Preventing fraud during the COVID-19 pandemic

In addition to washing hands and social distancing, it’s important to be diligent and make sure your finances are safe from fraudsters. Phishing and other scams are common during times of crisis, so it is now more essential than ever for customers to feel secure with their financial gatekeepers.

In addition to generic emails around mobile banking functionality, branch availability, and cleaning enhancements, some banks are directly communicating with customers about the threat of fraud, and how to detect it and avoid becoming a victim.

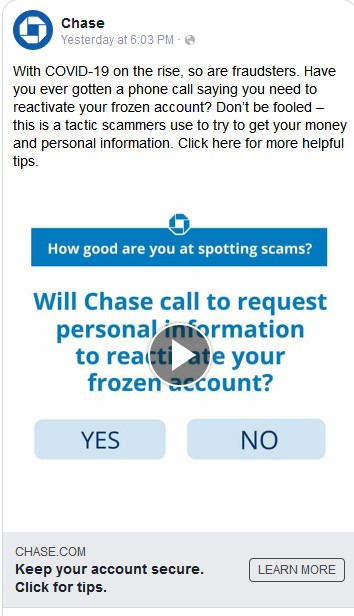

Chase used Facebook to warn about fraudsters

Ads running from March 18-21 informed customers of methods that scammers may use to take advantage of distracted and vulnerable people. Chase encouraged customers to “Click for tips” to “Keep your account secure.”

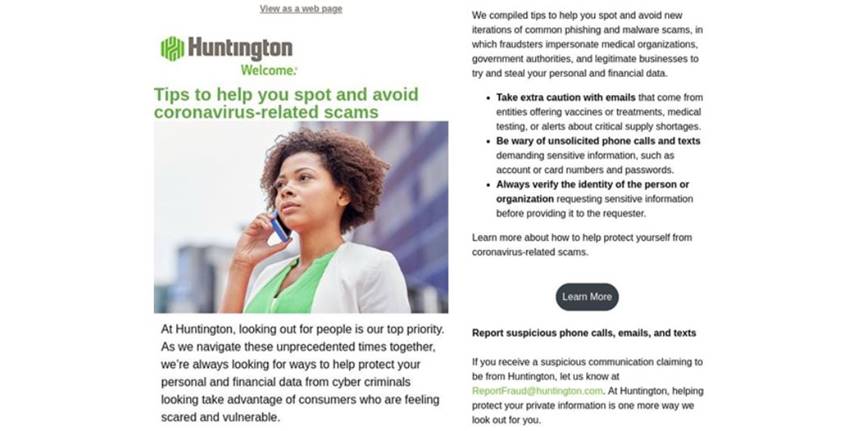

Huntington Bank encouraged customers to watch out for common scams

Huntington sent an email on March 21, instructing customers to be cautious with emails, unsolicited calls and texts, and any person or organization requesting sensitive information. It specifically called out offers for vaccines, testing, and critical supplies.

Bank of America offered assistance and fraud warnings, without specifically calling out the Coronavirus

Bank of America’s “Servicing Update,” sent March 18, did not mention Coronavirus or COVID-19 by name, but instead referred simply to the need for help “during this time.” It listed fraud protection as one of many ways to help.

Wells Fargo also included a fraud reference within general communication

Wells Fargo’s emails first appeared on March 16 and have continued daily. Being aware of suspicious emails and texts is just one of many messages in this text-heavy communication.

What we think

Customers have been inundated with email communications from companies across all industries, outlining the various responses to the coronavirus. Most messages have been excessively general, highlighting protocols and hinting at potential areas of customer assistance.

It’s refreshing to see brands take a more personal tone, and speak to specific areas of customer need. Protection from scams and fraud is something that banks have been promoting for some time, but will become especially relevant as customers begin to shift worries from health to finances.

Banks that can demonstrate security and help their customers navigate past possible threats that are likely to arise will be in the best shape to come out of this pandemic stronger than ever.