Lightbulb Moments: Spark Your Strategy (Vol.5)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 6 things you need to know from March 2024:

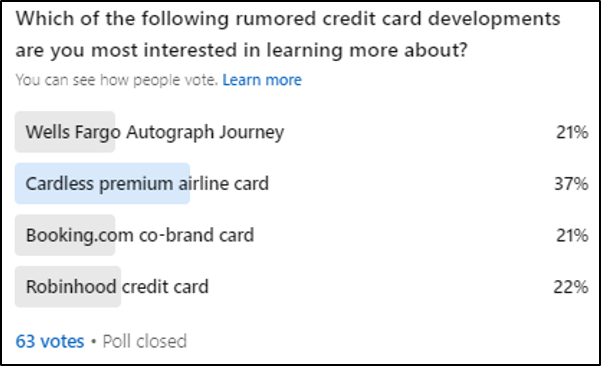

1. New card rumors

It’s been a quiet start to the year in terms of new credit card launches – even slower than what we experienced in 2023.

To better understand which card launch rumors were grabbing the industry’s attention, I ran a poll via LinkedIn. Of the 63 marketing and product leaders that joined the fun, the Cardless premium airline card was the clear front-runner.

You heard it here first: Cardless Co-founder and President, Michael Spelfogel teased this 2024 launch on the Mintel Little Conversation podcast last October.

💡 It will heat up: 2023 was a mixed bag with new product launches while other innovative new players decided to call it a day. With outstanding balances surpassing a new record of $1.13 trillion in Q4 2023 and the big banks making record profits, challengers will try to take a piece of the pie and incumbents will need to launch new products to stay competitive. I think it will heat up. Stay tuned!

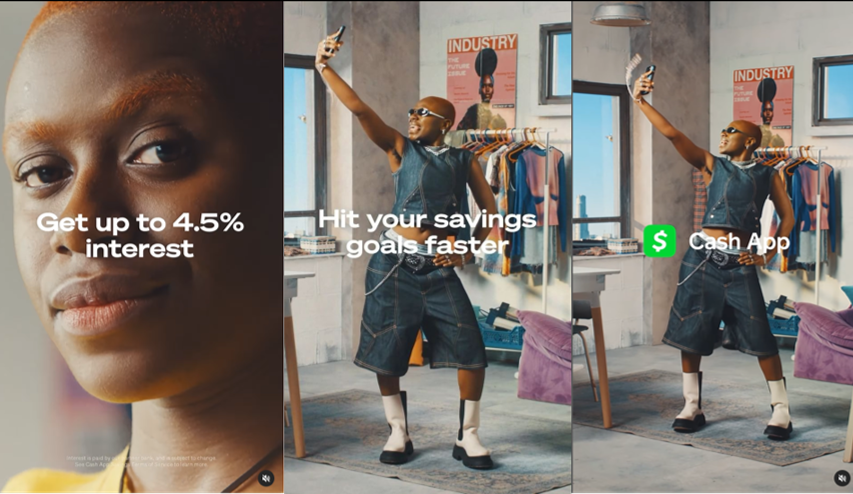

2. Cash App takes on the big banks

“It’s about time they did this. Now Cash App is a worthy competitor to big banks,” said one Instagram follower in response to the launch of Cash App offering 4.5% APY on savings for customers who directly deposit $300 in paychecks each month.

- Target: Households earning up to $150K.

- Strategy: Cash App Card as the “gateway” to Cash App as a primary banking solution.

- Opportunity: P2P Payments (56M monthly actives) ➡Cash App Card (23M) ➡Primary banking (2M).

💡 Growing threat to established banks: I’ve long thought the big banks have underestimated the potential threat of Cash App, which has grown steadily over the years to surpass Venmo and Zelle as the second most popular P2P provider behind PayPal (many are surprised to learn that more consumers use Cash App than Venmo). Cash App has bold plans to add “credit building, spending insights, and subscription management tools” in addition to traditional banking products and further integrate AfterPay for BNPL at the point of sale. Cash App understands its target audience, developing products and campaigns to address their specific needs. Banks should pay attention to a competitor that has become emboldened with Jack Dorsey back at the helm.

3. $8 late fees

Done. Following an initial proposal published more than a year ago, the Consumer Financial Protection Bureau finalized its rule on credit card late fees—reducing the typical fee from $32 to $8 and prompting an immediate legal challenge from the US Chamber of Commerce.

Pending legal challenges, the effective date of the final rule will be “60 days after publication of the rule in the Federal Register” – in other words, soon.

President Biden mentioned credit card late fees as part of a broader policy to eliminate so-called “junk fees” in his State of the Union address.

💡 Consumers will pick up the tab: Given the industry backlash to this rule it seemed there might be some wiggle room on the $8, but that window just slammed shut. Those who were testing new approaches in anticipation will be well positioned to move forward while those with their heads in the sand will now be scrambling. Late fees are an important lever in managing risk and generating revenue BUT, they are one of many, and issuers will seek other ways and new pricing combinations to address risk and revenue concerns. You can be sure that consumers will continue to pick up the tab in some form and we will be tracking how it plays out at Comperemedia.

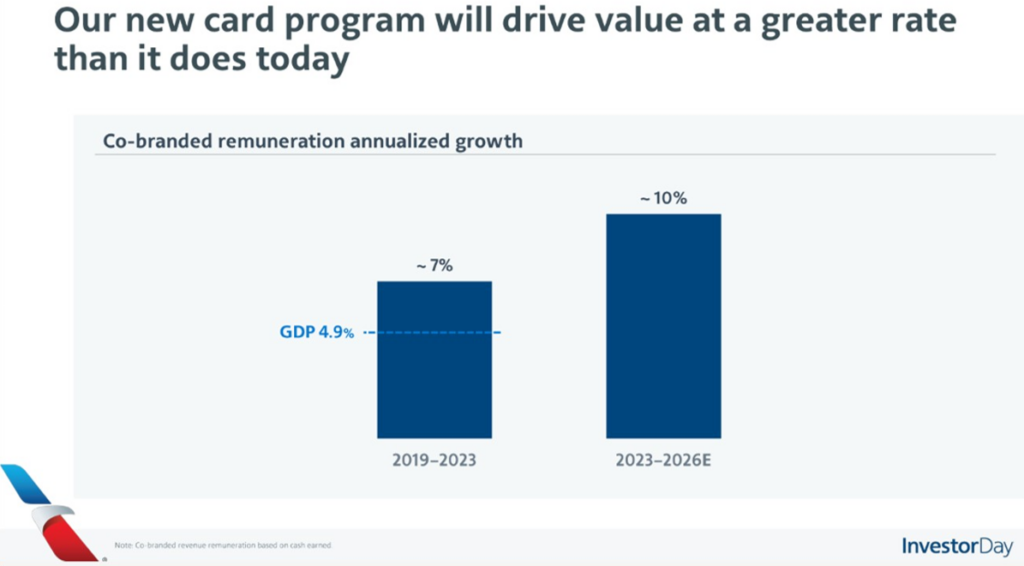

4. American to put the squeeze on card issuers

American Airlines is “refreshing” its card partnerships to drive up value according to comments made during its recent Investor Day. According to CNBC, Chief Commercial Officer, Vasu Raja said that a renegotiation of contracts would increase revenue for American (see chart).

💡 Big opportunity

- In July 2016, American announced new agreements with long-standing partner Citi as well as Barclays to issue its consumer and business cards (Barclays was mainly restricted to airside promotions). At the time, the length of the agreement was undisclosed but it looks like the time has come revealing an 8-year time frame.

- One of the most interesting slides in the Investor Day presentation shows how American thinks of the scale of the card opportunity. With just 6% of US travelers owning an American Airlines cobrand card and 23% being members of the AAdvantage loyalty program there is plenty of upside potential for a new product lineup.

- The term “renegotiation” suggests the same issuers are front runners but you never know. I’ve long thought the multi-issuer approach – playing one off against the other – was not a customer-centric way to approach it—plus it sounds like American will be looking to issuers to squeeze costs while adding more value to seize the opportunity outlined above. Regardless of how it ultimately plays out, in an era where the pace of enhancements is accelerating and with the American Express/Delta card pushing to new heights, it is a good time to inject new momentum.

5. Wells Fargo launches Autograph Journey

Wells Fargo launched its Autograph Journey Visa Card targeting frequent travelers.

- Annual fee: $95

- Sign-on bonus: 60,000 bonus rewards points after spending $4,000 in the first 3 months.

- Statement credit: $50 annual statement credit for airfare purchases.

- Accelerated earn on travel: 5x points on hotels, 4x points on airlines, 3x points on other travel and dining.

- Points Transfer: Includes Choice Hotels and British Airways with more partners to follow.

💡Plugs a gap in the bank-branded lineup

- Since launching a strategy to build a presence in credit cards to match its status as the 4th largest bank, Wells Fargo has added Active Cash (2% cash back – launched 2021), Reflect (revolver focus – launched 2021), and Autograph (no-fee travel – launched 2022) in addition to co-brand launches with Bilt Rewards (2022) and Choice Hotels (2023). The launch of Autograph Journey plugs a gap in the lineup and comes after Wells Fargo has been building up its capabilities with Autograph Exclusives (access to live entertainment) and an initial list of points transfer partners.

- The Autograph Journey value prop looks a lot like the Chase Sapphire Preferred Card and based on launches so far it seems Wells Fargo is following the Chase roadmap to build out its product lineup. That suggests an ultra-premium Chase Sapphire Reserve-style product is in Wells Fargo’s future!

- Wells Fargo is building a competitive product lineup but the challenge is competing when its marketing budget is barely one-fifth of marketing giants like Amex, Chase and Capital One. Wells Fargo’s asset cap makes things complicated, but at some point, it will be lifted (possibly in 2025) and then the bank – perhaps with a fully fleshed-out card lineup – should be well-positioned for future growth.

6. Bank of America’s digital billboard

Bank branches as DIGITAL BILLBOARDS.

I took a short video of this Bank of America digital billboard in a branch window while out in the non-stop rain in NYC recently. What caught my attention was that it included a promotion for the new loyalty partnership with Starbucks that I originally posted a couple of weeks ago in Volume 4 of Lightbulb Moments.

💡Two quick points

- There is no doubt that branches in dense urban areas have become billboards to promote bank products and those billboards are now becoming more sophisticated. That said, on the adjacent window was a poster ad for something else that looked like it been taped to the window so we are in a transitional stage! Recent announcements of branch expansion from Chase and PNC are notable in this context.

- I posted recently about the Bank of America/Starbucks partnership and made the point that success depends on getting the message out (arguably something that didn’t happen with prior Starbucks financial services partnerships). Starbucks kicked off its campaign with in-app promotions and here we see Bank of America leveraging its branches to get the word out. Seems like the partnership is off to a solid start!

Want insights like these from our industry experts delivered to your inbox? Sign up for our newsletter today!