Lightbulb Moments: Spark Your Strategy (Vol.6)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 5 things you need to know from March 2024:

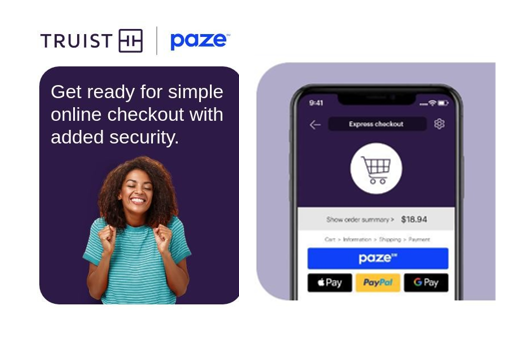

1. The Paze Seven are gearing up

Emails from the seven participating banks of Paze – the new digital wallet from Early Warning (also a provider of Zelle) – have started shifting from “coming soon” to a more imminent “get ready” to in some cases notifying customers that their cards have now been added to Paze Wallet.

The seven banks include Chase, Bank of America, PNC, Truist, Wells Fargo, U.S. Bank, and Capital One.

💡 PayPal killer? Last week Early Warning Services put out a press release announcing 28% growth in transaction volume for its P2P service Zelle in 2023 and 120 million consumer and business accounts (Zelle launched in 2017). Early Warning spent last year working on merchant acceptance for Paze and has now begun its consumer marketing rollout. PayPal, with its long history, remains the dominant player in digital wallets, particularly when it comes to e-commerce which is exactly where Paze has set its sights. With these trusted bank brand names and given the growth trajectory of Zelle it would be unwise to bet against Paze becoming a player in this market. The groundwork is being laid for a new marketing battle over digital wallets. Here come the wallet wars!

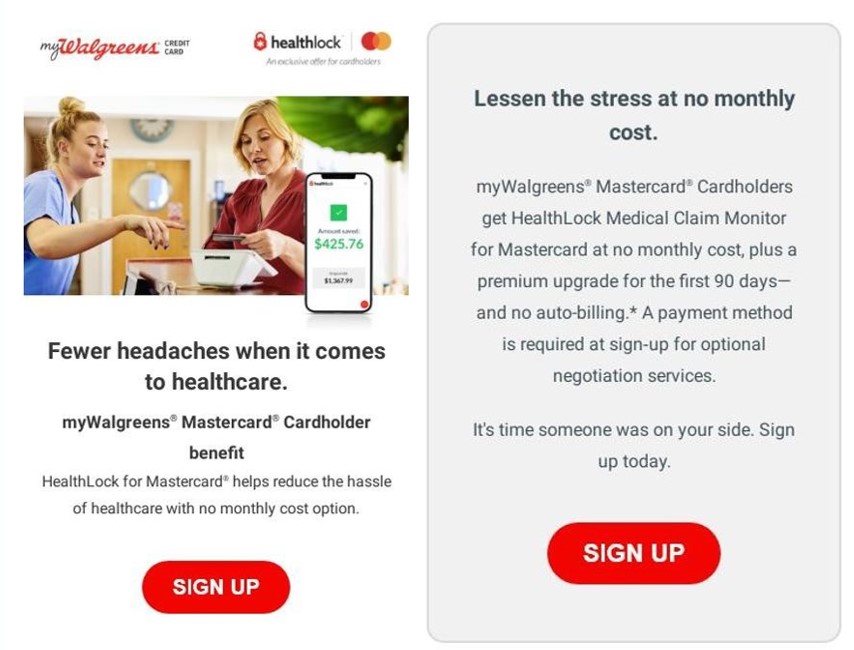

2. Mastercard rolls out HealthLock

New benefit alert! HealthLock has announced that HealthLock for Mastercard will be available for ALL MASTERCARD CARDHOLDERS IN THE US following a limited rollout in 2023.

- Medical Claim Monitor (FREE): Monitors data breaches and provides alerts.

- Medical Claim Auditor (free for 90 days then $4.99 per month): Audits healthcare bills for accuracy.

- Medical Claim Saver (free for 90 days then $19.99 per month): All of the above + negotiates with healthcare providers to reduce bills.

💡 Relevant benefit:

- Healthcare data breaches hit a new record in 2023 and according to Mastercard, 80% of hospital bills contain errors making this a benefit that meets an increasingly important consumer need.

- Some issuers are getting the word out already. According to HealthLock, “the service was made available to select US-issued HSA and FSA Mastercard cardholders last year” but we’ve already seen promotions on Comperemedia Omni for other types of credit card that aren’t connected to an HSA or FSA. Most notably, we observed emails to Synchrony myWalgreens Mastercard cardholders and CareCredit Mastercard cardholders but we also saw the first mention in acquisition direct mail from Spokane Teachers Credit Union (STCU). Obviously, all Mastercard issuers can now offer this benefit but those getting the word out can demonstrate to customers that they are adding value plus offer a point of differentiation vs Visa, Discover and American Express.

3. Citi’s new pause ad

PAUSE for Citi! I started watching “Apples Never Fall” on Peacock. Great show – “A drama, wrapped in a mystery, inside a formula,” said The New York Times. I paused it and look what showed up (see below). It’s a “pause ad” for the Citi Custom Cash Card that earns 5% on your top eligible spend category including, of course, streaming.

💡 A non-intrusive format that will evolve:

- Pause ads are a relatively new phenomenon in the streaming world and gained more traction last year. Unlike the unwanted interruption of a typical ad, pause ads take advantage of an interruption that is self-initiated. While I don’t welcome ads increasingly appearing on paid subscription services, like Peacock Premium (wasn’t ad-free the whole point?), I have to admit the “pause ad” seems to be a great idea that maximizes the moment in a non-intrusive way.

- On the flip side, it seems the pause ad format is clearly in its early stages and limited. In the Citi example there were no details regarding the value prop of the card. No call to action or click-through to apply. No voice-over. It reminded me of the static local ads that would run in the cinema before the movie started (if you ever arrived that early). That said, hats off to Citi for diving in. I’m sure we will see this format evolve.

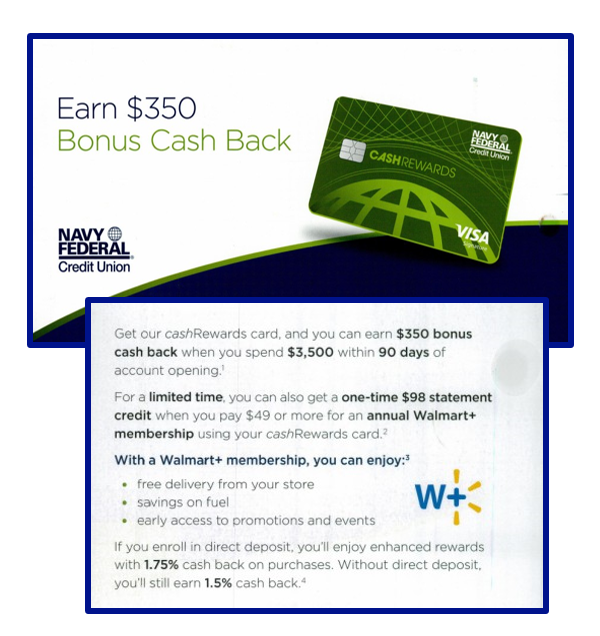

4. Navy Federal Credit Union’s rich offer

With sign-on bonuses heating up in cash back, Navy Federal recently sent some targeted offers for its cashRewards card that stood out from the pack.

- Target: Department of Defense and Coast Guard Active Duty, Veterans, civilian and contractor personnel, and their families.

- $350 for spending $3,500 in the first 90 days AND a limited-time $98 Walmart+ statement credit.

- 1.75% cash back (with direct deposit) no annual fee, no BT fee or foreign transaction fee.

Source: Comperemedia Omni [02/01/2024 – 02/29/2024] as of 03/24/2024

💡 Standing out with added value: At $3,500 the spend threshold is high but $350 is a big incentive for a no-annual-fee card, especially with the added value of the Walmart credit. $200 has been table stakes for a while in cash-back cards but now we are seeing $250 and $300 become more popular as competition heats up for the most creditworthy consumers.

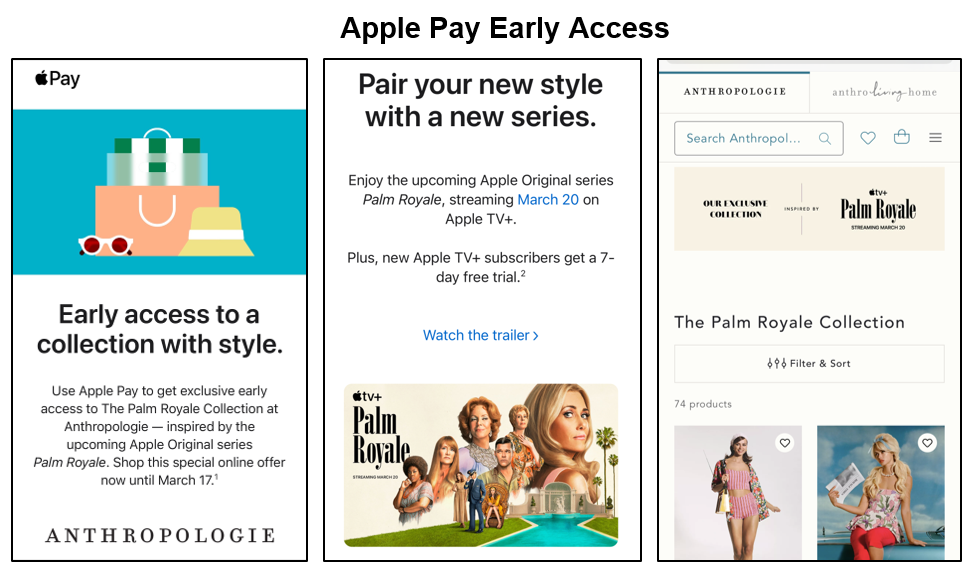

5. Apple (Pay) flexes its ecosystem with Anthropologie collaboration

Apple Pay users received an email in March inviting them, for a limited time, to “use Apple Pay to get exclusive access to the Palm Royale Collection at Anthropologie” – a clothing range inspired by the Apple Original Series Palm Royale which began streaming on Apple TV+ on March 20.

💡Taking the wallet wars to another level! Earlier I posted about the launch of Paze with the seven participating banks ramping up communications for the new digital wallet. In the past, we have seen digital wallet campaigns that usually involve some form of cashback or rebate but nothing as creative as this as far as I can recall. Apple is leveraging key components of its ecosystem – Apple Pay | Apple Original Series | and Apple TV+ – as well as a partner that also wins, to bring new value to Apple Pay users. This unique combination will be difficult for other wallets to compete against and they will have to find creative ways to raise awareness and drive adoption in the face of stiff competition from Apple Pay.

Want insights like these from our industry experts delivered to your inbox? Sign up for our newsletter today!