Q2 earnings calls uncover pandemic priorities

After the end of Q2 2020, the earnings calls of major financial services companies highlighted growth areas which gave clues to future marketing priorities.

Digging digital

Several institutions highlighted the increased use of digital banking practices by customers amid the pandemic. To align with this increase in activity, brands sent out a flurry of ads showcasing mobile payments, mobile wallets, automated investing, and the ease of banking at home.

Citi pushed a relatable spin on the current banking experience via video ads that showcased interaction with its digital banking products.

By promoting “award-winning banking” and 24/7 digital access, Citi hoped to assure potential consumers of mobile banking and lure in customers who may have been apprehensive to fully bank via mobile devices before the pandemic.

Deposits devotion

Matching consumers’ tendency to save/invest more and spend less this year, brands noted an increase in deposits and investment account activity. Through advertising of no fees, low minimums, and account automation, brands pushed deposits products as a secure and effective way to build for the future amid uncertainty.

Bank of America cited nearly normal net growth in checking from Q1 despite the pandemic, emphasizing its current importance to consumers and the bank. The bank lured in newly financially-conscious consumers on Twitter with a $100 bonus offer, a potentially lucrative sum for the unbanked.

Supporting small

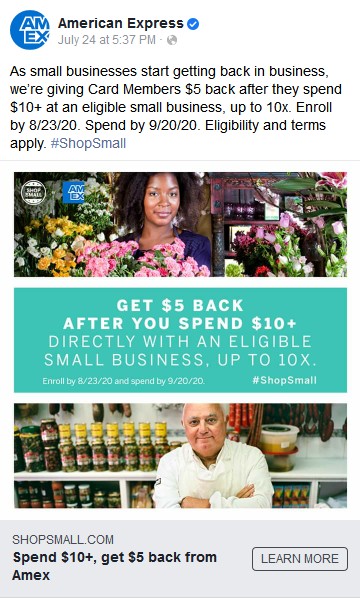

In its call, American Express continued to tout its Shop Small campaign in support of small business, leveraging its unique position as a payment processor, credit card issuer, and bank. American Express noted that small businesses have been hurt more than expected by the pandemic, and increased offers to encourage customers to buy from small businesses.

What we think

As the COVID-19 pandemic carries on in America with no end in sight, financial services companies have had to fully adjust to the next normal, where customers are apprehensive to spend significant sums of money amid an uncertain economy and interact with financial brands almost exclusively from home or their mobile devices.

In future quarters, brands should more heavily lean into addressing customers’ anxieties around their finances, whether it be acknowledging that money is tight, addressing that banking activity has likely changed permanently, or more heavily pushing communication that seeks to educate and incentivize rather than briefly cater to temporary needs. Doing so will foster a strong bond between company and customer, and give institutions a leg up in building relationships with consumers who are forced to migrate digitally for their financial needs.