Lightbulb Moments: Spark Your Strategy (Vol.8)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 5 things you need to know:

1. Spanish language subway ad by the FDIC

Over a year after the 2023 banking crisis, I was surprised to see this ad from the FDIC while riding the NY subway. The FDIC launched its campaign in October of last year (in both English and Spanish) to raise consumer awareness for its $250K deposit insurance. Following a pause in December, the campaign picked it up again in 2024 for tax season when many consumers get refunds.

Featuring a piggy bank placed in potentially risky situations, the goal is to “reach those who may have lower confidence in the U.S. banking system or who are unbanked, as well as those who use mobile payment systems, alternative banking services and financial products that may appear to be FDIC-insured but are not.”

💡 Banks should level up: The ad is a sobering reminder of last year’s banking crisis. According to the FDIC, an increase in false claims regarding deposit insurance is causing confusion among consumers particularly as it relates to non-banks and crypto so providing clarity and resources and raising awareness is helpful. Banks should also step up to meet this important consumer need.

2. The Perpay Credit Card rollout

No big announcement but emails indicating a broad rollout of the Perpay Credit Card began hitting inboxes in April with some touting a TWO MILLION MEMBER WAITLIST 😲.

Perpay launched in 2017 with an innovative e-commerce site where consumers can buy now and pay later while building credit by setting up automatic withdrawals from their paychecks.

Over eight million have signed up providing low-hanging fruit for the subsequent Perpay Credit Card launch. Emails have gone out in just the first couple of weeks of April promoting the card with a range of subject lines.

- No credit check

- Credit limit based on direct deposit from your paycheck

- Automatic payments from your paycheck

- 2% cash back on purchases at Perpay’s marketplace.

- Opening fee: $9

- Monthly fee: $9

- APR: 29.49%

💡 No big splash needed: Perpay found an innovative way to combine credit building with buy now, pay later by leveraging direct deposit. With eight million+ members and a MASSIVE two million+ credit card waitlist, they have been generating significant interest and seem to have decided that now is the time to make their move. Good luck trying to find a press announcement or social media post about the launch. Maybe a bigger campaign is in the works but with so many members to tap into and with many demonstrating a high level of interest in a new card, it might not be needed. It will be interesting to see how this one unfolds.

3. Chase and Citi promote travel sites

It’s prime time for credit card travel booking sites with dedicated travel site campaigns rolling out to coincide with the ramp-up in spring/summer travel.

In March, Chase launched its “Where Travelers Go” campaign encouraging travelers to “Dream, discover and book at Chase Travel.” In April, Citi launched a new Citi Travel Newsletter with “trip ideas, travel trends and more” encouraging Citi customers to book via the Citi Travel portal.

💡 Time to put those travel site investments to work: With consumers cutting back on goods in favor of experiences and hybrid work arrangements encouraging them to travel more, US passenger traffic is estimated to reach an all-time high in 2024, according to trade group Airlines for America. Recently, Delta has reported that it expects summer travel to fuel a record second quarter in terms of revenue. Card issuers like Citi, Chase, Capital One, Amex, Credit One, SoFi, HSBC, and more have been launching/relaunching/updating/partnering to the point where having a travel booking site has almost become table stakes for serious contenders in the travel credit card space—but so far the extent to which these sites have been marketed has been mixed. Americans are booking trips and it’s time to put those travel site investments to work.

4. Mercury launches a personal account for founders

New product alert! Since launching in 2017, Mercury has offered business banking/cards for startups and has now opened a waitlist for Mercury Personal, a subscription-based PERSONAL BANKING PRODUCT for founders and investors.

- 5:00% APY on savings

- $5M in FDIC insurance 😲

- No fee for domestic wires

- Custom accounts “for your spouse, personal assistant, financial advisor, or anyone who needs access”

- Subscription fee of $240 per year.

“Personal banking was by far the most requested feature from our customers,” said CEO, Immad Akhund.

💡 Innovative play but tentative early steps:

- Ongoing innovation. Mercury has stood out from the pack for its ongoing innovation and was notably quick to pivot (and benefit) from the collapse of SVB last year—adding $5M in FDIC insurance for its customers through its sweep network and creatively getting its message out via social media, OOH and podcast advertising. The company claims to have more than 100K startups as customers.

- I posted earlier about the FDIC’s ad campaign to raise awareness of FDIC insurance and said how it was a sobering reminder of last year’s banking crisis, well Mercury’s timing couldn’t be any better! Extending its $5M in FDIC insurance to its customers for Mercury Personal will be a huge differentiator vs the standard of $250K, particularly for this premium target market.

- Removing founder friction. By being able to switch seamlessly from a business account to a personal account within Mercury’s platform (as demonstrated on its website) Mercury removes a key point of friction for business owners who typically have to manage and move funds between multiple accounts.

- Limited rollout. Despite a big announcement today it looks like it will be a slow rollout with invites being sent out “over the next several months” according to the waitlist confirmation email I received in my inbox with potential applicants assessed via a questionnaire.

5. A flurry of new product waitlists opens up

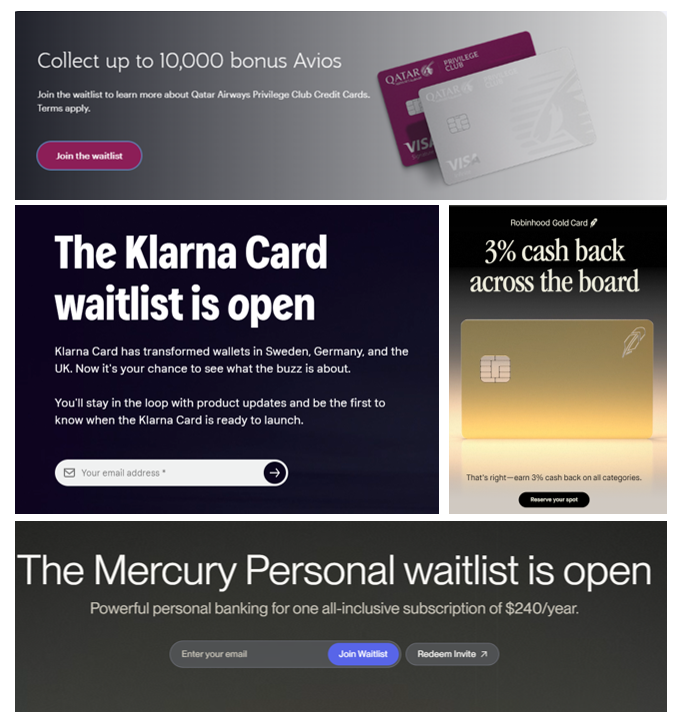

Waitlists are back baby! We’ve seen a flurry of waitlists open up recently as pre-launch marketing strategies roll out for 2 new Qatar Airways co-brand cards from Cardless coming in May, a new/updated Klarna Card (debit), Mercury Personal banking for founders, and the recent big splash for the Robinhood Gold Card that earns 3% cash back.

💡 Pre-launch opportunity remains:

- In 2020 I predicted that pre-launch marketing would become the norm. Apple had raised the bar with its pre-launch strategy for Apple Card and it seemed the additional awareness gained from a pre-launch followed by an official launch plus the opportunity to get product feedback and make adjustments during a beta period would likely be replicated industry-wide. Roll on 4 years and while some take this approach (mainly fintechs), I wouldn’t say it’s the norm and I still think there is a big opportunity to leverage creative pre-launch marketing tactics to gain an advantage in a crowded market.

- The flurry of waitlists opening up is a good indicator that innovation is alive and well. Incumbents are challenged and ultimately consumers win with better products that meet their needs.