Three Innovative Fintech Solutions in Canada

Canada is moving slowly on fintech development with a lack of competition in the financial space. The big banks are dominating the industry, holding a majority of the country’s assets in their hands. With Scotiabank acquiring Tangerine and RBC acquiring HSBC Canada, the level of competition has shrunk dramatically over the past decade.

A lack of competition not only endangers the financial ecosystem; it also transfers the costs onto the consumers. Without healthy competition, institutions have no incentives to reduce fees. Canadians are, therefore, left with limited options.

The rising economic pressures have led consumers to seek alternatives with recent Mintel research revealing that 45% of Canadians have multiple accounts at different financial institutions. Many keep a minimum balance at one of the “Big Six” to maintain the benefits of withdrawing cash conveniently while moving the majority of deposits to another institution that has better rates.

The Canadian financial system needs new competition and a fresh boost, as such below are three innovative fintech solutions that brands can implement in Canada.

1. Consumer Banking: Servicing the Gaps

Fintechs are revolutionizing the ways Canadians bank, filling in gaps within the banking system to bring more financial freedom and options to consumers. Rising interests and mounting debt are urging Canadians to re-evaluate their financial bills and daily expenditures. Technological advancements and the absence of fees offered by fintechs are emerging as a competitive edge, providing a reliable banking alternative for those seeking more value-added services to meet their needs.

KOHO is venturing into traditional banking, blending cost-effective financial solutions with technological advancement. KOHO has a mission to allow Canadians to spend smarter, save quicker, and restore financial balance. The fintech’s move will be “securing a banking license in Canada.”

Source: Comperemedia Omni [01/01/23 – 03/31/24] as of 04/10/24, KOHO

Nesto is on a mission to provide Canadians with the most advanced direct-to-consumer digital mortgage experience. The company offers competitive mortgage rates backed by an AI-powered algorithm and a seamless digital experience for renewing or obtaining home financing solutions free of charge.

In its most recent press release, Nesto announced a strategic partnership with Canada Life to service its residential mortgage portfolio. This collaboration will leverage Nesto’s “award-winning customer service platform” to help Canada Life’s customers obtain a better, more seamless mortgage experience.

2. SMB Fintechs: Boosting Business Efficiency

Managing a business is about managing cash flow. To replace the old-fashioned accounting process and eliminate reporting errors, fintechs are building smart tracking systems with AI-powered algorithms and automation to help business owners manage corporate spending and tracking efficiently.

FundThrough offers a convenient solution to small businesses with invoice financing risks.

Cash flow is essential for SMBs and cash is king for most small businesses to manage their operations efficiently, as observed in the Small Business Marketing Trends in 2024.

FundThrough creates a tech-empowered platform that lets businesses connect their accounting software and directly submit outstanding invoices for funding, so businesses can access cash sooner without having to wait on net terms.

This provides a convenient solution for SMBs to handle invoice processing and gain more control over getting funded on their own terms.

Plooto helps firms automate all payable and receivable workflows so they can spend more time growing the business. From sending international payments to paying CRA taxes, Plooto has all business payments integrated into a single, digitally empowered platform.

3. Wealth Management: It’s More than Investing

Online investment platforms have been broadening their services into mortgage & loans and consumer banking. The addition of service can be beneficial to attract new customers, diversify product portfolios to increase revenue streams, and give these brands a leg up to compete on new fronts.

Questrade provides managed investing portfolios with low account fees to help new investors get up-to-speed. Questwealth Portfolio leverages robo-advisors and industrial expertise to meet the wide range of investment goals of the customers.

Source: Comperemedia Omni [01/01/23 – 03/31/24] as of 04/10/24

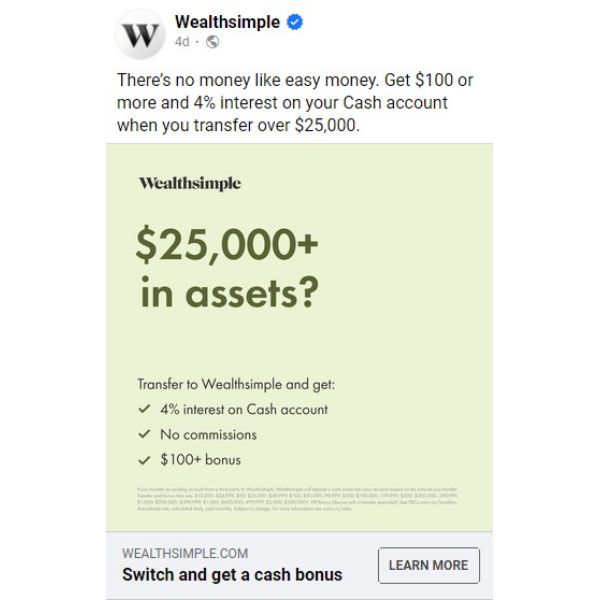

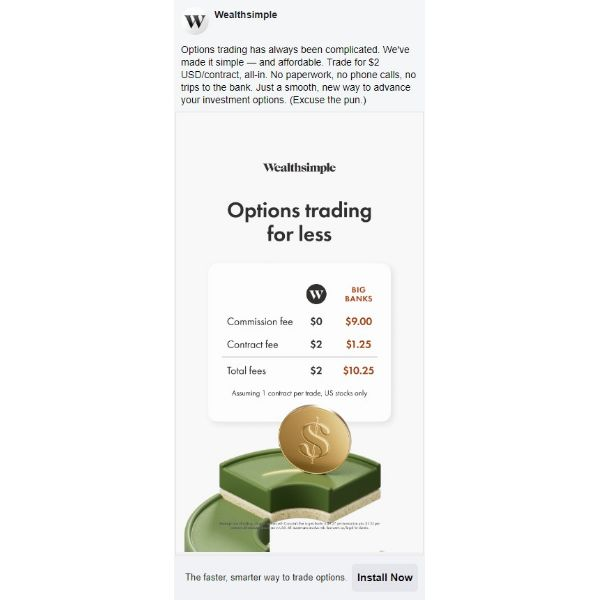

Online investment platform Wealthsimple taps into spending and savings, offering the country’s first high-interest chequing account. Wealthsimple has a tiered rate for its cash account: 4% interest as a base, 4.5% for $100K and above, and 5% for $500K and above. The company offers a pay-what-you-want tax filing service. Customers can file their returns for free and decide whatever they are willing to pay at the end of the filing.

For additional information on the Financial Services industry in Canada, contact us today.