Lightbulb Moments: Spark Your Strategy (Vol.2)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 7 things you need to know from January 2024:

1. Sezzle’s Financial Fitness Bootcamp

BNPL firm, Sezzle sent more than 4 million emails in January promoting a “FREE 4-week Financial Fitness Bootcamp.”

Subscribers receive a weekly “workout of the day email” which includes 4 weeks of financial tips, access to credit-building tools, and a financial personality test.

Sezzle email promoting a “FREE 4-week Financial Fitness Bootcamp”

Source: Comperemedia Omni [1/1/2024 – 1/19/2024] as of 1/26/2024

💡 Engagement: Sezzle describes itself as “the responsible way to pay” and the new year is the perfect time to match the consumer mindset for resolutions with a tongue-in-cheek nod to all of those new gym memberships/toning goals (many of which are dropped by the end of January). With 2.6 million active consumers (transacted in the L12M) including 210K subscribers to Sezzle Premium (launched June 2022) or Sezzle Anywhere (launched June 2023), this is a clever marketing campaign to deepen and re-ignite customer engagement.

2. Owners Bank offers interactive training sessions for SMEs

In April 2023, Connecticut-based Liberty Bank launched its Owners Bank digital brand for small businesses with an unapologetic message – “You don’t have time for the BS so let’s get down to business.”

Owners Bank is big on education. As part of its “small business financial wellness academy” Owners Bank and Liberty Bank together offer innovative, interactive training sessions of 10 minutes or less for small business owners.

Source: www.ownersbank.com/education/

💡 Small business owners need more support than ever: According to the National Federation of Independent Businesses (NFIB) small business optimism remained in the doldrums through December and small businesses “remain pessimistic about their economic prospects” said Chief Economist, William Dunkelberg. Banks and card issuers can help small businesses by finding new and creative ways to adapt their products/messaging to the changing needs of small business owners.

3. What’s next for card marketing?

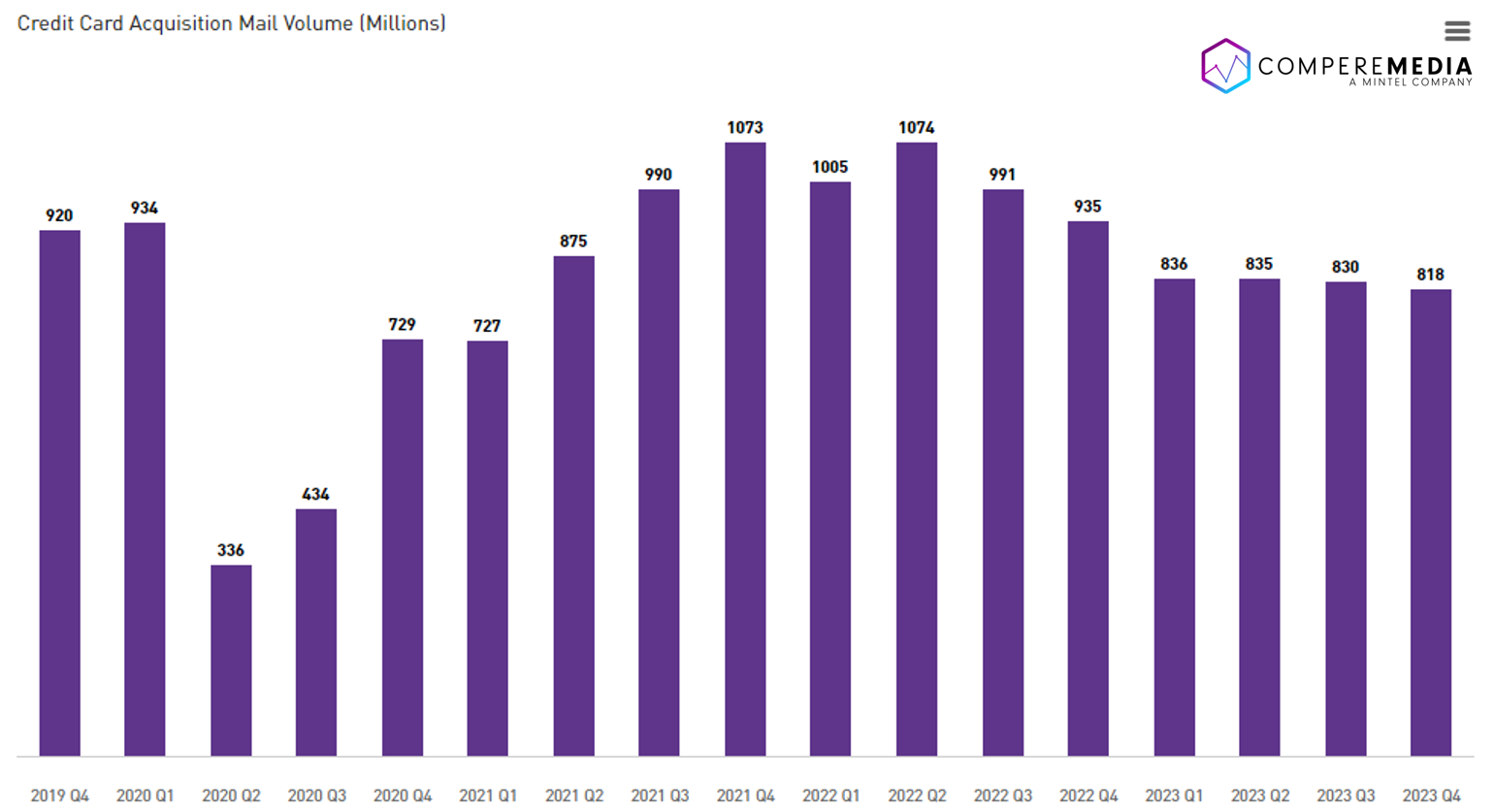

A year ago it was all about “efficiency” when it came to marketing, whether your budget was up/flat/down in light of an uncertain, but generally bleak economic outlook. It turns out that consumer credit card acquisition mail volume—a KEY INDICATOR OF CREDIT SUPPLY—dropped 17% in 2023 vs 2022. Following two years of post-pandemic growth, things started to stabilize in 2023 as a potential soft landing came into view.

Source: Comperemedia Direct [10/1/2019 – 12/31/2023] as of 1/19/2024

💡 Bullish or bearish: It has always amazed me how well the pattern in marketing activity tracks the Dow Jones Industrial Average, not precisely following every peak and trough but in a broader sense they are quite well aligned. The stock market is hitting new peaks which makes me BULLISH about card marketing this year. Consumer budgets remain stretched and delinquencies are on the rise, but Chase reported record profits fueled by record marketing spend in 2023—and isn’t planning on letting up in 2024. The sustained marketing drive from one of the biggest spenders in the industry will have a ripple effect as competition intensifies and card issuers battle for share of voice and ultimately share of wallet.

4. Citi launches Citi Shop

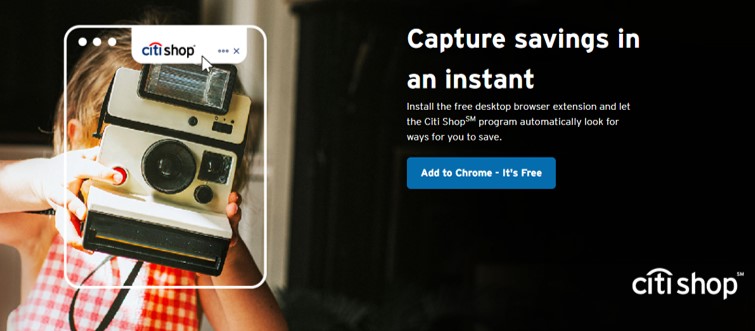

Citi has launched Citi Shop, a desktop browser extension powered by Wildfire Systems Inc., to help Citi-branded cardholders save money.

- Add the extension to a browser

- Enroll a US Citi branded card

- Receive cardholder alerts for savings at 5,000 online merchants across 30 different categories

- Earn savings as statement credits displayed in the Citi Shop dashboard in the mobile app AND/OR

- Redeem coupons instantly at checkout

Source: www.citi.com/credit-cards/citishop/home

💡 Extreme couponing, Citi style: Similar but different (to Capital One) Capital One rebranded Wikibuy, its free browser extension, as Capital One Shopping back in 2020 and reportedly has millions of shoppers signed up. The growth strategy is based on making the extension available to all (you don’t have to be a customer). Citi Shop on the other hand is only for US Citi-branded cardholders so its focus is more on value-add and engagement than growth.

Right product, right time. Citi needs some positive news following Q4 earnings. Consumer budgets are stretched due to inflation and rates remain high. According to Mintel, 70% of consumers are willing to go out of their way to save money, and 55% of adults identify as bargain hunters. Households who are stretched are increasingly reliant on discounts to meet their needs. The launch of Citi Shop couldn’t come at a better time.

5. A United/Chase mobile alert breaks through

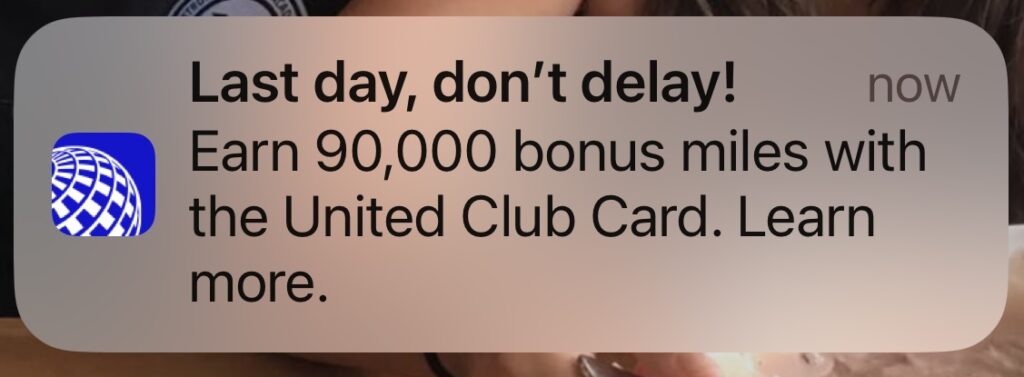

An alert popped up on my phone with a jolt and a buzz that demanded my attention. A welcome offer for the United Club Infinite Card ($525 annual fee) issued by Chase. 90K bonus miles for spending $5K in the first 3 months and the offer expires 1/24.

💡Made me look: I *think* I got an alert because I was recently back in the United app after booking a flight but it made me stop and look. Marketers need to break through the clutter and demand attention.

6. Capital One’s biggest marketing quarter ever

Capital One spent $1.25 BILLION on marketing in Q4 2023 up 12% from Q4 2022 and its highest ever reported. Note: for the full year spend was flat in 2023 vs 2022 coming in at $4 billion.

Specific callouts fueling growth:

- Travel portal

- Airport lounges

- Capital One Shopping

2024 outlook:

Capital One has a “zeal for growth” fueled by:

- STABILIZATION across all segments

- A QUEST to win at the “top of the market” (premium)

- The ongoing mission to be a NATIONAL BANK

💡Huge: The barometer for the health of the credit card industry has spoken. Stabilization is the word of the day/month/year (I didn’t count how many times stable/stabilize/stability/stabilization was mentioned on the Q4 2023 earnings call but it was A LOT). With industry-wide concerns about rising delinquencies, Capital One’s reassuring message of stability suggests that it is full steam ahead in 2024.

7. Amex’s global product refresh

40! That’s the number of products globally that American Express plans to refresh this year according to comments made on the Q4 2023 earnings call. Amex will modify its products every 3-4 years to reflect changing consumer needs said Chairman and CEO, Steve Squeri.

Asked whether that included a refresh of Platinum (last enhanced in 2021), Squeri didn’t give much away…or did he? “We don’t pre-announce that. You’ll have to wait and see,” he said.

💡 Welcome to a new era of enhancements: The pace of change in credit cards has been accelerating for several years with Amex leading the pack. The billions of dollars being pumped into marketing from Amex, Chase and Capital One in 2024 will usher in a new era where products are enhanced, refreshed, updated, and revamped more regularly to stay relevant and compete. Maintaining the status quo won’t be an option.

Want insights like these from our industry experts delivered to your inbox? Sign up for our newsletter today!