Marketing to higher-income households

The current inflationary dynamic has resulted in a consumer dichotomy that forces brands to consider two different consumer groups. As identified in our 2023 Omnichannel Marketing Trends, the Preserving Prospects consumers feel the stark impact of the rising costs of living in contrast to the Opulent Optimist who are excited by the strong global dollar and experiential opportunities in a post-pandemic world.

In crafting marketing strategies to appeal to the Opulent Optimist consumer group: *higher-income households (HIH), here are 3 ways financial services brands can engage with their audience.

1. Leverage a tailored feel

With starkly different realities than the general population, brands should tailor messages, campaigns, and offers to the unique traits of HIHs in order to elevate the relevancy of their products and services. According to Mintel’s forthcoming Marketing Financial Products report, nearly 6 in 10 HIH adults tend to pay attention to brands’ mission or social purpose, compared to 44% of **lower-income households (LIH).

To effectively engage HIH audiences, brands should focus on refining messaging to appear authentic and relatable, while still tastefully showcasing wealth. Chase’s #BuildingANewLegacy campaign strikes this balance, which highlights both authenticity and an exclusive, luxurious image. By featuring female wealth management employees, Chase aligns with the moral motivations often associated with HIHs, further enhancing the campaign’s overall appeal.

Questions to consider:

- Does my verbiage signal and understanding of HIHs lifestyles?

- Does my offering meet a need for an elevated product or service?

2. Cater to their unique needs

Brands should grasp the nuances amongst both older and younger HIHs by concentrating on their distinct needs for investment advice and long-term solutions.

Brands have the opportunity to leverage investments to HIHs as a growing number of consumers come into more wealth. On paid Facebook, Fidelity highlighted its financial advisory and investment services, emphasizing how they can assist in protecting and expanding consumers’ wealth plans— enabling them to “live the life they want” that aligns with their niche lifestyles.

Questions to consider:

- How can I communicate the benefit of investing to younger HIHs?

- How can I position my brand as an educational resource to assist HIHs in navigating the wealth transfer journey?

3. Connect with their travel aspirations

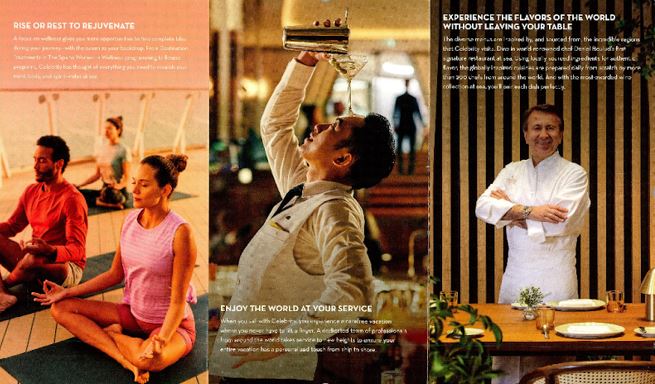

Brands should leverage HIHs’ current financial dynamic and priorities by catering to their keen desire to travel by capitalizing upon travel partnerships.

By continuously enhancing their reward programs and adapting to evolving travel trends, brands can sustain their allure and significance among HIHs who prioritize indulgent travel experiences over products. Over direct mail, American Express highlighted its extensive list of luxurious cruise travel destinations to reach and relate to HIH consumers.

Questions to consider:

- How can I enhance my travel reward program to appeal to HIHs’ desires?

- Does my offering highlight the exclusive benefits of being in a travel relationship?

Want to gain access to our biannual report series emphasizes notable marketing strategies for financial services brands aiming to connect with consumers from higher-income households? Get in touch here.

*HIHs are defined as households with a reported annual income of greater than $100K in the US and in Canada.

**LIH are defined as households with a reporter annual income less than $50k in the US and $55k in CA.