Insider Insights: Capital One x Discover

The big news on this Bank Holiday is that Capital One is rumored to acquire Discover.

We will continue to update this page with the latest Insider Insights from our team of experts. Using Comperemedia competitive intelligence tools to monitor up-to-the-minute email activity and engagement, social sentiment, and other direct marketing, we will break down the notable consumer and brand activity and offer our POV on the road ahead.

Updated as of 5:00 pm ET 2.19.24

Discover’s recent activity (or, lack thereof) points to the beginning stages of an acquisition: In late 2023, Discover announced it is selling its student loan business; additionally, Comperemedia’s Marisa Frys observed in her latest paid search report that Discover, the largest spender in paid search, recently began pulling back spend.

Discover is, arguably, Capital One’s biggest competitor. Both brands have a large focus on students and entry cards, and both brands have high yield savings products. Capital One acquiring Discover would create a powerhouse within the online banking and entry credit card market, but it would also allow Capital One to create financial efficiencies for its credit card processing costs. Below are our initial thoughts and predictions on this matter:

Capital One would leverage Discover’s card network for all entry and student cards

As Discover already has a strong presence in student cards, an area Capital One has consistently invested in, Capital One would leverage Discover’s processing to cut costs for its entry cards. Meaning: Savor Student, Quicksilver Student, and eventually Capital One’s other no-fee cards and credit-building cards, would adopt Discover as a processor so Capital One would not have to deal with interchange fees on these cards. For Capital One’s other higher-end cards, the brand is likely to stick with Visa/Mastercard, as the consumers investing in higher-end cards want more retailer access.

Capital One rids itself of a big competitor in the online deposits space and gears itself up for a larger lending portfolio

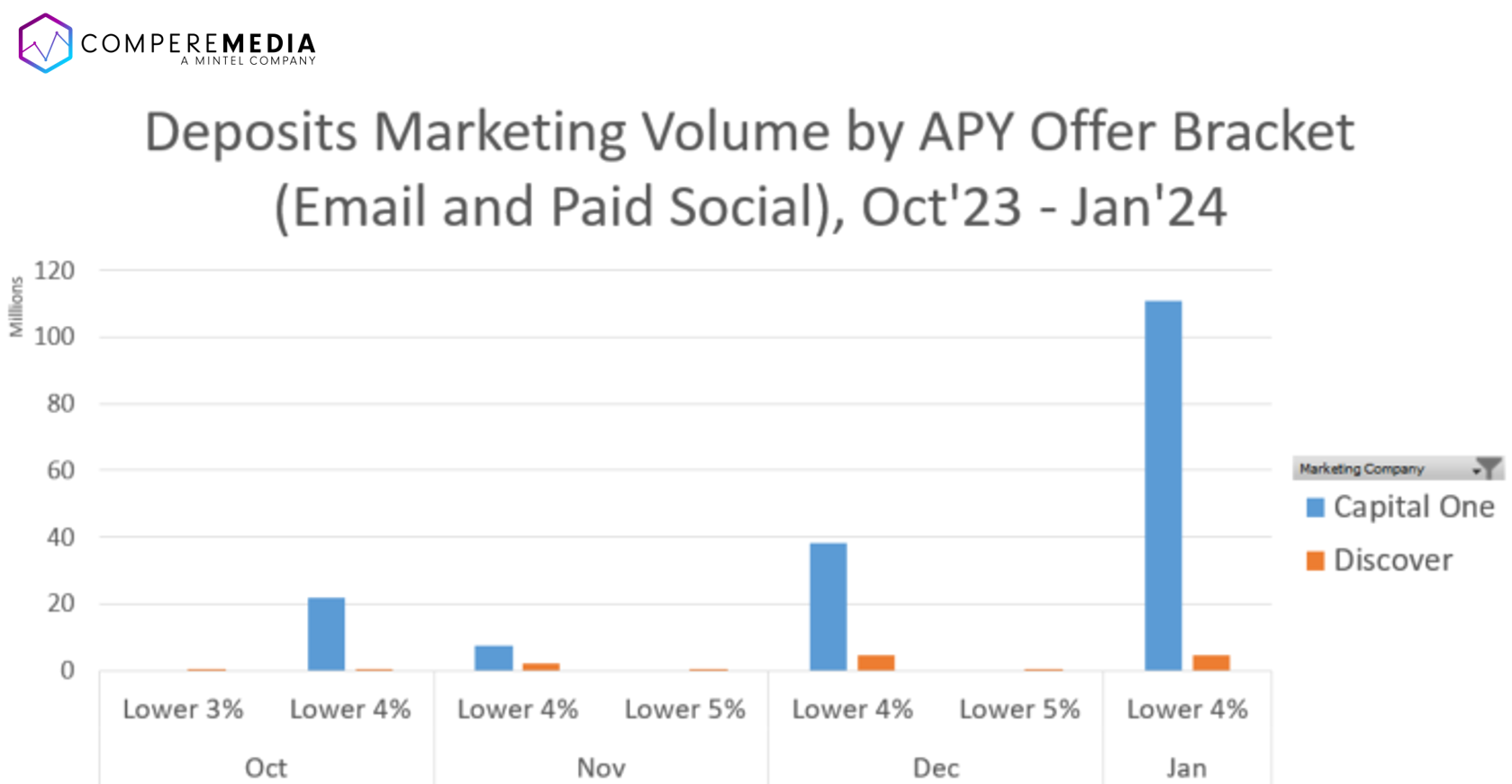

Capital One and Discover are both anomalies within the legacy banking space, as both offer High Yield Savings accounts equitable to challenger brands. Lately, Capital One has invested more in the deposits space, advertising a 4.35% HSY APY, and while Discover advertised the same APY, it has cut back marketing significantly, pointing to Capital One being more bullish in the future value of attracting deposits customers. This, along with a merger with Discover, would set Capital One up nicely with the deposits access to boost its lending portfolio, ideally once rates begin to decline and borrowing becomes much cheaper.

Antitrust allegations will loom

If this rumor is true, it will not happen without significant pushback. As Capital One and Discover are the two biggest brands in the student card and subprime space, this merger would lead to the makings of a monopoly for student cards. This dominant of a force within the credit space for students and subprime is sure to raise eyebrows and leave consumers (and the government) to wonder how this will impact interest rates imposed on card users as well as merchant fees.