Lightbulb Moments: Spark Your Strategy (Vol.7)

Comperemedia’s Chief Insights Officer, Andrew Davidson is well known for sharing the latest insights on financial services products and marketing strategies/innovations on his LinkedIn, as an event speaker and as a host on Mintel’s Little Conversation podcast. In this bi-weekly recap, he will provide you with the latest news and insights happening in the financial services industry.

Here are the 5 things you need to know:

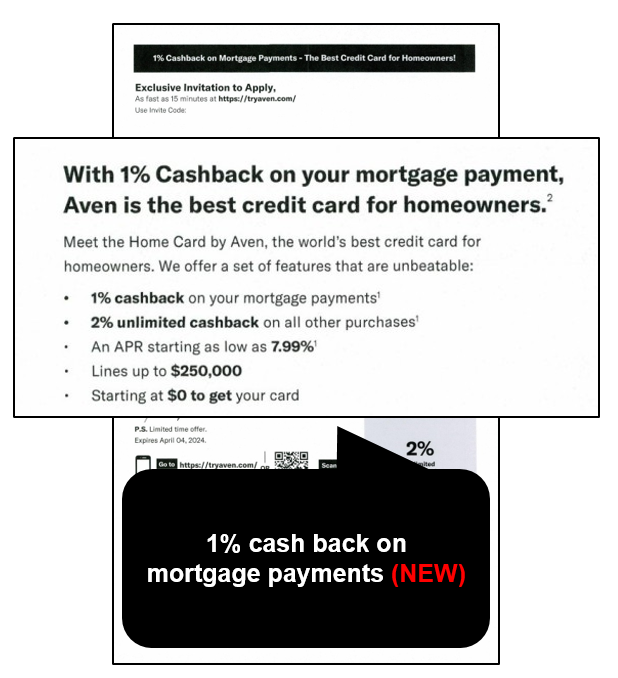

1. Cash back on mortgage payments

Bilt Rewards received an injection of funding to fuel its expansion from rewards for rent to rewards for mortgage payments, but it seems Aven has beaten them to it. We first picked up Aven’s marketing back in 2021 when it launched with a bold claim of being “the world’s first credit card backed by home equity” offering homeowners not only a low APR but huge credit limits and 2% cash back all with no annual fee. According to a mailer Comperemedia picked up in February, Aven is now testing a new product called the “Home Card by Aven” that includes all prior features AND 1% cash back on mortgage payments.

Mortgage payments are validated by Plaid and cardholders who spend $4K during the first 3 statement periods can qualify for up to $200 cash back per year.

Source: Comperemedia Direct [02/01/2024 – 02/29/2024] as of 04/08/20204

💡Credit card innovation

Record high rates and a sluggish housing market can make the Aven Card the ideal solution in the current environment, unlocking home equity for homeowners, especially those considering a HELOC. By utilizing Plaid to add cash back for mortgage payments, Aven has broken through into unchartered cash-back territory for one of the biggest household expenses. With a reward capped at $200 per year you have to wonder whether it is worth the complication of connecting your mortgage payments with Plaid but Bilt is clearly also interested in this approach and my guess is that they won’t be the only one. Until everyone offers it, this will be a BIG OPPORTUNITY.

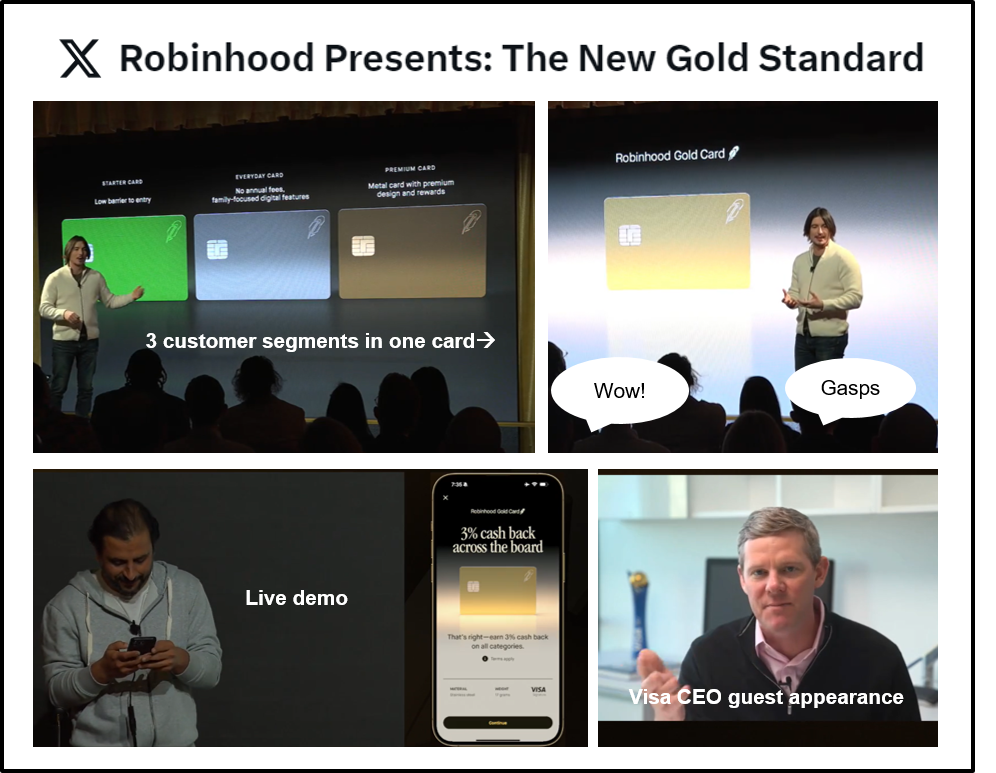

2. Robinhood’s creative Gold Card launch

Most new card launches don’t get a dedicated article in the WSJ, but Robinhood did when it launched (initially waitlist only) the new Robinhood Gold Card on March 26th after acquiring fintech credit card challenger X1 for $95M in June 2023. CEO Vlad Tenev broke the news at an Apple-esque first-ever “Robinhood Presents livestream” hosted in NYC and streamed on X.

You have to be a Gold member to get the card.Out of 23.4 million customers, Robinhood has 1.42 million Gold subscribers who pay $5 per month for premium features in the investing app, most notably 5% APY on uninvested deposits.

Features:

- 3% cash back on ALL categories

- 5% on travel booked through the Robinhood travel portal

- No annual fee or foreign transaction fees

- Metal card

- Virtual card numbers

- 5 authorized users of any age

Source: Robinhood on X

💡 Most creative card launch campaign since Apple Card

- The 3% might get some headlines and I know it’s early days but I love the creativity of this launch:

- Livestreamed launch event in NYC featuring product announcements, live demos, guest appearances and giveaways where the excitement was palpable.

- Opportunity to earn a limited edition Solid Gold Card weighing a hefty 36g by referring 10 friends to Robinhood Gold – nice move!

- Collaboration with Ben Baller to develop a gold chain so that the gold card can be worn as jewelry (As part of the pre-launch a few NBA players wore the chain/card while walking out of the tunnel recently)

- Two apps could cause friction. Aside from points redemption limitations (you basically get to redeem into a Robinhood brokerage account or through Robinhood’s travel/shopping portals) developing a card app that is separate from the investing app might cause friction for customers as well as marketing confusion—even though Robinhood demonstrated live how they could move money from one app to the other with ease. That said, I won’t put a damper on this exciting launch for now! Looking forward to seeing what comes next.

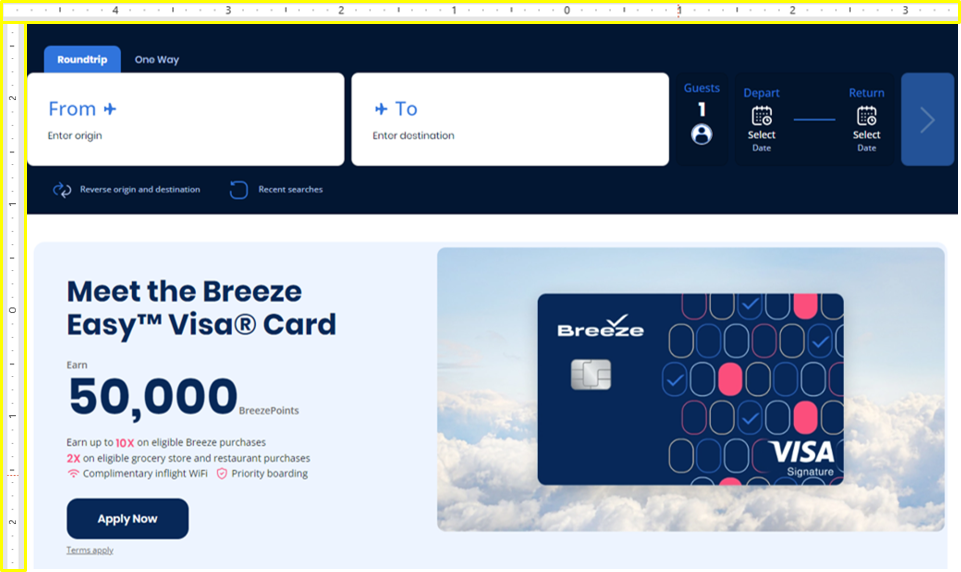

3. New Breeze Easy card takes over the home page

Every airline these days promotes a credit card on their homepage. The new Breeze Easy Visa Card from startup low-cost airline Breeze Airways, issued by Barclays, gets my “website takeover” award for its prominent placement with more space dedicated to the new credit card than even the flight search bar.

Breeze launched in 2021 with flights from smaller, local airports and reportedly 2.3 million passengers took a Breeze flight in 2023. On launch day, Breeze sent approximately 300-400K emails rebranding the loyalty program to Breezy Rewards and inviting program members to be “one of the first” to get their hands on the new $89 annual fee co-branded credit card.

Source: Comperemedia Omni [03/01/2024 – 03/31/2024] as of 04/08/2024

💡The credit card as the path to profitability

- Can this card help to generate some seriously nice profits? Seriously Nice is Breeze’s tagline and BreezePoints are “twice as nice” with the credit card. The airline has been riding the post-pandemic return to travel trend and is now up to 56 cities nationwide but, like Avelo – another low-cost airline launched in 2021 – it has struggled to make a profit due to higher fuel costs. CEO David Neeleman says Breeze is on track to make a profit in 2024 and the card launch could signal that it is on the way to getting there.

- Breeze partnered with Barclays to launch its credit card thereby following the traditional path of other low-cost airlines like Frontier (also Barclays) and Allegiant (BoA), both with well-established programs and very different to Avelo which took a unique approach by establishing a partnership with Capital One in 2022 to offer its customers a Capital One branded Venture/VentureOne card card with additional Avelo benefits including a statement credit and priority boarding. In other words, NOT a co-brand card in the traditional sense. We haven’t seen much marketing for the unique card since launch but did capture some acquisition emails in March. As these airlines both target a profitable 2024, it will be interesting to see how they expand their marketing campaigns to drive loyalty and increase customer spending.

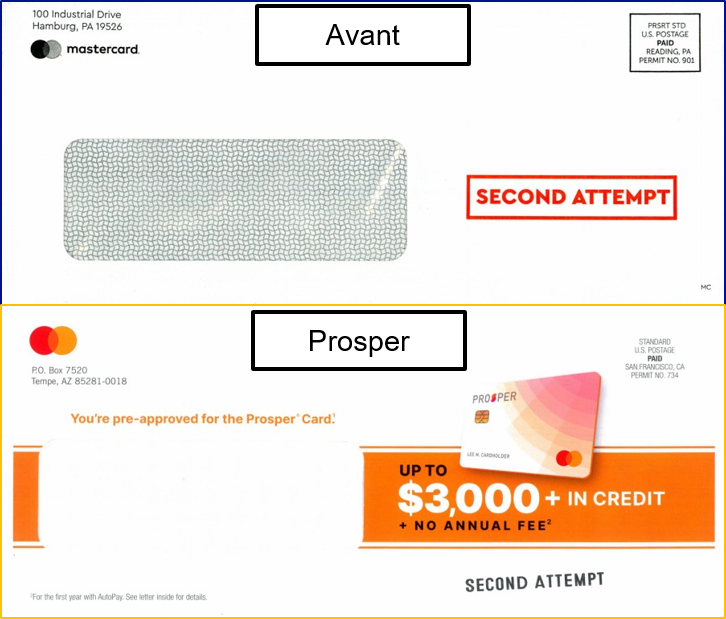

4. Debt collection language in marketing

With credit card delinquencies on the rise some non-prime focused issuers have been testing the use of debt collection language – and specifically the phrase “SECOND ATTEMPT” – in acquisition marketing for credit cards. In these two direct mail envelope examples, one (Avant) looks like an urgent attempt to reach a customer for the second time with the unstated inference being the urgency of a missed payment date or outstanding bill.

In the second example (Prosper) the same phrase is used but it is clear that it is the second time that Prosper has reached out to this prospective cardholder to offer a new card with the inference that the offer won’t be available indefinitely. It’s the same phrase but the interpretation is different based on the creative execution.

Source: Comperemedia Direct [01/01/2024 – 03/31/2024] as of 04/08/20204

💡Finding a stress-free way

Making an acquisition offer look official (like a bill) as a way to boost open rates isn’t new. Using the tactic during a time when consumers have record levels of debt and delinquencies are rising might be effective but subprime consumers are already stressed and can do without messaging that further increases their stress levels. According to Mintel 75% of subprime consumers say that credit card debt causes them stress. A better way might be messaging around stress alleviation like Varo Bank giving its secured cards a spa day and encouraging potential customers on Instagram to “discover a stress-free, worry-free way to build credit.” There are opportunities for both product development and marketing to provide relief from credit stress.

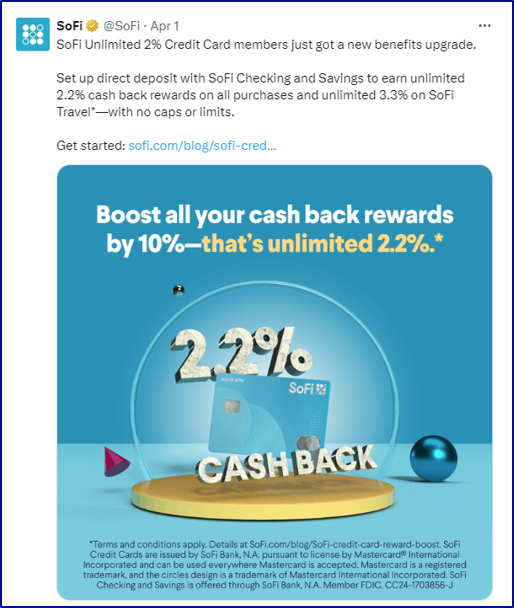

5. SoFi raises the cash back stakes with 2.2%

2.2% cash back is no April Fools joke. Despite the April 1 timing of the announcement on its blog and via X, SoFi really did launch a NEW 10% boost on cash back rewards for SoFi Unlimited 2% Credit Card members who set up direct deposit with SoFi Checking and Savings. That = 2.2% cash back on all purchases and 3.3% cash back on purchases on SoFi Travel.

Note: The new benefit is available to both new and existing cardholders.

Source: SoFi.com, SoFi on X

💡Cashbackflation?

- Is this the start of a new phase in the escalation of cash back as a flat 2% becomes less of a differentiator? Robinhood launched 3% cash back for its Gold members (although Gold members pay a $5 per month fee) and now SoFi has raised the stakes to 2.2% for its no-fee SoFi Unlimited 2% Credit Card (although it requires a banking relationship). Despite the minimal additional dollars earned the marketing opportunity to stand out as the best cash-back offer on the market is clear.

- All in one. 81% of Gen Z/Millennials would prefer to have all of their financial services in the same mobile app and SoFi is going all in on this strategy by providing meaningful rewards in exchange for a deeper relationship.