The human element of financial guidance

In an age of digital banks, blockchain currency and in-app money management, financial institutions may feel that the future is completely digital. While digital is certainly important, banks shouldn’t lose sight of the importance of branches in building a human connection for stronger customer retention, guidance and education.

While younger consumers are more open to digital advisors and online customer service, consumers of all ages are visiting bank branches significantly more often than they use online chat services. According to Mintel research on the banking experience, 60% of consumers say they visited a bank branch in the last three months and only 12% say they chatted online for customer service.

Financial advisory

While fewer than 10% of all consumers use their bank’s advisory services, banks are still campaigning to promote these services. Bank of America, PNC and Wells Fargo have all made financial guidance services like booking appointments with advisors the focus of marketing campaigns in an effort to bring customers into their branches.

For example, Bank of America sent email campaigns in March 2018 encouraging customers to schedule one-on-one meetings with advisors.

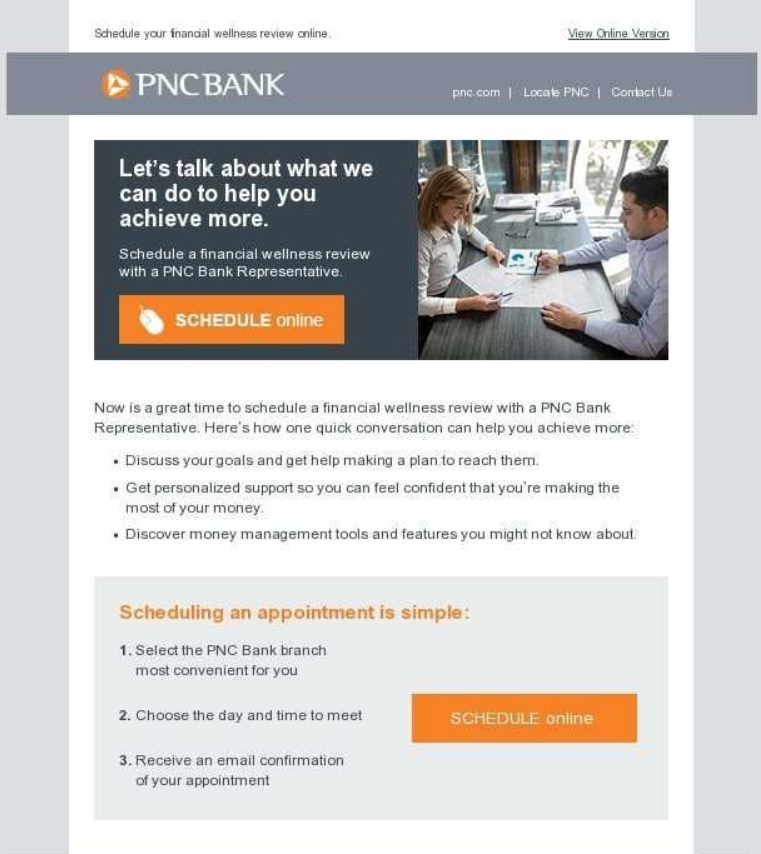

PNC also used email campaigns in February 2018 to encourage existing banking customers to schedule a financial wellness review with a PNC rep in order to discuss goals and craft a financial plan to meet them, receive personalized advice and learn about money management tools and features they may not have known about.

In various direct mail campaigns sent in December 2018, Wells Fargo encouraged its customers to contact a financial advisor to help them build a personalized investment plan.

Social media can educate and promote

When done right, social media can help brands humanize themselves. For example, Bank of America and PNC have utilized various social media platforms such as Twitter to link to their respective financial education resources. Under the hashtag #PNCPOV, PNC linked its POV articles to Twitter 137 times from January 2018 through September 2019.

Wells Fargo has also promoted its financial resources through social media, including Financial Health Conversations through Pinterest and financial guidance webinars on YouTube.

What we think

Banks should work to bring consumers out from behind their digital walls and into the open to discuss their financial needs. Encouraging face-to-face interactions, like sending branch visit invitations, helps exhibit concern for customers’ financial well-being. Humanizing a brand by building personal connections can be difficult for digital banks, or banks without a strong branch presence. However, these brands can leverage the accessibility of social media to educate and advise their consumer-base in an informal and easily digestible manner.