[Guest post] Data insights: Social ad strategies from the top brands on Facebook and Twitter

Social media advertising is booming. In fact, US social network ad spend will reach nearly $38 billion by 2020. That’s one reason why it’s crucial for brands to get their Twitter and Facebook advertising strategies on point.

The top advertisers across both sites have already figured out the best ways to engage their audiences. Pathmatics’ analysis of these brands shows the trends that have helped them get to the top.

Top advertisers on Twitter and Facebook

There are several interesting comparisons among types of brands advertising across Twitter and Facebook. For starters, the industries that spend the most on Facebook advertising are food and drink, retail, fashion, beauty and style. No surprise, given how the rise of Direct-to-Consumer (D2C) and the prevalence of consumer packaged goods (CPG) brands.

While food and drink also takes the top industry spot on Twitter’s biggest advertisers, media and financial services companies follow. Twitter has a heavier focus on real-time news and business updates, which is why media and financial services companies lead the way on Twitter advertising.

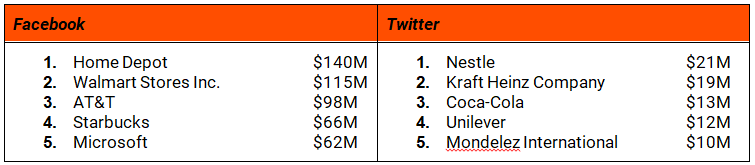

The food and drink industries are spending heavily across Twitter and Facebook, and CPG brands top the list of top Twitter advertisers. Consider the top five advertisers by spend on both platforms since June 1:

Top Facebook advertisers include a telecom carrier, a big box retailer and a storied tech company. Top Twitter advertisers, however, are much less diverse, as they are all CPG brands. This comparison also shows a compelling trend from Facebook to Twitter advertising, as the top five brands advertising on Facebook have averaged an estimated spend of $96M, whereas the top five on Twitter have only averaged $15M since June 1. This huge difference in spend is likely because Facebook has broader reach to varying demographics, whereas Twitter’s user base skews younger.

What’s trending in social advertising

Despite the differences in ad spend across Twitter and Facebook, social media advertising trends are quite similar from platform to platform. A few examples:

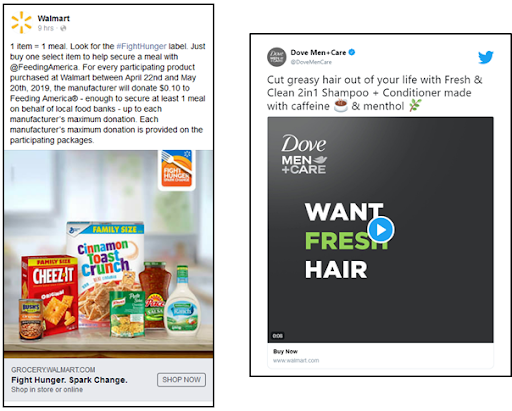

Advertising purpose, not just products. Consumers require the brands they do business with to communicate authentically and with integrity. As such, brands are advertising their involvement within the local community with regionalized ads, or with national nonprofit organizations that tie into the advertising brands’ core messages. Take Walmart, for example: Several of the company’s top ads feature a call to action for consumers to look for the Fight Hunger labels on food items in its stores, which supports local food banks.

Hashtags and emojis galore. Given social media’s obsession with hashtags and emojis, it’s no wonder why the two are a staple among social ads — especially on Twitter. Emoji usage in tweets garner about 25% more engagement than those without, and on Facebook, using emojis results in 57% more likes, 33% more comments and 33% more shares.

Hello, video. One surprising trend that Pathmatics found is how prevalent video ads are on Twitter. In fact, it’s the top ad format for each of the top five Twitter advertisers since June 1. Given that video tweets attract 10 times more engagement over those without, and also save brands more than 50% of cost-per-engagement, video ads have proven to be an excellent ad method on the platform. Conversely, the top Facebook advertisers have a much different mix, using link, photo and carousel posts more frequently than video posts.

2020 vision: Social advertising’s future

A brand’s decision to spend on Facebook advertising versus Twitter isn’t as clear cut as it seems. Though Facebook has about six times as many users as Twitter, and owns the lion’s share of social media advertising — 57% to Twitter’s 13%, to be exact — Facebook’s advertising business is beginning to show signs of stagnation.

The platform’s lack of transparency across political ads, poorly regulated targeting practices and propensity to propel fake news to the top of users’ newsfeeds are making brands second guess how much of their social media budget to spend with the platform. And as Facebook doubles down on privacy to address federal and consumer concerns, the company expects its ad revenue growth to decelerate into 2020.

As a result, Pathmatics anticipates there will soon be a changing of the guard in terms of advertisers’ preferred social media marketing mix.

![[Listen]: Navigating Facebook advertising in 2019](https://welcome.comperemedia.com/wp-content/uploads/2019/07/CM_SocialMedia_FacebookAdvertising_Blue200Blog_2000x1000.jpg)