Lightbulb Moments: Spark Your Strategy (Vol.4)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 7 things you need to know from February 2024:

1. A credit union Super Bowl Ad

I had headed into the kitchen to replenish the chips and was on my way back to the game when I heard the words “…financial credit union.” Too late! I’d missed it. Who was the plucky credit union that dared to venture onto advertising’s biggest stage?

Answer: Jovia Financial Credit Union, headquartered in Westbury NY (200K+ members and 22 branches across Long Island) aired a 30-second ad in the New York area during Super Bowl 2024 with the theme of catching “Jovia-itis” an “inflammation of money and happiness” caused by not-for-profit banking.

💡 Bold Move: At an average cost of $7 million for a Super Bowl ad, cynics might quip the not-for-profit line isn’t a surprise. In my opinion, this is a bold move that will have caught the attention of millions of New Yorkers in the Jovia footprint and beyond as the credit union reportedly seeks to expand outside of its Long Island base. It will be interesting to see whether Jovia can build on the campaign and how much it will move the needle in terms of growth in 2024.

2. SoFi and the NBA

After letting the dust settle on the most viewed US TV event in history (123 million watched Super Bowl 2024), the NBA and SoFi announced that SoFi is taking over from BBVA as its official banking partner. Video ads proclaiming that SoFi is “the next generation of banking” were posted on the NBA’s social media channels—including Instagram where the NBA has 86 million followers.

- SoFi Generational Wealth Fund: As part of the campaign, SoFi partnered with five-time NBA All-Star Jayson Tatum to establish the SoFi Generational Wealth Fund, into which SoFi is donating $1 million to promote financial literacy.

- SoFi Zero Giveaway sweepstakes: SoFi is giving away $10K weekly, for 18 weeks throughout the season for fans who open a SoFi Checking and Savings account.

💡 Not the Super Bowl but…

- According to the NBA, games average 1.7M viewers, and viewership is on the rise. Combined with the NBA’s significant digital assets the NBA has a vast reach and represents a great opportunity for SoFi to continue to build its brand.

- SoFi is on a tear, reporting 44% membership growth in Q4 2023 with now more than 7.5 million members. Smaller than you expected? Peer competitor Lending Club claims around 4 million members while fintech Dave claims 10 million+. For comparison, Chase claims to serve 66 million households. Establishing trust is a barrier for fintechs. SoFi has focused on building its brand with high-profile sponsorships such as SoFi Stadium – and now the NBA – so everyone has heard of SoFi which gives it the legitimacy that other fintech brands without similar marketing budgets might lack.

3. Bank of America and Starbucks

Bank of America and Starbucks have announced a new loyalty partnership whereby BoA credit and debit card customers can link a card to the Starbucks app to earn 2% cash back plus one Starbucks Bonus Star per $2 spent.

The launch combines BankAmeriDeals (launched in 2012 and now has 45 million customers) with Starbucks Rewards (launched in 2009 and now has 34 million customers).

💡 Third time’s a charm? Can Starbucks finally leverage its brand power and much-lauded loyalty program into a successful financial services partnership? This will be its third major attempt. In 2009 the company launched the Duetto Card, initially issued by Bank One (subsequently Chase) which was discontinued shortly after, and then in 2018 it launched the Starbucks Rewards Visa with Chase which was discontinued in 2023. Less ambitious than a co-branded credit card, a loyalty partnership acknowledges these past challenges while still trying to unlock new opportunities for customer engagement and potentially also for growth. It should be a win-win for both brands but success will depend on getting the message out.

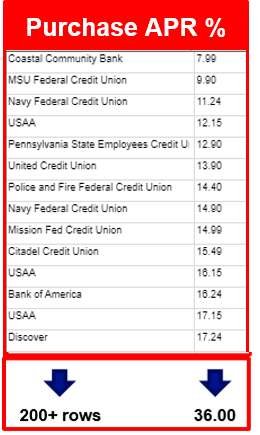

4. Rate Advantage

The Consumer Financial Protection Bureau put out a press release on February 16th citing results from its recently updated Terms of Credit Card Plans survey showing that large banks charge more interest than small banks and credit unions.

💡 Rate advantage: This isn’t exactly breaking news. After all, credit union rates are capped at 18.00% but a quick look at rates offered via acquisition direct mail in January underscores the point. There is an opportunity for small banks and credit unions to amplify their competitive rate advantage in marketing while record-high rates persist and consumers continue to rack up record amounts of debt. Put that low APR front and center!

5. Capital One and Discover: A perfect match

After a day of speculation, Capital One put out a press release late Monday formally announcing its acquisition of Discover Financial Services and emphasizing the SYNERGIES & SAVINGS of the proposed acquisition.

💡Like a glove:

- Capital One’s excitement is palpable at the prospect of getting hold of Discover’s prized card network. I mean, when does the opportunity to acquire a global payments network fall into your lap? The acquisition has the potential to give rocket fuel to Capital One’s already ambitious growth plans and take the company to a whole new level. For Discover, the relief seems apparent with the prospect of finding a way forward after a turbulent year that has only been getting worse.

- The two companies fit like a glove in many respects. Capital One credit cards are traditionally strong towards both ends of the credit spectrum and have recently been pushing more aggressively into premium while Discover is traditionally strong in the middle. Rising delinquencies at Discover? Well, who better to swoop in and save the day than the data-led experts at Capital One with decades of experience managing non-prime consumers through the business cycle? From banking to lending there is plenty that is complimentary.

💡💡On the flip side:

- This could be a major distraction for Capital One after it has made some giant strides in successfully challenging competitors at the premium end of the market. Will it have the capacity to do it all? Judging by the uncontained excitement in CEO Rich Fairbank’s video message to associates I wouldn’t bet against it.

- There is a chance that regulators won’t allow this acquisition to go ahead given that it brings together two of the largest players in the industry BUT by beefing up the Discover Network it adds competition to an area that regulators have been focused on with the proposed Credit Card Competition Act (CCCA) – so maybe it gets a pass?

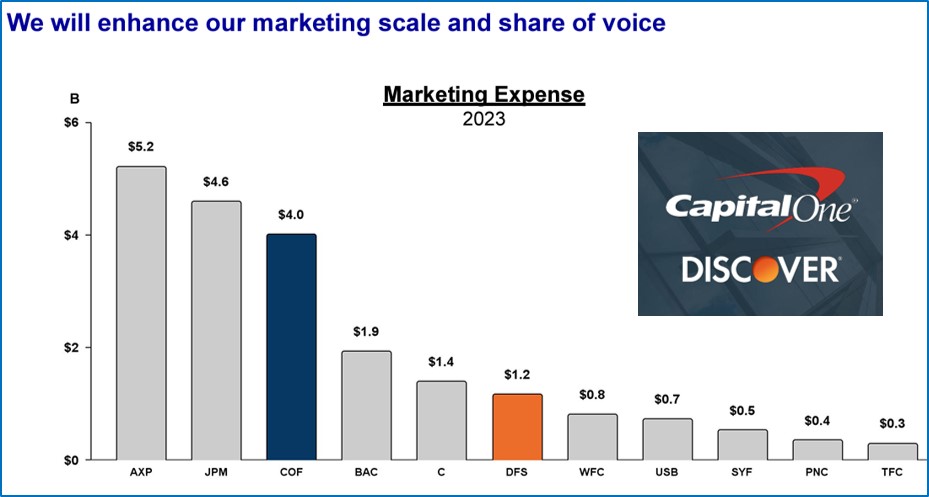

6. Capital One and Discover: Marketing and brand implications

“The network brand is a jewel,” said Capital One’s Rich Fairbank at an Investor Presentation to discuss its acquisition of Discover Financial Services.

- Capital One is planning for a modest reduction of 10% of Discover’s $1.2 billion in annual spending on marketing over two years. Efficiencies in credit card direct marketing and other activities will be offset by investment in the network brand.

- Capital One will keep the Discover brand for its credit cards that will be offered among Capital One’s range of card options although over time Capital One’s branding will be more apparent. “Additive and complementary,” says Capital One. The Discover Network, on the other hand, is the “jewel” and marketing investment will be directed towards enhancing the network brand.

💡Changing the game:

- Big spender: The combined entity will have similar levels of marketing spend as American Express and Chase at around $5 billion a year. If you thought we had reached peak marketing spend, things just moved up a notch.

- All about the network: It’s clear what Capital One prizes the most in this deal – the network.

7. Credit card balance transfer fees on the rise

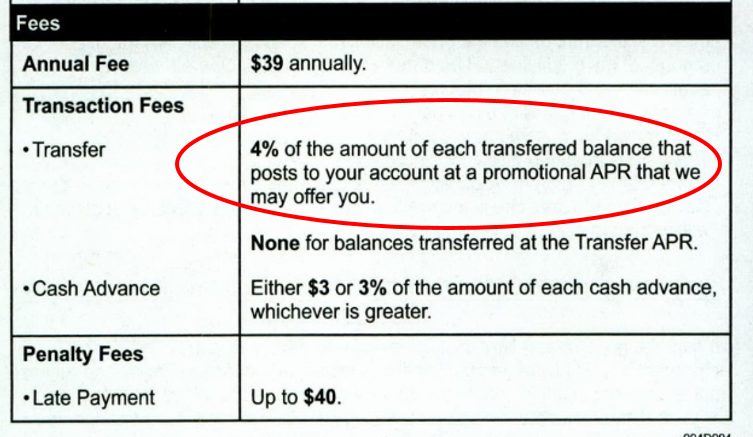

With the Consumer Financial Protection Bureau’s ruling on late fees scheduled for implementation at some point later this year, credit card issuers are seeking ways to replace lost revenue. Capital One is planning for implementation in October and will take some steps before and some steps after the final ruling comes into effect (according to comments made during its Q4 2023 earnings call).

Well, one of those steps has materialized with the issuer raising its intro BT usage fee from 3% to 4% but only (strangely) for new customers of cards that DO NOT have an intro BT promotion like QuicksilverOne. In other words, the 4% applies to future promotions that might be offered once the cardholder has been approved.

💡 Card issuers will find a way: The standard BT usage fee is 3% but 4% and 5% are trending upwards in light of the proposed rule. Issuers will find new ways to make sure they don’t lose revenue and consumers will feel it one way or another.

Want insights like these from our industry experts delivered to your inbox? Sign up for our newsletter today!