Verizon sets its sights on credit cards

Verizon plans to launch a co-branded credit card with Synchrony before July 2020.

The announcement reflected a pre-launch strategy for existing customers only. Verizon provided minimal information, stressing the benefits for loyal customers. The move contrasted that of T-Mobile Money’s announcement: While T-Mobile Money provided information on the APY service capabilities, Verizon was purposely vague, going off hype alone to drive sign-ups.

Launch strategy predictions

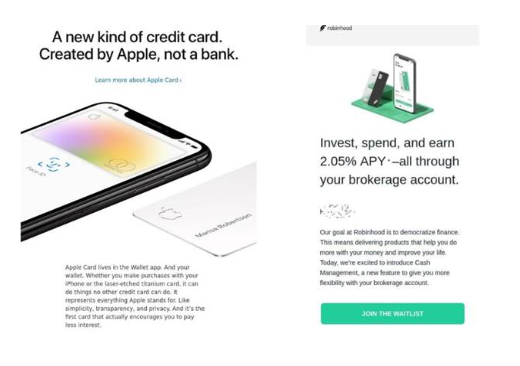

We predict Verizon’s launch strategy will mirror Apple and Robinhood, with product-focused ads on low-cost channels, like email and owned social, that communicate trust.

As we’ve found with Apple and Robinhood, non-banks launching a card have followed a certain marketing formula. Brands typically:

- Are conservative with spend, relying heavily on current customers.

- Make the product the main focus, eventually evolving it as a way to receive discounts and earnings.

- Communicate trust as the underlying message with no fees and diverging the brand from typical banks.

Incentives Predictions

Verizon will likely leverage Synchrony and create incentives to go with the card; competitors will need to beat them at their own game.

To provide value, instill loyalty, and differentiate it from the market, we predict Verizon will:

- Leverage the Synchrony customer base to expand reach.

- Launch discounts and increased rewards when purchasing and linking the card to Verizon products and subscriptions.

What we think

Launching a credit card to deter churn reflects Verizon’s efforts to build loyalty in a competitive market. It’s now a commonplace strategy, with other non-bank brands leveraging credit to help ingrain the product into the lives of its customers.

Competing brands should consider conquesting strategies as the new card rolls out – both with paid search and within the inbox – to push their competing product’s value proposition to consumers familiar and interested in the Verizon credit card. As discount incentives are likely, it will also be important for competitors to highlight similar or better returns on a Verizon cell phone bill when paying with their card versus Verizon’s.

![[Part 1] Competitive Strategies: What is next for Netflix?](https://welcome.comperemedia.com/wp-content/uploads/2019/12/CM_SocialMedia_CompetitiveStrategiesNetflix1_Green200Blog_2000x1000.jpg)