Fintech 2021 strategy review: Outgrowing niches and focusing on brand strength

After largely playing defense in 2020, fintechs sought to fortify their brands’ associations in 2021 with forward-thinking solutions for modern life.

Fintechs carved out of their niches of origin. Across sectors, 2021 saw fintechs compete with big banks’ product suites as many continued the trend towards super apps, marketing themselves as the best one-stop shop. Aspiration expanded from banking to include a credit card, Upgrade expanded from lending to include banking, and investing apps doubled down on crypto.

Crypto products give fintechs a brand boost. Brands like Robinhood, Wealthfront, and CashApp used their newness to their advantage, engaging consumers by planting roots in the crypto space, and distinguishing themselves from incumbent firms by leveraging their tech-branding to pitch themselves as the future of financial services.

Insurtechs demonstrated branding for life in COVID. Insurtechs like Lemonade and Metromile produced marketing for the new normal, positioning their products as the best alternatives for the reality of life in a pandemic. Lemonade expanded its pet insurance offerings, and Metromile promoted a new pay-as-you-drive insurance product, seeking to capitalize on reduced driving habits.

Mobile banking

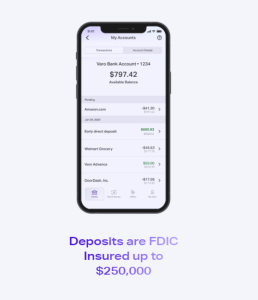

Value propositions for mobile banking fintechs commonly emphasized convenience, modernity, and security. Chime, which has long been the leader in this space, positioned itself as a sensible alternative to traditional banking and leveraged that brand strength to promote its credit card venture. Varo distinguished itself from the pack by being the first mobile banking fintech to cut out the middleman and gain a national charter, a move that doubled customer accounts and tripled revenue in just 13 months.

Source: CNBC

Mobile banks sought to portray themselves as banking options that care. Aspiration expanded its eco-friendly banking services to offer a credit card in 2021. Facebook ads for the card centered its promise to plant a tree for every purchase plus one more for each transaction rounded up to the nearest dollar. Varo utilized display ads to promote its low-fee cash advance program to show consumers that Varo has them covered in a pinch.

Source: Comperemedia Omni [01/01/21-12/31/21] as of 01/24/22

Digital payment

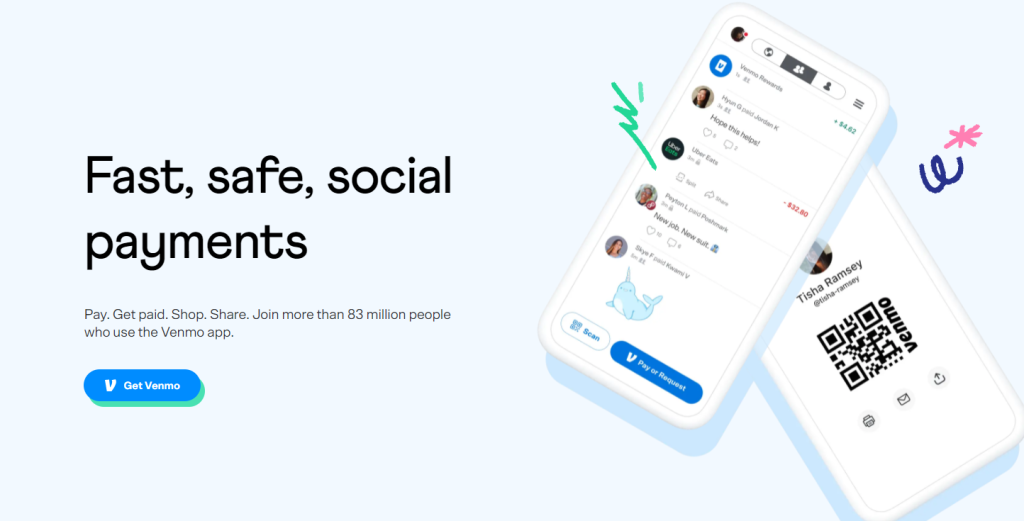

The main recurring value propositions by digital payment fintechs were ease, modernity, and security. Venmo boasted speed and security on its website’s homepage and broadened its product suite to include a credit card and a debit card that can also pull from a user’s Venmo balance. Cash App positions itself as the easiest option for multiple financial services, from digital payment to crypto investing to banking with a debit card. Venmo and Cash App also engaged the public with giveaway campaigns on their Instagram accounts, strengthening their brands in the process.

Source: Mintel social media monitoring [01/01/21-12/31/21] as of 1/24/22

Digital wealth management

Value propositions of digital wealth management fintechs commonly referenced ease, modernity, and flexibility. Acorns attracted customers with the low-risk proposal to invest spare change and suggested baby steps can lead to achieving big financial goals. Robinhood promised to teach a consumer to fish, claiming that its platform and resources can turn anyone into an investor. Wealth management fintechs also utilized the giveaway strategy to get users excited and spread awareness about new feature launches, while investing fintechs leveraged their tech branding on crypto products to claim their authority on financial products of the future.

Source: Mintel social media monitoring [01/01/21-12/31/21] as of 1/24/22

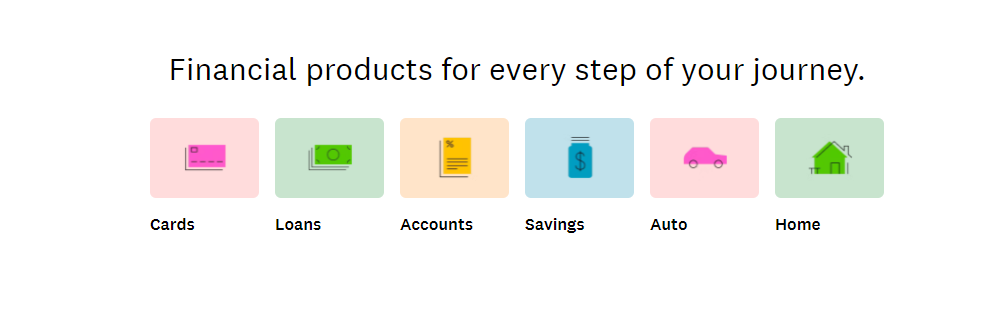

Digital lending and credit

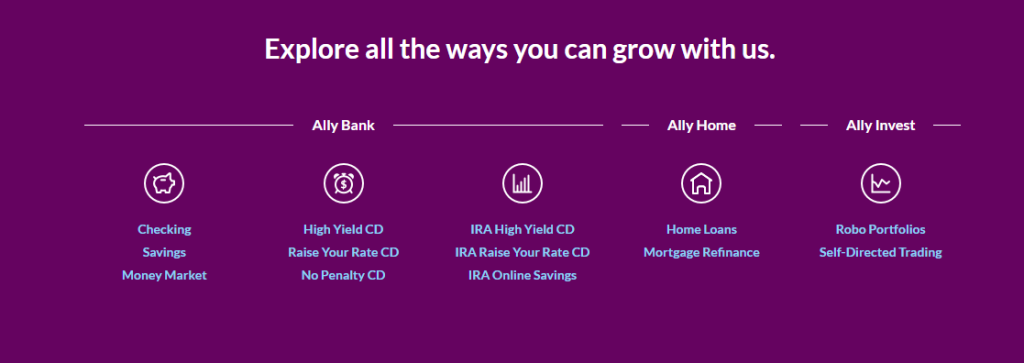

Digital lending and credit fintechs largely positioned themselves as one-stop shops with a breadth of services and use cases. It’s sink or swim in the ever-crowding sea of fintechs, and companies like Credit Karma made sure to diversify its services, prominently featuring a wide array of services on its website’s homepages. Ally began with a banking focus but expanded to home loans and mortgage refinancing.

Upstart and Upgrade offered rate consultations and centered user reviews in their display ads for personal loans.

Source: Comperemedia Omni [01/01/21-12/31/21] as of 01/24/22

Insurtech

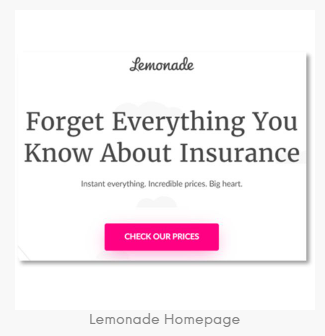

Some insurtechs promised to save consumers from exasperation with proposals of modernity and speed. Lemonade is largely considered the leading insurtech company, offering renters, homeowners, life, pet, and, most recently, auto insurance. Its website promised big improvements on the traditional insurance experience, from prices to claim speed to customer satisfaction. Ethos provided life insurance and advertised the opportunity to get same-day coverage and an estimate in seconds.

What we think

Despite being put on the defensive, fintechs possess the tools to be agile in recalibrating their brands for the future, including:

More brand partnerships

With the social media landscape shifting more towards video content, fintech startups are well poised to help explain their newer products to unreached consumers. Cash giveaway programs are designed to reach far and build followers, and that kind of publicity is attractive to up-and-coming content creators.

Uncertain future for block-chain products

China banned crypto mining, and other countries may follow suit. The mainstreaming of these products gave fintechs a much-needed shot in the arm, but crypto trading services will lose value if crypto itself does. By diversifying into NFT territory, fintechs could put up guard rails while maintaining a future-focused brand advantage.

Household name super app

The proliferation of fintech choices is accelerating, and consumers are looking for a way to make fewer decisions. As many fintechs widen their product suite to avoid redundancy, we predict there is room for a brand that develops an elegant user experience with an intuitive collection of financial services to rise high above the rest.