Lightbulb Moments: Spark Your Strategy (Vol.1)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 6 things you need to know from January 2024:

1. Branching Out

When Chase launched Freedom Rise it was all about the branch but Chase is now taking it to the next level by targeting some new-to-credit customers who already have a Chase bank account via pre-screened direct mail with the message: “We selected you for this offer because of your credit history and your checking account activity with us.”

Highlights:

- Target: Consumers who are “starting out with credit”

- Increase your approval chances by having a Chase account with a balance of $250+

- 1.5% cash back

- $25 for enrolling in automatic payments

- Credit line increase after 6 months

- No annual fee

- Free credit score with Credit Journey

- 26.99% APR

Source: Comperemedia Direct [11/1/2023 – 11/30/2023] as of 1/17/2024

Messaging revealed: What’s interesting about seeing this first direct marketing campaign is that it reveals what Chase believes will resonate most from the value proposition. The combination of building credit AND earning cashback is the key but what I think is very clever (and unique) is the messaging around increasing the chance of approval. The latest survey on credit access from the Federal Reserve Bank of New York shows a credit card rejection rate of 19.6% with consumers reporting “significantly higher average perceived likelihoods of a future credit application being rejected” in the next 12 months. By providing an opportunity to reduce the chance of rejection, Chase can encourage hesitant applicants and expand its new-to-credit applicant pool.

2. $8 late fees here we go!

Some OneMain Financial BrightWay Mastercard offers promoted a late fee of $8 (usually “up to” $40) in November, well before the CFPB’s final ruling on late fees (anticipated in Q1 2024).

Highlights:

- Target: Credit building

- Credit limit up to $1500

- $65 annual fee

- 1% cash back

- 35.99% APR

- $8 late fee

- Qualify for a CL increase/APR decrease with 6 on-time payments

- Graduate to the no annual fee BrightWay+ card after 24 on-time payments

- Track progress in the app

Source: Comperemedia Direct [11/1/2023 – 11/30/2023] as of 1/17/2024

Carrot or stick? OneMain developed a unique value proposition for its customers when it launched the card back in 2021 and it appears to be catching on with approx. 340K customers signing up during its “limited access” period. OneMain rewards its customers for on-time payments and it will be interesting to see how that carrot approach holds up with the reduction in the late payment fee. Reducing the late fee this early is a bold move but there is an early mover advantage in getting out ahead of the new regulations in terms of lessons to be learned.

3. Texas Pride!

The first direct marketing campaign for the H-E-B Visa Signature Credit Card (launched April 2023) powered by co-brand specialist Imprint and issued by First Electronic bank not surprisingly is all about Texas pride. “It pays to be a Texan” is the message and cardholders can choose from 2 Texas-inspired card designs.

Highlights:

- Target: H-E-B grocery store shoppers (430+ stores in Texas and Mexico): “Proudly serving Texans since 1905.”

- $50 limited-time sign-up bonus

- 5% cash back at H-E-B’s 15+ brands

- 1.5% cash back everywhere else

- No annual fee

- 18.24% – 29.99% APR

Source: Comperemedia Direct [11/1/2023 – 11/30/2023] as of 1/17/2024

Identity marketing: By leaning into its strong Texas identity and brand loyalty, H-E-B has created a campaign that is likely to resonate with Texans and generate interest in the card. This campaign is a great example of how identity marketing can be used to effectively target a specific audience by tapping into brand loyalty.

4. Weather-based marketing with a chance of credit

Whether it’s 32F in Ashburn or 25F in Columbus, Carnival Cruise Line has been sending personalized dynamic emails in January reminding recipients of the weather (thanks, we know!) and suggesting that it’s TIME TO ESCAPE THE COLD. Cruise promo emails include an ad for the Carnival Mastercard issued by Barclays offering 20K FunPoints plus a 0% promo APR “on every Carnival Cruise booking” AND interest-free financing from Uplift (recently acquired by Upgrade).

Source: Comperemedia Omni [1/1/2024 – 1/13/2024] as of 1/17/2024

How times have changed! Remember the dire outlook for cruise lines during the pandemic? Many will never forget it but fortunately, the cruise industry is on a path of recovery and growth, with strong passenger demand and fleet expansion. Rising prices don’t seem to be putting off consumers who seem determined to travel but that means financing for travel will be even more important this year. Offers for co-branded cruise credit cards are also back in the mail not only from Carnival but also Princess Cruises (also Barclays) as well as Norwegian Cruise Lines and Royal Caribean Cruise Lines (both Bank of America) but many of these cards now have to compete head-on with Uplift who specializes in travel financing and has been establishing a relationship with many cruise lines and travel companies in the past few years. The net result is more competition and more choice for consumers at a time when they need it most.

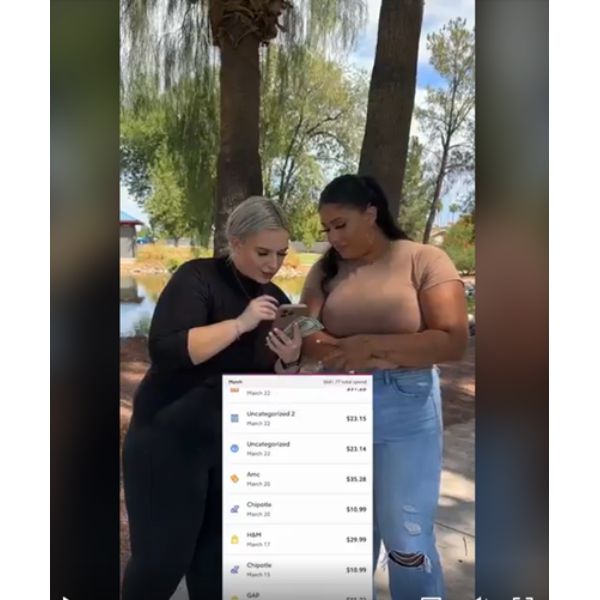

5. Q. Which financial brand killed it on TikTok during the first week of January 2024?

Rocket Money outspent all other financial services brands on the channel from 1/3 -1/9.

The new year is a good time of the year to re-set those financial goals and simplify/de-clutter those subscription services. For Rocket Money, which helps consumers identify subscriptions they don’t need and cancel them, it’s the ideal time to get its message out. Consumers are considering cutting back on their subscription services due to increasing prices.

Source: Comperemedia Omni [1/3/2024 – 1/9/2024] as of 1/17/2024

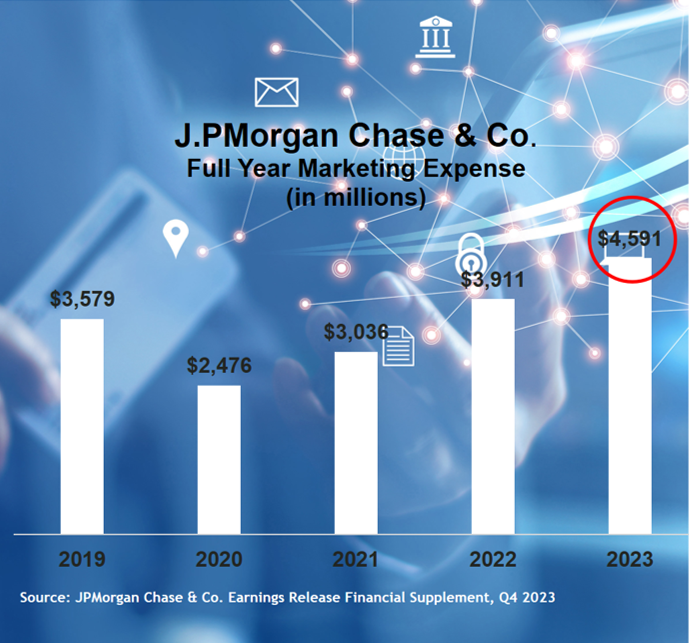

6. Record year fueled by record marketing spend

JPMorgan Chase & Co. reported record profits in 2023 prompting headlines like “JPMorgan Just Made More Annual Profit Than Any US Bank Ever” (Bloomberg). Key to the strategy was an investment in marketing like never before with spending up 17% in 2023 while many others remained flat/cut back and peaking in Q4 with nearly $1.4 billion spent on marketing in that quarter alone.

Source: JPMorgan Chase & Co. Earnings Release Financial Supplement, Q4 2023

2024 outlook:

Chase isn’t letting up. Commenting on a planned 8% increase in expenses in 2024 for CCB (Consumer & Community Banking) CFO Jeremy Barnum called out credit card marketing as one of the drivers. “We are seeing great opportunities, demand, and engagement for our card business.” Chase has thrown down the marketing gauntlet to its competitors. Those without hefty budgets will have to be even smarter, scrappier, and innovative to compete this year. Game on!

Want insights like these from our industry experts delivered to your inbox? Sign up for our newsletter today!