State of the Economy: The Biggest Challenges Facing Today’s Real Estate Market

As we saw from the 2008 Financial Crisis, real estate lending is a keystone of the American finance system, and uncertainty in this space continues to prevail. This precarity around sentiment continues to build on both the commercial and residential real estate fronts – with rising interest rates, stagnant and declining sales, and mounting inventory and affordability issues acting as concerning indicators of what is likely to come.

The State of Residential Real Estate

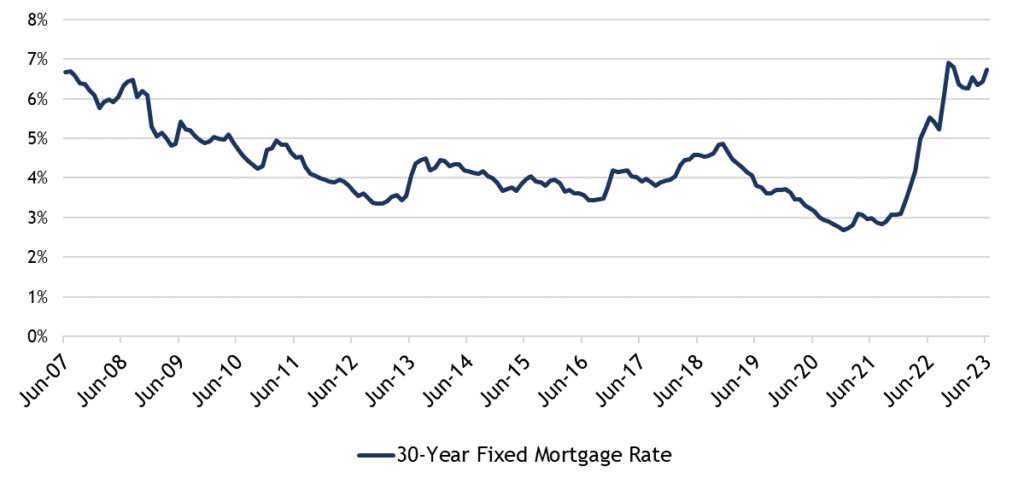

A combination of elevated inflation, elevated home prices, volatile mortgage rates, and economic uncertainty has either kept many potential homebuyers on the fence or pushed them away from the market outright. Mortgage rates were at historic lows from the tail-end of 2020 until early 2022, which is right around the time the Federal Reserve began raising interest rates at its most aggressive pace since the 80s in efforts to cool surging inflation (note: while not directly correlated, the Fed’s benchmark interest rate still has a significant impact on the 30-year fixed mortgage rate). Mortgage rates are currently above 6% – the highest they have been since 2007 and a far cry from the sub-3 % days seen during the pandemic.

Another issue plaguing the residential market continues to be limited housing inventory, which was only made worse during the pandemic. With mortgage rates at historic lows, heaps of investors pounced at the opportunity and swooped what they could of available inventory for single-family homes; per CoreLogic, investors purchased 24% of the single-family homes sold in 2021. The one-two punch of labor shortages and supply-chain disruptions induced by the pandemic has also intensified the acute lack of supply and led to a decline in new construction builds. Any consumers are just not opting to move right now due to the current high-rate environment, as that would entail losing out on the much lower mortgage rate they had locked in the past – leading to fewer houses being put for sale and keeping an upwards pressure on already elevated home prices. Brought forth by higher mortgage rates, higher home prices, along with limited inventory, existing home sales continue to be on a downward spiral. According to the National Association of Realtors, year-over-year sales declined by a whopping 20.4% as of May.

According to forthcoming Mintel research, over 40% of consumers are planning on traveling domestically during the next three months, while nearly 20% are planning international travel during the same time. Other spending outlets, namely restaurant dining, could also be bolstered off the back of this travel appetite and the warm weather. As such, consumer spending is very likely to rebound from its muted Q1 levels, raising the possibility that inflation may not cool by as much as the Fed wants it to during the summer, leading to higher urgency on the rate hiking front and subsequently prolonging recovery across the housing market.

The State of Commercial Real Estate

Though indirectly related to consumers, as of late commercial real estate (CRE) has been often discussed as an area of scrutiny. Part of this lag is due to CRE operating on a 3-7 year cycle, with residual effects of pandemic telework and shifts away from city residency only starting to play out this year. Low-quality properties where vacancy rates are high are at the greatest risk, particularly considering that the financing of CRE loans often involves a balloon payment in the final year of the loan term. In other words, there is a confluence of factors stacked against CRE this year, putting low-quality properties where vacancy rates are high at the greatest risk.

Currently, $270 billion in commercial mortgages held by banks are set to expire this year and, with the current high-rate environment and lower demand for office space, there’s concern that a wave of defaults could ripple to broader credit problems. According to Trepp, June delinquency rates for commercial mortgage-backed securities saw a startling jump to 3.90%, the highest rate in 14 months with office delinquencies now at 4.50% Corroborating this, Blackstone limited withdrawals from their real estate fund for the sixth straight month, showing a degree of high-net-worth skittishness around this highly illiquid asset class. Though some are more optimistic, with CRE categories like industrial, retail, and hotels modulating overall delinquency numbers the last couple of months, almost a quarter of mortgages on office buildings must be refinanced this year at higher rates.

What we think

As far as the residential market, 2023 is already a wash when it comes to home buying. Just 8% are planning on purchasing a home within the next 12 months, per recent Mintel research. Even across the four regions (Northeast, Midwest, South, and West), these sentiments continue to hold. As such, the residential market will likely pick up steam by Q2 2024, which coincides with the traditionally busy spring season for homebuyers. Inflation should have cooled down to its target rate by then, alongside further easing across mortgage rates, as well as overall greater affordability due to more favorable economic conditions.

Though the commercial market is a concerning indicator, there will be regional differences in terms of initial impact, with downtown areas like San Francisco having the bleakest outlook around property valuations. However, in all likelihood, the impact of credit risk driven by CRE shows signs of being systemic. The latest data indicates that community and regional banks are far more likely to have direct exposure to CRE than the 25 largest banks. This means that if the CRE domino does fall, there will likely need to be further banking consolidation and/or government intervention to avoid a credit crunch. Tempering the optimism that consumers and lenders are feeling towards a soft landing, expect that banks will continue to scale back on their lending as we wait and see how real estate plays out this year.

Interested in the latest economic updates? Stay up to date as our experts assess and analyze marketing trends during this economic cycle here.

Biota Li Macdonald is the Director of Marketing Strategy for Comperemedia, specializing in financial services and insurance trends, particularly in the areas of health insurance, fintech, cryptocurrency, and global marketing implications.

Amr Hamdi is a Senior Finance Analyst at Mintel, leveraging consumer research and competitive marketing analysis to provide detailed consumer reports around diverse topics such as banking and insurance. His specialty areas of interest include macroeconomic policy and fintech.