Crypto Curious: Stablecoins & The Crash of Luna/UST

Investment markets and crypto markets have been hit hard over the last couple weeks and months. Dominating recent crypto news is the collapse of a token called Luna and a connected “stablecoin,” TerraUSD (UST), which erased $60 billion in value in the span of three days. This event has invited regulatory scrutiny toward crypto and especially toward stablecoins. In order to understand some of the potential implications, let’s take an introductory look at stablecoins.

What are stablecoins?

Stablecoins are a category within cryptocurrencies. The goal of a stablecoin is to create Internet-native money that’s pegged to the price of real-world assets, with the most common asset being the US dollar. In the case of dollar-backed stablecoins, the price of the coin is meant to stay pegged to $1.00 with a 1:1 value. In contrast to more volatile crypto assets, stablecoins are valued by consumers and institutions alike for their price stability, as well as fast payment processing and being foundational to crypto-based innovations like Decentralized Finance (DeFi) and the Metaverse. With interest rates previously at historic lows and even considering recent increases, there is great demand for the high yields created by lending stablecoins, which is similar to the interest rate earned by saving money in a traditional banking account or the yield generated on the bond market.

With the huge explosion of market cap for stablecoins in the last year, it’s important to emphasize that not all stablecoins are created equal. While many of the top stablecoins are supposed to maintain the price of USD, there are different strategies for doing this, each with pros and cons. The simplest way to think of the current stablecoin design is whether the asset backing it is held in reserve: fully-collateralized, non-collateralized, or partially-collateralized. Given the most popular stablecoin use cases, we’ll focus on the first two.

Fully-Collateralized Stablecoins

If a stablecoin is fully-collateralized, that means for every digital coin there’s an equivalent dollar in a bank account for which you can exchange your coin. With this approach, there is minimal risk of the coin depegging from the price of a dollar, so long as the dollar reserves actually exist. This is great for stability, but given that a custodian needs to be in control of the reserves, fully-backed stablecoins are considered more centralized. Decentralization is a core value to many users in the crypto community, so the centralization of these coins is seen as a negative, especially given that the entity backing the coins can freeze user assets at any time for any reason, including government or regulatory compliance. Stablecoins fully backed with dollars are currently the most popular, with examples including Tether (USDT) and USD Coin (USDC), which are respectively the 3rd and 4th largest cryptocurrencies by market cap. Stablecoins fully backed by crypto assets are also possible, like in the case of Dai (DAI), where reserves are maintained via over-collateralization to account for the natural volatility of the crypto market.

Non-Collateralized Stablecoins

Non-collateralized stablecoins are also known as algorithmic (algo) stablecoins. Without collateral, these stablecoins tap into supply and demand dynamics and rely on an algorithm to maintain their dollar peg. If the coin is trading above $1.00, the coin’s protocol will mint more coins, increasing the supply, and dropping the price. But if the coin is trading below $1.00, the protocol will burn coins, decreasing the supply, and increasing the price. That’s the general idea, but how specific protocols manage the minting/burning and therefore maintain the dollar-peg is different. Because these stablecoins are managed by a protocol on the blockchain, instead of a single entity, algo stablecoins are the more decentralized type, which appeals to crypto consumers who favor decentralization; however, they are unproven and the riskiest type of stablecoin, and the recent failure of Luna/UST has shaken consumer confidence.

The Collapse of Luna/UST

Terra Labs managed the Terra ecosystem – at its center was UST, their algorithmic stablecoin pegged to $1.00, and its sister token Luna, which gave holders governance power over the Terra ecosystem, much like ownership of certain stocks grant you decision-making votes. Like other non-collateralized stablecoins, UST maintained its price with supply and demand dynamics, with the protocol burning/minting Luna and UST to maintain UST’s price.

This strategy works as long as there is demand for UST, and there aren’t too many people who are trying to sell and exit the ecosystem. But if people were to lose confidence and the demand were to falter, a mass exodus could lead to a hyperinflationary situation for Luna.

Terra’s marketing strategy to maintain demand involved positioning itself as a hedge against inflation and a crypto bank account of sorts. It offered an initial interest rate of 20% on UST deposits – paid from a fund managed by Terra Labs – to attract users, while developers built DeFi applications like the savings, lending, and borrowing platform Anchor to keep users in the system.

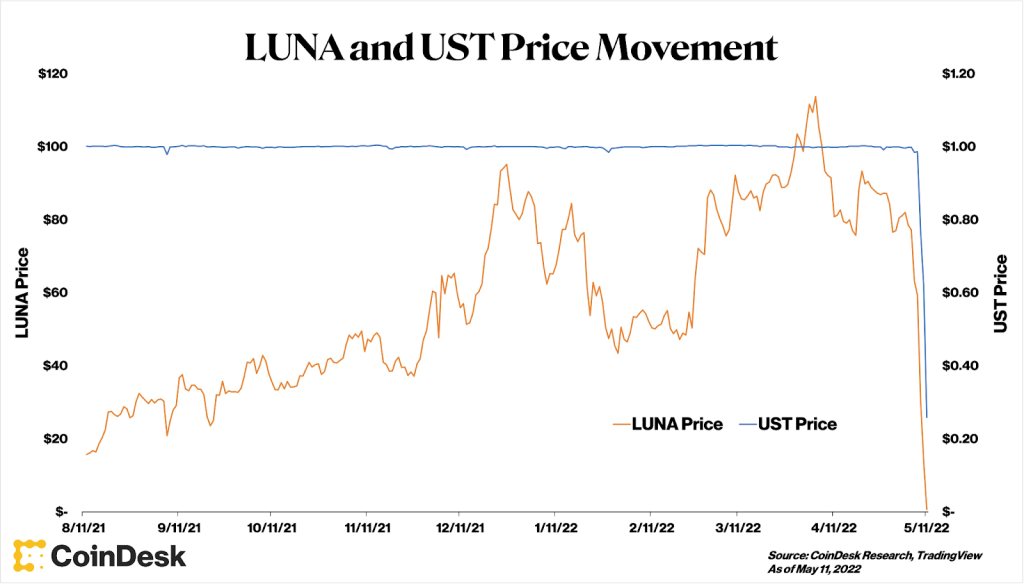

This strategy worked for a while, but eventually the worst-case scenario happened. A mass selling of UST caused the market price to fall a concerning amount in the opening hours of the event. UST’s brief de-pegging shattered confidence, initiating what was akin to a run on a bank, that ultimately led to a hyperinflationary supply for Luna and a collapse in price of UST as users rapidly exited. This “death spiral” erased almost all value for the Terra ecosystem in a matter of days, which was an unprecedented event in terms of speed and magnitude for a crypto asset ranked in the top five. If an investor had put $1 million in Luna on May 6th, by May 13th, it was worth less than $1,000.

Regulation, CBDCs, and The Future of Stablecoins

For all the Luna/UST mess, there’s a cautionary lesson to be learned for both investors and builders on stablecoins that will last. Though many retail investors lost life savings, it was fortunate for the crypto space that the collapse happened while Terra/UST was still in nascent stages and wasn’t intertwined enough with other companies, funds, and the overall economy to cause widespread catastrophe. Proven stablecoins that are fully collateralized can still be a good way for a crypto-interested consumer to reduce the impact of volatility while earning significantly higher interest than a savings account.

Though the future of non-collateralized, algorithmic stablecoins is uncertain due to broken consumer trust, it’s only a matter of time before someone tries again and is temporarily successful to the degree that the Terra ecosystem was. Stablecoin regulation is imminent, but at this point, it’s unclear if stablecoin issuers will be regulated as banks or in a way that’s distinct from them. While clarification on what has been a regulatory gray area will be a relief, there are concerns that regulators will group all stablecoins together in a heavy-handed way, without understanding the nuances. Regulators will need to balance consumer protection with encouraging much-needed innovation.

Until an official digital dollar is created via a central bank digital currency (CBDC), and the Federal Reserve has made it clear they’re still in an exploratory phase, the closest digital dollar will be stablecoins. Despite concerns that stablecoins would make monetary policy much less effective, SEC Commissioner Hester Peirce states, “We’re dollarizing more of the world through stablecoins and giving the dollar more value.”