New regulations in the Canadian credit card and telecom industries have marketers changing course

Recent regulations and the evolving COVID-19 situation are causing card issuers and telecom providers to shift their acquisition focus away from less profitable product lines.

Cash back credit card volume and incentive share are down

While credit card direct mail offers promoting rewards have been on a slow decline since January 2019, the share of offers for cash back cards fell significantly after November’s announcement of increased merchant fees. After the announcement, direct mail credit card offers with incentives dropped to the lowest levels seen in over 10 months.

Some issuers, like TD Bank, improved the incentives on offer despite an overall falling share of offers with incentives. The top campaign with rewards, in terms of estimated mail volume, from November 2019 to February 2020 was an Aeroplan Visa Infinite offer with an incentive of up to 40,000 points that cardholders could earn within the first three months of card ownership by meeting certain conditions, along with a card rebate.

Issuers are looking outside point of sale for balance generation

Balance transfer offers are up 20-30% year over year (depending on the month) as issuers attempt to push alternate means of balance generation due to a loss of revenue from point-of-sale transactions; with issuers losing 0.1% on processing fees, balance transfers have become an even more attractive means of building consumer balances. As an example, TD’s top January balance transfer offers were for its Cash Back Visa Infinite card, even though the bank was pulling back acquisition offers for its cash back cards.

Despite reductions in acquisition offers, January 2020 balance transfer activity increased 24%, and February activity was up 38%, according to Comperemedia.

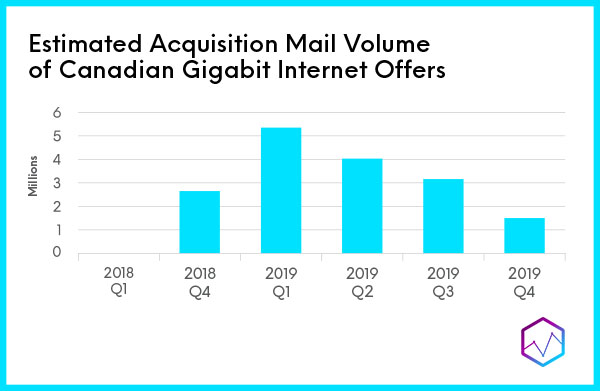

CRTC regulations are impacting the Gigabit internet promotions

Videotron was forced to completely cancel its Giga offerings in Quebec due to impacted profitability because of the new resale regulations. As a result, other issuers, like Bell, significantly pulled back marketing of Gigabit internet in the province.

What we think

Before COVID-19, there had been a credit card marketing shift to push travel rewards cards over other card types, but given the state of international travel, card issuers are shifting focus back to cash back or points cards. Telecom providers are in a tough spot, losing resale revenue from regulations, facing financial challenges from COVID-19, and losing additional overage revenue due to relatively new “unlimited” products. Significant changes in product marketing are looking likely, with providers limiting offers for low ROI products like Gigabit internet and Unlimited cellular data plans.