Lightbulb Moments: Spark Your Strategy (Vol.3)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 8 things you need to know from February 2024:

1. Capital One’s eye-popping business card offers

Capital One has launched a two-pronged assault on the small business card segment with a pair of eye-popping, limited-time sign-on bonuses designed to create a stir.

- Capital One Spark Cash Plus charge card customers can now earn $3,000 (up from $1,200) with $1,500 awarded after spending $20K in the first 3 months and another $1,500 awarded for hitting $100K in spend in the first 6 months.

- Venture X for Business charge card customers can now earn 300,000 bonus miles (up from 150K) and it’s the same structure as Spark Cash Plus with 150,000 miles awarded after spending $20,000 in the first 3 months, and an additional 150,000 miles for hitting $100K in spend in the first 6 months.

Source: Comperemedia Omni [01/01/2024 – 02/02/2024] as of 02/09/2024

💡 The big 3 battle it out: When it comes to small business card marketing, the big 3 (American Express, Capital One and Chase) outspend the rest by some distance. Recently, Capital One has muscled its way to the top of this elite pack with a series of big-budget, omnichannel campaigns focused on its charge card products: Spark Cash Plus and Venture X for Business. This latest development of a MASSIVE INCREASE in the sign-on bonus for both cards is designed to move the needle vs Amex and Chase.

How will the competition respond? The sign-on incentive for Chase Ink Premier (the most direct competitor to Spark Cash Plus) is $1,000. We’ve captured some targeted 200K offers from Amex on Comperemedia but the public offer is 150K points. It’s a gap, compared to Capital One’s current offer, but I predict the competition will respond rather than risk giving up any ground. With approximately 5.5 million small business applications in 2023 according to the Census Bureau, we are just getting started in this increasingly competitive segment.

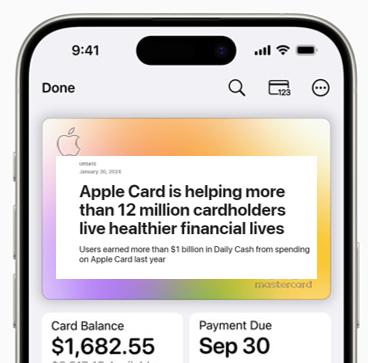

2. What was the powerhouse marketing channel that got Apple Card to 12 MILLION customers?

Apple announced that it has achieved 12 million Apple Card customers since its launch in 2019, representing phenomenal growth. What was the marketing channel that got them there?

- Not TV, although that dominated during the launch in 2019

- Not display, although it certainly had its moments in 2020

- Not video which peaked in 2021

- Certainly not paid social when Apple only ever used Twitter (no Meta or X for them)

- Certainly not good old direct mail with not a single offer sent!

The answer: Email! Over 1 billion emails were sent promoting Apple Card in 2023 alone with multiple touchpoints extending across the massive Apple ecosystem of existing customers and millions of emails sent annually for the past 5 years.

💡 Changing the narrative: Apple Card has been one of the most innovative (and most talked about) launches in credit card history. From the pre-launch campaign to the onboarding experience to the value prop and frequent product updates. In recent years the press has been negative amidst a swirl of leaks and rumors from Goldman Sachs. This article is an attempt to change the narrative and get back to celebrating Apple Card’s successes as it looks to the future.

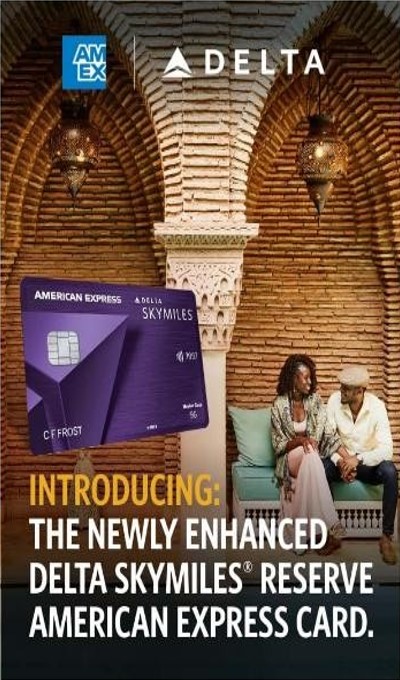

3. Amex product refresh: 6 down, 34 to go

Emails began rolling out on Feb 1 to Delta SkyMiles American Express Card Members updating them on MAJOR CHANGES to the value proposition of their cards. Amex recently announced that 40 products would be updated this year, well that’s 6 updates right here (3 consumer and 3 business cards).

Annual fee increases:

- Delta SkyMiles American Express Reserve/Reserve Business: Up to $650 from $550

- Delta SkyMiles American Express Platinum/Platinum Business: Up to $350 from $250

- Delta SkyMiles American Express Gold/Gold Business: Up to $150 from $99

💡 Premium card inflation continues: I’ll leave it to The Points Guy to evaluate the value of the new/enhanced benefits but it’s the higher fees that stand out. According to Mintel, 35% of cardholders say they are willing to pay a higher fee for better rewards and that rises to 63% for Gen Z and 47% for Millennials. Amex is leaning into this strategy across all of its products and we will see how far consumers and small business owners are willing to stretch their loyalty before they consider alternative options.

4. New card alert! The Huntington Secured Credit Card

Hold the phone! Just when I thought we had gone through the entire month of January 2024 without a new credit card launch…NEW CARD ALERT! Huntington National Bank launched The Huntington Secured Credit Card on Jan 29 with 1% cash back and no annual fee designed for Huntington customers who are new to credit or rebuilding credit.

Key features:

- Minimum $250 deposit (equals credit limit)

- 1% cash back

- No annual fee

- Huntington Late Fee Grace (extra day to pay if a payment is missed)

- No foreign transaction fees

- Free FICO scores

- 28.24% APR

- Card upgrade review for the unsecured Hungtinton Cashback credit card after 7 months

💡 Unique claim at the right time:

- Unique claim. “One of the first among regional banks to offer cashback rewards with no annual fee” [on a secured card] is the claim which I think is spot on. More banks are offering secured cards and more banks are offering secured cards with rewards but not many are offering secured + rewards + no annual fee. US Bank comes to mind. Who else?

- On trend. Credit building/new-to-credit competition will increase this year as consumers try to get back on their feet and Gen Z comes into focus.

- Nice timing. Interesting timing when also considering a recent PYMNTS article reporting that “1 in 4 consumers are looking to smaller banks for their next credit card.” With the right product and targeting, regional banks can compete with national players.

5. Mastercard at the Grammys

You have to hand it to Mastercard for trying to be culturally relevant whether it is with music, gaming, ridesharing, streaming or saving the planet. At this year’s Grammy Awards, it was all of the above.

- February 4th-29th: Use Mastercard to pay for a Lyft ride and Mastercard will plant a tree

- February 7th – March 31st: Subscribe to SiriusXM to get 4 months free and 10 trees will be planted (plus more trees planted for listening to the app)

- Singer SZA’s Instagram sweepstakes where Mastercard cardholders can enter for the chance to win one of the seeds incorporated in SZA’s performance outfit

- Mastercard is launching a game mode within Fortnite’s UEFN engine titled Restore the Forest Speedrun

- Grammy House, presented by Mastercard hosted key events in the run-up to the show

💡Creative but A LOT to digest: A ton of creativity on display but so many brands made the message about what was being offered a bit fuzzy even if The Priceless Planet Coalition to restore 100M trees was the overarching theme. That said, here I am posting about it so it clearly resonated and I only had half an eye on the Grammys. It will be interesting to see how much these card usage initiatives are promoted in the coming days.

6. New Chase Sapphire Lounge

The Chase Sapphire Lounge by The Club with Etihad Airways opened at New York’s JFK Airport in January coming hot on the heels of a new lounge at New York’s LaGuardia Airport launched in the same month for Sapphire Reserve cardmembers ($550 annual fee). That brings Chase to 4 lounges, in addition to the Sapphire Terrace at Austin, with 4 coming soon.

Capital One has 3 lounges with 3 more planned while American Express is at 24 Centurion Lounges (13 in the US) after kicking this trend off in Las Vegas back in 2013.

The focus on lounges prompted Southwest (an airline without its own lounge network) to surprise and delight some of its Chase-issued credit card customers at the end of last year with emails offering them one year of complimentary access to Priority Pass Select!

💡Lounge wars intensify: As anticipated the lounge wars are intensifying this year but we are just getting started as issuers build out their capabilities and airlines seek to retain their value. Lounge differentiation is the next step and how to convey those points of difference in card marketing.

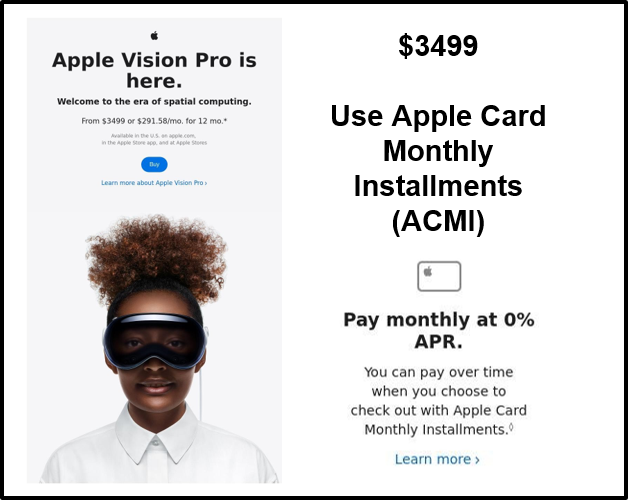

7. Apple Card steps up for Vision Pro

Apple’s Vision Pro headset launched with plenty of hype ushering in what Apple is referring to as a new era of “spatial computing” that “seamlessly blends digital content with the physical world.”

Starting at $3,499 it’s a pricey gadget, even for early adopters which is why Apple is leading with Apple Card Monthly Installments (ACMI), a feature launched in 2019. Using ACMI, Apple Card customers can spread the cost of Vision Pro into 12 interest-free payments of $291.58. More than 27 million emails were sent last week to Apple customers with the promotion and prompting those who don’t already have an Apple Card to “apply for one in minutes.” With this type of reach, it’s no wonder that Apple Card has 12 million customers!

💡 The Apple ecosystem comes together: This is a great example of how the Apple ecosystem comes together for the benefit of the brand. The high price of Vision Pro will limit demand but by leading with ACMI it provides a more affordable (somewhat) alternative for those eager to enter the world of spatial computing.

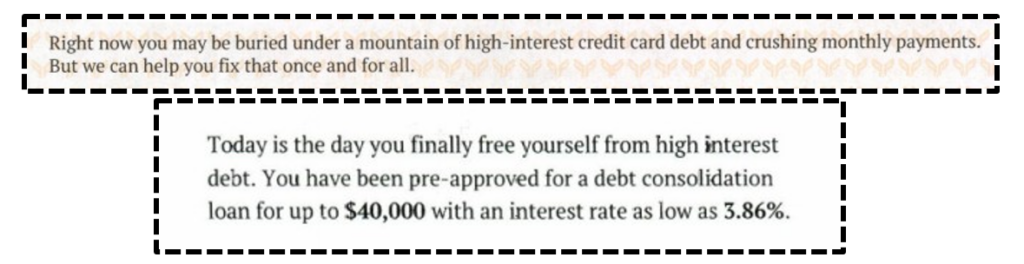

8. Misleading debt consolidation marketing

Americans now owe $1.13 trillion on their credit cards according to the Federal Reserve Bank of New York, well guess what folks? We have seen a spike in debt consolidation messaging in Personal Loans marketing with lenders offering relief from mounting debt and record-high interest rates. The problem is, while many of those offers are from legitimate institutions there has been a surge in debt consolidation offers from questionable companies that lack transparency and are not accredited by the Better Business Bureau.

💡 Lessons for consumers, marketers and scammers:

- For consumers: Watch out now more than ever! See the Lending Tree article on how to spot personal loan scams.

- For marketers: With the average credit card balance hitting a record $6,360 according to TransUnion, consumers are looking for a break but are susceptible to scams or misleading offers. It’s important for banks to help educate consumers but also to be transparent and upfront with their debt consolidation marketing.

- For scammers: Just stop.

Want insights like these from our industry experts delivered to your inbox? Sign up for our newsletter today!