The End of the Insurance Bundle? Millennials Put it on the Chopping Block

Bundling is a key tenet of personal lines insurance, as it benefits both customers and carriers. Customers receive a discount and convenient policy management, while carriers are generally rewarded with more loyalty. Property & Casualty (P&C) marketing is stocked with promises of potential savings when combining policies, and powerhouses like GEICO and Progressive are spending millions of dollars to urge consumers to bundle.

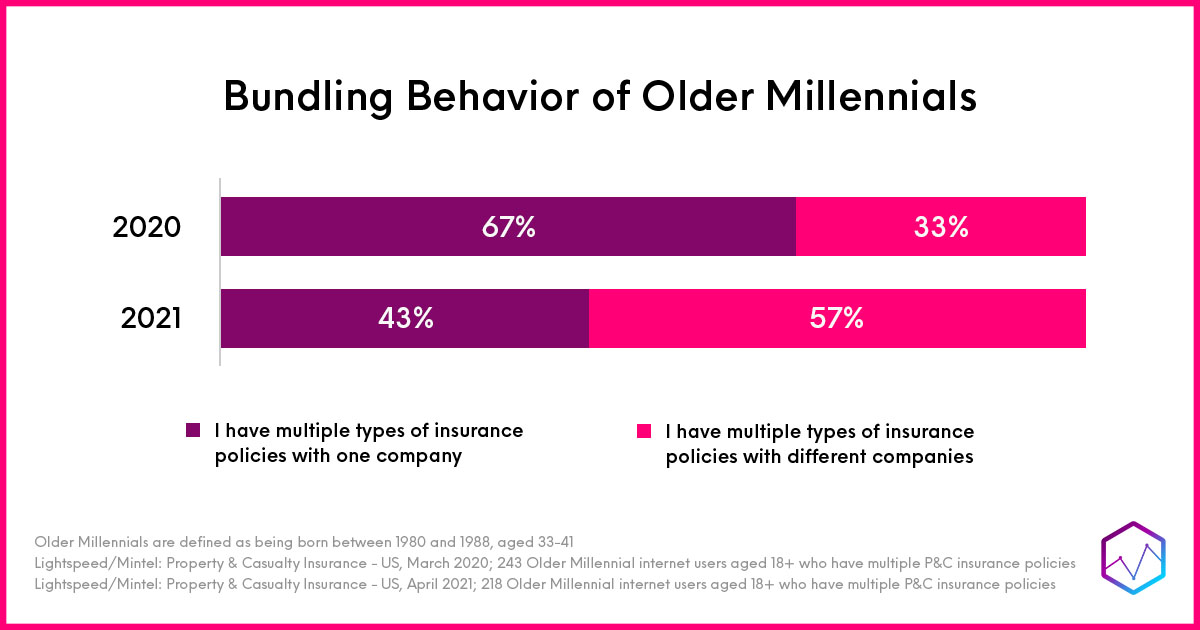

Despite the benefits and massive marketing reach, older Millennials, defined as being born between 1980 and 1988, are opting not to bundle, instead preferring to hold multiple policies with different providers. Mintel’s research on P&C insurance found that the percentage of older Millennials bundling their policies declined from 67% in 2020 to 43% in 2021. Mintel can confidently assume that this shift is tied to homeowners insurance, as 40% of older Millennials switched their homeowners policy in the past two years, with another 28% planning on switching within the next year.

Why was there such a significant drop?

The booming housing market provides some clarity. Historically low mortgage rates during the pandemic spurred a surge in demand for homes, as consumers financially unscathed by COVID-19 looked to take advantage of this low-rate environment. Millennials are in their prime home-buying years, and the leap into homeownership was made all the more enticing due to low rates, triggering them to shop for insurance coverage.

Older Millennials were also keen to refinance their mortgages to lower their monthly payments. According to Mintel research on secured lending, 38% of older Millennials had refinanced their mortgage during the pandemic – the highest of any generation. As the volume of mortgage refinances surged for this group, many could have looked to save even more on homeownership costs by seeking out lower insurance premiums.

How can marketers respond?

Unlike their older counterparts, Millennials may not be as incentivized by the traditional bundle, and marketers need to take note. With major brands all sharing the same “Bundle and Save” message, the offer is becoming less alluring. According to JD Power’s 2020 Home Insurance Study, customer service is the key to lifetime value, and “Millennial customers are significantly more likely to select their homeowners insurer due to good service experience than are Boomers.” Insurtechs Lemonade and Hippo jumped on this opportunity. In video campaigns launched in the last year, both brands went beyond standard savings offers and instead focused on how they improved the customer experience. From touting efficient and automated claims to extra coverage for electronics and appliances, Lemonade and Hippo understand they are speaking to a younger audience that may even be willing to shop around for better value rather than simply opting for a bundle.

Lemonade:

Hippo:

Insurers looking to expand in this space or win back business need to shift their focus from price to how they deliver value, especially for those who have multiple policies with one company. From mobile inspections to home maintenance solutions, insurers have the resources to walk the walk.

Is this the end of the insurance bundle?

Not at all. In fact, in upcoming Comperemedia research on the insurance purchase process, 78% of older Millennials would prefer to have all of their insurance policies with a single company, but this is not exclusive to P&C. Between health, life, and personal lines coverages, consumers are attracted to having fewer “adult” things to organize. But, P&C carriers need to pay special attention to Millennial homeowners right now. This is a generation who witnessed unprecedented catastrophes and started entering the workforce during a recession, exposing them to the role of insurance companies from a young age. The brands that recognize that these consumers are seeking safety, security, and trust, in addition to a good price, will earn their loyalty in the end.

Lizzie Egan is Comperemedia’s Manager of Insurance Content, providing omnichannel marketing analysis and competitive insights to insurance carriers.

Amr Hamdi is a finance analyst at Mintel, providing competitive insights on the financial services industry.