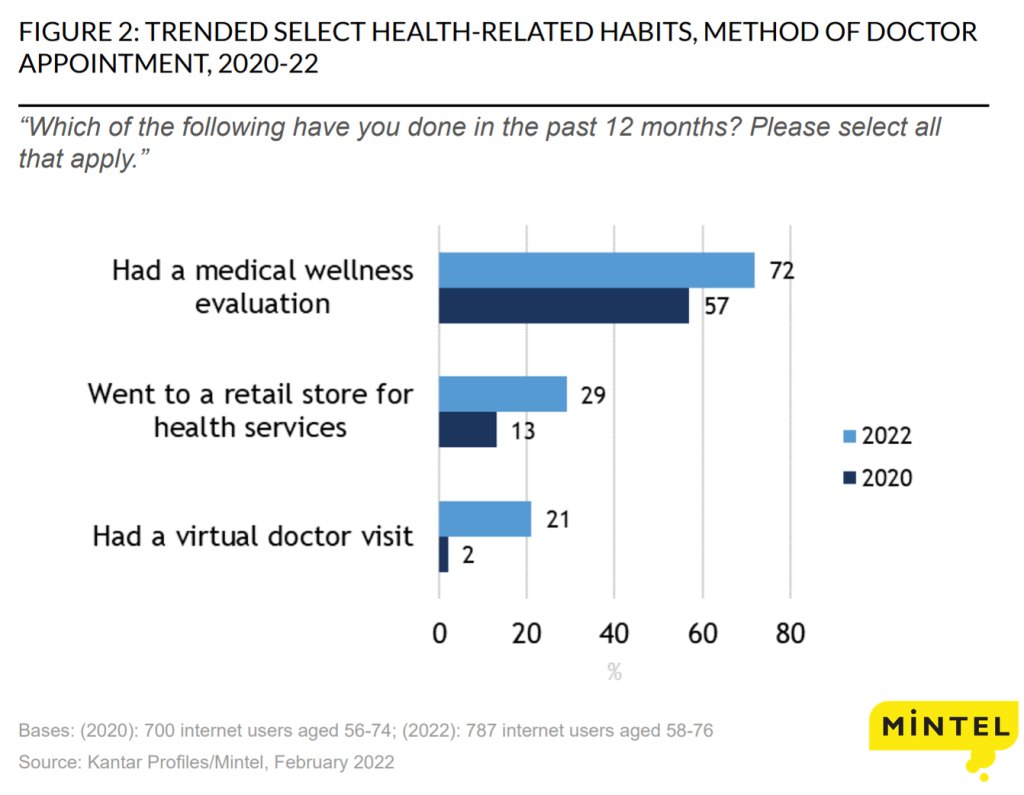

Along with all other age groups, seniors saw tremendous growth in telehealth interest in the last couple of years. According to Mintel consumer data, the share of Baby Boomers who have had a virtual doctor’s appointment in the past year shot up to 21% this year from just 2% in 2020. Part of this may be credited to the recent restructuring of CMS telehealth policies, as Medicare only covered telehealth under very limited circumstances prior to the pandemic. Now with CMS approving mental health visits covered under Medicare Part B and many health insurers offering mental and behavioral health coverage under Medicare Advantage (MA), the broadening coverage of virtual services will directly support the 72% of consumers who are now more open to telehealth visits.

Since the pandemic, many health insurers have formed partnerships and increased their behavioral health and primary care provider (PCP) offerings. Just this year, some examples include:

- Humana partnered with Array Behavioral Care to provide behavioral telehealth services to MA individual and group members this year, as well as virtual counseling and psychiatry services.

- Amazon partnered with Teladoc so that users can connect to a physician through their Amazon Alexa devices, which provides mental health services through BetterHelp.

- Cigna expanded access to virtual care through its MDLive subsidiary, giving members access to its network of virtual PCPs which includes behavioral healthcare. The firm is also piloting a virtual-first health plan.

- CVS Health partnered with Amwell to provide a new virtual PCP offering, including on-demand behavioral health services.

- Scan Group launched a new primary care medical group for seniors with a combo of virtual and at-home services, with an MA plan offered in Arizona, California, Nevada, and Texas.

Virtual offerings bring convenience and a broader provider network

There are some obvious strengths that come with the widespread availability of telehealth benefits, including convenience. The U.S. Department of Health and Human Services details in a Medicare report that dual-eligible beneficiaries were more likely than others to use telehealth to ensure access to care and that telehealth expanded access to historically overlooked populations. One reason for this occurrence is that not everyone has access to reliable transportation or, especially in the case of seniors, are well-suited to drive regularly. With an older age group, many of whom are suffering from chronic illnesses that make mobility a challenge, having the luxury of regular doctor visits from your own home may be a significant improvement. For the many seniors who rely on caregivers, virtual services can also allow for those family members to attend virtually without the need to take additional time off.

On the provider side, Mintel consumer data shows that consumers are still finding that choice of doctors is the top factor in selecting a Medicare plan, so it could also benefit seniors to have access to a much larger network, particularly when it comes to specialists. This month, many healthcare groups lobbied Congress to take action on some legislation that would encourage telehealth, indicating that “telehealth has helped bridge gaps in care, especially in communities facing significant workforce shortages.”

Barriers to entry limit widespread telehealth adoption

On the other hand, telehealth needs to be offered with an understanding of its limitations. For example, some issues require physical examination that cannot be addressed virtually. In addition, it’s important to consider hardware requirements like owning a device with a large enough screen, having an internet connection that’s fast enough to support video conferencing, and the level of digital literacy of the patient. There have also been recent reports of fraud, often involving overbilling for treatments or services that were not considered medically necessary. Many of these barriers to entry will likely be compounded when considering utilization by an older age group.

What we think

Telehealth has been thriving, playing a crucial role in addressing provider shortages, particularly with virtual PCP and behavioral health offerings. As telehealth becomes more of the norm, insurers should look to differentiate themselves by calling out the differences of their virtual services and being clear about their value proposition. Though there are some limitations in telehealth that should be considered by providers, boosting telehealth options will give customers more flexibility and options to meet their particular needs. For many underserved senior populations, those options could mean the difference between them getting the care they need when they need it vs. forgoing care, at a higher cost later to all parties.

Another thing to consider is that while telehealth has been primarily associated with video conferencing, increased access to data and other emerging innovations will open up opportunities beyond just real-time video chatting. This will include insurers filling out their ecosystems with additional services, asynchronous video, or AI texting. Also, expect insurers to offer more telehealth options within specialty services like dermatology, oncology, and dentistry in the next year. Though utilization among seniors will likely lag for some of these newer use cases, insurers should see any telehealth investment as a long-term play.