Three key opportunities for student loan lenders

After nearly three years of deferred payments, rising rates and inflation have shifted the student loan landscape as borrowers entered a challenging financial reality.

While students awaited news regarding potential loan forgiveness, their financial situations underwent significant changes. Inflation concerns, rising interest rates, and the overall impact of a post-COVID reality contributed to an overall increase in consumer debt. The resumption of student loan payments will add an additional financial stressor, forcing borrowers to adjust their spending habits.

Lenders will need to assess the current perception of students seeking their first educational loan. Shifting market dynamics and negative news surrounding the landscape may make consumers more cautious as they navigate their options. Brands must remain vigilant of student loans’ continued significance both before and after repayment news.

Below we outline three opportunities for student lenders as a result of the landscape’s changing dynamic.

1. A change in channel strategy

With changing consumer preferences, digital innovations, and evolving market dynamics, a fresh approach to channel selection is crucial in the private student loan landscape. Lenders must go beyond traditional direct mail and rethink how they are communicating their products and services to gain traction in a crowded landscape.

Oversaturation in direct mail also shows there is room for diversified strategy extensions across digital and paid social channels.

Brands should consider adopting these new digital channel strategies to create conversations with consumers at undersaturated touchpoints.

Sallie Mae utilized paid Facebook and YouTube to reach and relate to students. Its educational FAQs approach was a sound strategy to try to connect with confused borrowers.

While direct mail’s high saturation highlights the opportunity to venture outside of the channel, low saturation within email showcases the opportunity to venture in—as only four out of ten lenders utilized the channel.

Even more so, students may be hyper-focused on their inboxes as they search for updates—as many of them were transferred to another lender during the pause period—and lenders can enter the space to leverage the increased eyes.

From Discover’s messaging around tax season to SoFi’s government updates, lenders leveraged email to communicate important information and resources.

2. Home in on targeting techniques

To help borrowers navigate their options more effectively, lenders should be hyper-vigilant in identifying their target audience and unique value-add. Rather than excessively emphasizing parental marketing with student guidance or cosigning, brands could shift their focus to better understand and connect with the students themselves.

Lenders may be contemplating a shift in their communication strategy—whether they should focus on parents or students as their primary audience. It could be more beneficial for lenders to directly engage with the loan applicant, particularly given that nearly half of them assume full responsibility for the loan.

This 10% difference underscores that while parents may assist with the student loan experience, the ultimate decision-making and financial responsibility lie with the students. It’s often these students’ first time navigating the loan process, so lenders should consider that they may be unfamiliar with it and may require some additional guidance.

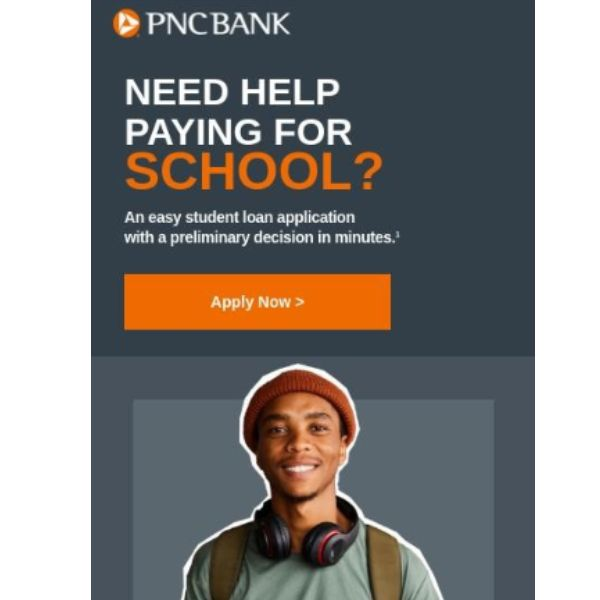

PNC Bank and Citizens Bank demonstrated this by shifting the narrative around cosigning, encouraging students to make the decision themselves rather than targeting parents directly.

3. Serve as an emotional and educational resource

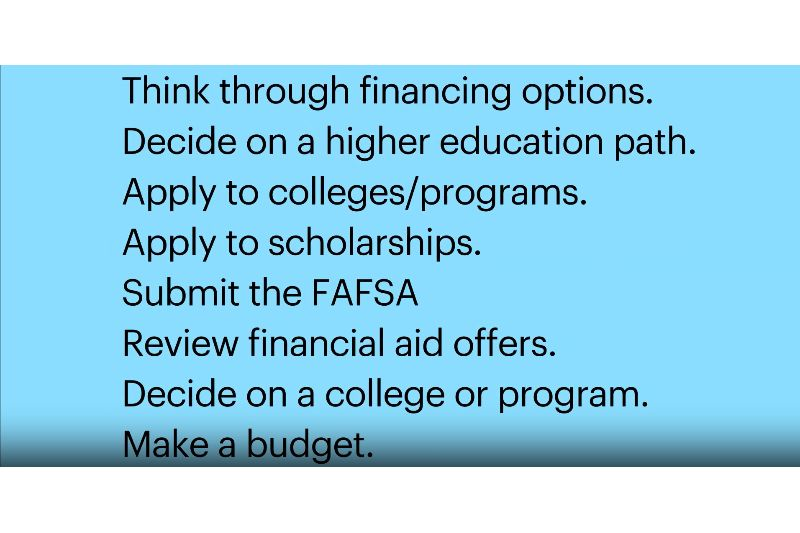

Lenders have an opportunity to reestablish meaningful connections with borrowers by changing their tone. To achieve this, lenders should focus on two essential elements: education and guidance. By offering borrowers educational resources and clear guidance, lenders can help alleviate concerns about taking out loans and navigating the complexities of the repayment process.

Lenders can be proactive in this approach by adopting an understanding and empathetic tone of voice.

As student payments resurge, brands should consider ramping up their communications regarding loan refinancing similar to this Navy Federal Credit Union paid Facebook advertisement. This can provide borrowers with valuable options and flexibility insights, helping them make informed decisions about their financial future.

What we think

While the private student lending space underwent mass uncertainty throughout the period of federal loan forgiveness, its recent absence can serve as a great starting point for lenders to try and connect—or even reconnect— with student borrowers. Lenders are presented with grand whitespace opportunities across awareness-based channels, specifically for educational messaging, as students open or resume their education payments.

Moving into the rest of 2023 and beyond, lenders should leverage messaging that showcases their understanding and pain points from students’ unfortunate circumstances, revamp audience and channel targeting techniques so that they center around the borrower’s narrative, and lean into being a source of financial literacy as students rediscover what it means to take out a loan.

Interested in learning more? If you’re a client, log in now to read the full Insight. If you are not a client and would like more information, contact us today and someone will be in touch with you.